Would You Accept a Credit Card Offer from a Debt Collector?

Hundreds of thousands of Americans have done just that last year, we learn from WSJ’s Jessica Silver-Greenberg. On the face of it, this proposition sounds quite oxymoronic. After all, debt collectors’ sole raison d’?¬tre is the collection of money, not offering it. So what are we to make of this story?

Well, as we will see below, debt collectors have discovered that providing fresh credit to debtors whom no other lender would ever work with, has proved a reliable strategy to recover some extra revenue from old debts that would otherwise have gone totally uncollected. Not to mention the revenue from the credit card program itself. Now, I don’t think that anyone doubted that debt collectors were motivated by more than just altruism when they launched their card issuing programs. But what about their debtors? How are these debt collector credit cards working for them? Well, I think that potentially the benefits of opening up such an account far outweigh the cost of doing it. Let’s take a closer look at these programs.

How Debt Collector-Issued Credit Cards Work

The concept behind these cards is quite simple. As Greenberg explains, a debtor is offered a new credit card on the condition that she agrees to use a portion of the new credit line to repay an old debt. In the example given by Greenberg in her piece:

To get the new credit card, Mr. Carpenito agreed to repay $400 on a seven-year-old debt that had expired under New York’s statute of limitations.

The statute of limitations sets a time limit on a lender’s ability to legally pursue the collection of a debt. Or, to put it another way, once the statute of limitations has expired, a debtor is under no legal obligation to pay back the debt. So, for all practical reasons, once the statute of limitations has expired, a debt is dead.

That does not mean, however, that it is illegal to accept payments on an expired debt. Far from it and that makes the program at issue possible. Other than the agreement to repay an old debt, these cards work just as their regular-issue counterparts.

What’s In It for the Issuer?

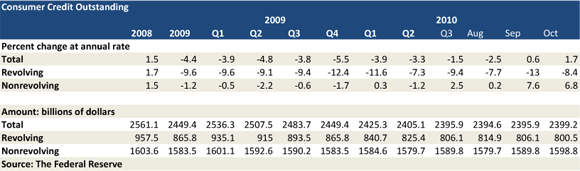

As Greenberg reminds us, there are plenty of U.S. card issuers that are now eager to extend credit to as wide a range of consumers as they can get their hands on. Banks have been on the case for a while now, issuing 5.4 million new cards to consumers with credit scores below 660 (which is Equifax’s definition of sub-prime).

Now, the debt collector type of card lowers the credit score bar quite considerably, (talking about sub-prime!), but the concept is still the same. The size of the credit line and the interest rate are determined according to the calculated risk level, which means that for this type of cards the former metric will be much lower than the average, while the latter will be higher. In another Greenberg example:

Ms. Weaver has a $300 credit limit that can go up if she stays current with her monthly payments. Her credit card carries an annual interest rate of 19%, compared with an average rate of 13.7%.

As you see, the card issuer is rather stingy with the credit line and lavish with the APR. And yet, debtors like the arrangement.

What’s In It for the Debtor?

As already mentioned, no regular lender would ever extend new credit to a consumer with a debt collection account on their credit report, even under a sub-prime program. Debtors know that full well. “No one else wanted to even work with me,” Weaver tells the WSJ.

Opening up a card, even with a $300 credit line, gives a debtor an opportunity to repair her credit much faster than she would otherwise have been able to. If she can consistently make her monthly payments on time, eventually her credit line will be lifted and she will attract the attention of other lenders who will be willing to extend credit to her on better terms.

But there is another aspect to having a credit card that many debtors find every bit as appealing – the sense of normalcy it brings with it. As one debtor tells Greenberg, without a credit card he felt “like dirt, especially when out on dates.” His assessment: “It was totally worth it.”

The Takeaway

As Greenberg points out, there is plenty of controversy surrounding debt collector-issued credit cards. For example, issuers have been accused of not clearly communicating to the recipients of their offers the fact that debtors are not legally required to repay debts for which the statute of limitations has expired. It is also true that the statute is renewed when there is a payment of any amount on an expired debt. And yes, these things should be made very clear in the card agreements.

Yet, it is also true that in the real world this type of lending is just about the only legally available avenue for debtors to get access to fresh credit and to start repairing their financial history. It should be kept wide open to allow issuers to give debtors the chance to prove that they are more trustworthy than their previous record indicates.

Image credit: Internethaber.com.

One Comment