Why Do You Get Credit Card Offers?

That is the question Daniel Grodzicki, an economist at Stanford University, has tackled in a new paper. The author begins by confirming a rather self-evident fact — the issuers’ offer decisions reflect customer poaching via rewards, introductory rates, and balance transfer programs — but he also makes some far less obvious, even counterintuitive, findings. For one, Grodzicki finds that an increase in the cost of funds has a greater effect on the quantity of offers sent than on the pricing of these offers to consumers.

Furthermore, it turns out that the costs of sending these offers has a greater effect on the number of offers individuals receive than does the level of competition among issuers. So, a reduction in the sending costs would increase the number of offers individuals receive relatively more than adding an additional market participant.

The author also gives us some interesting data on the distribution of credit card offers among the U.S. issuers — the market is dominated by the six biggest issuers — as well as some historical perspective on how the U.S. credit card market has evolved. It is truly amazing just how much has changed in the credit card world over the past three decades, with information technology being the main driving force, and it makes one wonder how great of an effect recent regulation and the rise of big data will have in the years to come. Let’s take a look at Grodzicki’s paper.

Where Did We Come From?

Grodzicki’s description of the 1980’s U.S. credit card landscape might sound a bit alien to many of you:

The credit card market of the 1980s was large and unconcentrated, and competing lenders faced few barriers to entry or doing business across state lines. Still, the market was, by several measures, uncompetitive: markups were high, prices were unresponsive to underlying cost, and lenders earned three to five times the ordinary rate of return in banking (Ausubel, 1991). During this period, applicants’ credit worthiness was assessed using simple metrics like debt to income ratios.6 There was little variation across banks in the information and methods used to screen customers. As a result, the credit card was a homogeneous product. There… were few differences in rates and fee structures; annual fees were meant to compensate the lender for expenses associated with usage.7 Cards did not generally offer special introductory or balance transfer offers, bundled insurance products, or rewards.

Then in the 1990s, the issuers’ embrace of information technology brought about change. Banks could now more easily acquire and assess information on prospective customers, which “placed significant competitive pressure on the industry”. As a result, prices fell and profitability declined, but credit became available to a broader range of consumers. In turn, easier access to credit made it more difficult for issuers to hold on to their existing customers. There had to be a response and there was:

[B]anks offered more products with low introductory teaser rates and balance transfer features. To further incentivize consumers, cards offered rewards programs, like cash back and frequent flier miles, as well as bundled insurance products. Special rate offers and rewards served a dual purpose. On the one hand they provided extra incentives to potential new customers. On the other hand they made the credit card a more heterogeneous good.

…

With more information on potential borrowers, lenders could better assess what types of cards specific consumers most liked, as well as how profitable these consumers were likely to be as holders of such cards. Consequently, there was a sharp rise in the variety of products offered in the market. As lenders could better target their products to individual prospective borrowers, the resulting set of offers any given consumers might consider became highly customized.

The upshot was that:

Today’s credit card market is larger than before, concentrated, and more competitive.

…

Whereas before the main decision in credit card lending was whether or not to extend credit to a new customer, lenders now hold a varied line of complex products from which they choose to offer cards to a heterogeneous consumer population. Moreover, large lenders now maintain and constantly update enormous amounts of information on potential borrowers. They analyze this information using sophisticated and proprietary behavioral credit scoring models to determine pre-screening and account marketing, pricing, account management, estimating losses from default, and predicting the profitability of individual accounts.

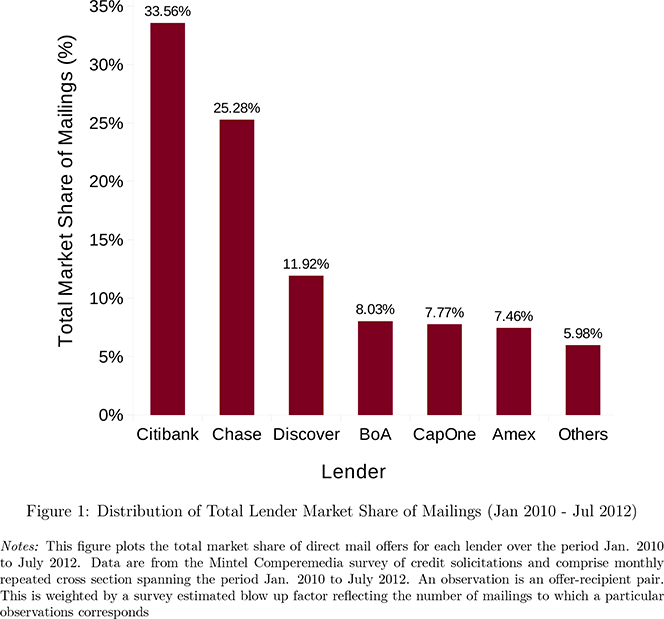

Who Sends Credit Card Offers and How Many Do We Get?

The U.S. credit card market is heavily concentrated — a fact that is, as Grodzicki points out, evident when you look at direct mail offers. The six biggest U.S. lenders account for more than 94 percent of all credit card offers sent between Jan 2010 and July 2012. Moreover, as you can see in the figure below, Citibank and Chase account for close to 60 percent of all mailings.

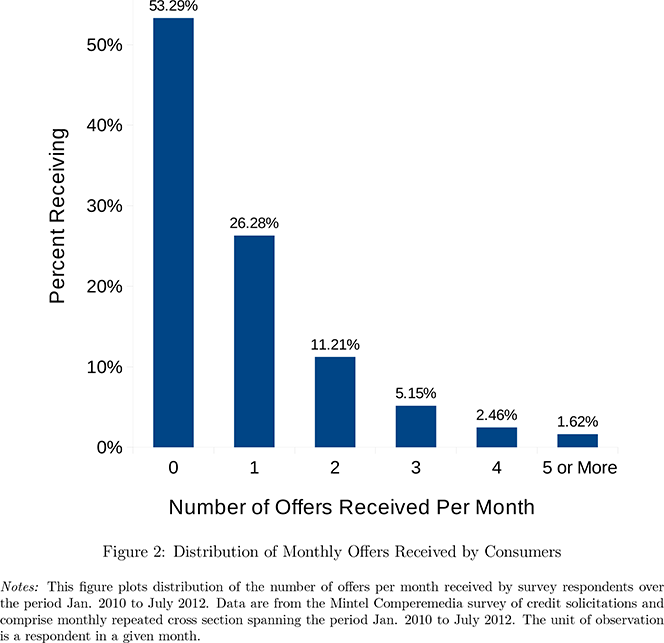

Grodzicki then gives us the results of a survey, according to which slightly more than half of all Americans (53.3 percent) do not receive any offers in a given month and about a quarter (26.3 percent) receive one offer. Here is the full distribution:

What Do We Look for in Our Cards?

Grodzicki then proceeds to calculate Americans’ sensitivity to both the regular interest rate and the length of the introductory rate offer. He finds that an increase of one percent in the regular interest rate reduces consumer take-up by about 75 percent and a “unit improvement” in the introductory rate offer increases take-up by 69 percent.

However, consumers are found to be relatively less sensitive to the length of the balance transfer offer than they are to whether the card includes fees on balance transfers. Counterintuitively, increasing the length of a balance transfer offer reduces take-up by 24 percent, while, as would be expected, including fees on balance transfers reduces take-up — by 73 percent. These results suggest to the author that consumers look for new cards to immediately transfer their existing balances.

Grodzicki finds American consumers to be far less sensitive to other fees than they are to balance transfer fees. For example, including fees on foreign currency transactions and / or annual fees reduces consumer take-up by less than half that of including balance transfer fees. Similar is the treatment of delinquency fees. However, bundled insurance offers and rewards products are found to be “very salient to consumers”.

The Takeaway

To analyze the effects of changes in the market environment on the number of offers received by consumers and their take-up, the author considers three counterfactual scenarios: rise in the cost of funds, reduction in mail-out costs and adding a competitor. His findings:

These have shown that there is a stronger competitive effect to reducing the cost of mailing offers than to adding market participants. That is to say that market frictions, such as cost of informing consumers of offers, are more important in curbing competition than the limited number of competitors. Lastly, increasing the cost of funding credit cards has a stronger short term effect on the propensity of lenders to send offers than on the quality of those offers sent. This is due largely to the importance of incumbency in getting potential customers to take up new cards. Nevertheless, I estimate a modest increase in the average rate on the best offer received by consumers, implying some degree of pass through by banks.

So, whereas an increase in the banks’ funding rates has, at most, a negligible effect on consumer pricing, it has a measurable negative impact on the number of offers they mail out. In other words, when their own cost of borrowing increases, the issuers respond by tightening their underwriting standards, so that only the most creditworthy consumers receive an offer, and cutting their profit margins.

I guess that makes perfect sense to me. The alternative — raising interest rates in lockstep with the rise in the funding rates — would lead to higher rates of charge-offs and evidently the issuers have calculated that such a scenario would be far less profitable than the one they have chosen to go with. It’s a numbers game.

Image credit: Flickr / rubenerd.

156 million Americans are receiving direct mail credit offers each month, but how many are actually opening the offers they receive? Grodzicki found that as banks?ÇÖ funding rates increase, money spent on direct mail measurably decreases, temporarily. Instead of continuing to spend on direct mail, banks should invest in a more efficient way to make offers, like prequalification. Prequalification is a mix of consumer-initiated decisioning and prescreen, in which the customer is able to compare their credit options in real-time, with minimal information given. It is a much more cost effective way to acquire new customers and to gain wallet share of existing ones, than sending millions of direct mail offers.