Younger Americans Take on More Credit Card Debt, Pay It off Slower

These are the main findings of a new study by Lucia Dunn, a professor of economics at Ohio State University (OSU), and Sarah Jiang of Capital One Financial. The study isn’t available online, as far as I can tell, but OSU’s Jeff Grabmeier has given us a summary of the findings here.

Now, this is not the first study to provide evidence that younger generations of Americans have fewer qualms about racking up credit card debt than their parents and grandparents. However, the two researchers claim to be the first team to have looked into both sides of the issue: the borrowing and paying off of the debt. Moreover, they’ve looked into quite a bit of data. The researchers have examined respondents from 18 to 85 years of age whose data were collected through two large surveys, which had a combined sample size of 32,542. Furthermore, the study has identified a fairly simple solution to the problem of ever-increasing indebtedness. So let’s take a look at its findings.

Younger Americans Owe More than Parents, Grandparents

Here are the data on the borrowing front:

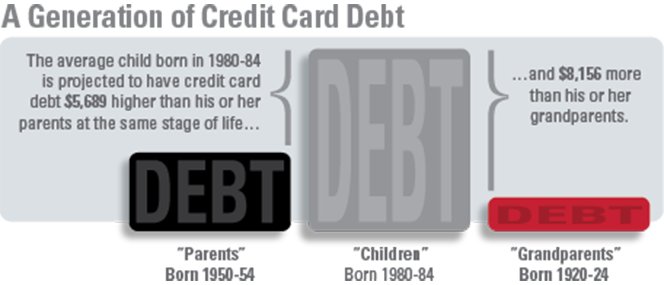

The results suggest that a person born between 1980 and 1984 has credit card debt substantially higher than debt held by the previous two generations: on average $5,689 higher than his or her “parents” (people born 1950-1954) and $8,156 higher than his or her “grandparents” (people born 1920 to 1924).

The researchers have created this infographic to illustrate their findings:

Why has our indebtedness to plastic grown? Here is Dunn’s answer:

Credit is more readily available now, and there have been changes in interest rates and less stigma attached to having credit card debt, which may all make younger people today more willing to go into debt.

I don’t think many would disagree with this explanation.

Younger Americans Pay off Credit Card Debt More Slowly

That is the other major finding. Here are the data:

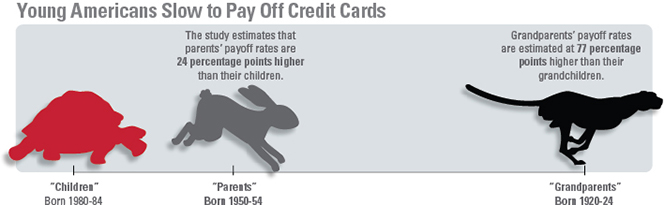

The study estimates that the children’s payoff rate is 24 percentage points lower than their parents’ and about 77 percentage points lower than their grandparents’ rate.

And here is the corresponding infographic:

And now here is the most interesting part. The researchers have also found that the rate of the minimum required monthly payment amount does affect cardholders’ debt repayment patterns:

The good news in this study is that cardholders respond to higher minimum payments by paying well above what they have to. Findings showed that increasing the minimum payment by one percentage point increased the average payoff rate by 1.9 percentage points. That means increasing the minimum required payoff rate from 2 percent to 4 percent increases that average payoff rate by 3.8 percentage points.

The real-world effects could be huge. For example, making only the 2 percent minimum required payment each month on a balance of $1,000 at an interest rate of 19 percent will mean it takes eight years and four months to repay the balance in full.

However, holding other factors constant, if the actual monthly payment increases from 2 percent to 5.8 percent as a result of the new policy, it will take only one year and nine months to pay off the debt.

So that is a pretty strong case for increasing the minimum required monthly payment amount. Given what the researchers have found, placing the lower limit at, say, five percent of the total outstanding amount would make a world of difference.

The Takeaway

Lucia Dunn makes clear the implications of her findings:

If what we found continues to hold true, we may have more elderly people with substantial financial problems in the future.

…

Our projections are that the typical credit card holder among younger Americans who keeps a balance will die still in debt to credit card companies.

It is not a prospect many of us would look forward to, I think. And yet, the most surprising thing to me is just how little is needed to prevent that possibility from becoming a reality. Just raising the minimum required payment rate from two to four percentage points might do the trick. As Dunn says:

Raising the minimum payoff rate can have a powerful effect on how people actually pay off their credit card debt, much more so than you might expect.

…

They may see the increase in their minimum payment and start feeling uncertain about their future ability to pay off their debt. That may encourage them to pay off even more than they have to, in order to bring their debt level down.

So let’s raise that rate!

Image credit: Au10tix.wordpress.com.

This is an alarming trend. The student loan debt has also skyrocketed while graduates are making a smaller income.

Credit cards are definitely an important business to the banks. There is no doubt about it. It is true that in the last few years consumer credit card debt has increased. The basic reasons behind this are: high unemployment rate, low pay scale, high cost of living and so on. The person who has more than one credit card is always suffering from debt burden. The main reason behind that is they spend beyond their means as they need not to carry any cash with them. Credit card is very convenient to use. The best way to avoid credit card lawsuit is to stay away from delinquent debts. Don’t open new credit accounts just because you need to shop more. Live within a budget and try to avoid incurring new debts.