Why Are Credit Card Interest Rates at Record Highs?

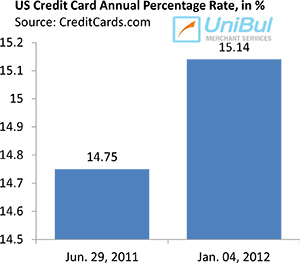

There has been a lot of buzz in the blogosphere about the sustained rise in U.S. credit card interest rates. In mid-December CreditCards.com — a website that conducts weekly surveys to calculate the average credit card annual percentage rate (APR) in the U.S. — reported the highest level they’d ever measured and the rate has only marginally decreased since then. Moreover, the average penalty rate has also increased, according to the website, even as many cards no longer have penalty rates.

So what’s causing this jump in interest rates? From what I’ve read, most commentators cite the CARD Act of 2009 as the chief culprit, because, by placing various restrictions on banks’ ability to charge fees and raise interest rates on existing accounts, it led to a substantial fall in card revenues, which issuers then had to find ways to make up for. I agree with this explanation, but I think it doesn’t tell the whole story and it doesn’t answer the question why the APR rise is so steep in recent months. I think that there is another reason for the more recent increase in average APR, one that hasn’t received any attention: issuers’ renewed interest in sub-prime borrowers. Let me explain.

Current Credit Card APR Levels

First, though, let’s take a look at the current CreditCards.com APR calculations. Here are the results from the website’s latest report (Jan. 4, 2012):

|

Avg. APR |

Last Week |

Six Months Ago |

|

|

National Average |

15.14% |

15.14% |

14.75% |

|

Low interest |

10.62% |

10.62% |

10.73% |

|

Balance transfer |

12.85% |

12.85% |

12.78% |

|

Business |

13.13% |

13.13% |

13.07% |

|

Student |

13.77% |

13.77% |

13.77% |

|

Airline |

14.54% |

14.54% |

14.31% |

|

Cash back |

14.74% |

14.74% |

13.90% |

|

Reward |

14.82% |

14.82% |

14.28% |

|

Instant approval |

15.49% |

15.49% |

15.99% |

|

Bad credit |

24.96% |

24.96% |

24.96% |

So what are we seeing here? While the national APR average has risen by 0.39 percent in the past six months, five of the nine categories that comprise it have registered a decrease for the same period and two have shown no change at all. Only two of the constituent categories have produced an APR increase. Additionally, only two of the categories — “instant approval” and “bad credit” — have an APR that is higher than the national average.

How Sub-Prime Drives APRs Upwards

So, our observations tell us that the only way the national average could have increased in the past six months would’ve been if the weight of the “instant approval” and “bad credit” categories had increased. So let’s examine these categories.

So, our observations tell us that the only way the national average could have increased in the past six months would’ve been if the weight of the “instant approval” and “bad credit” categories had increased. So let’s examine these categories.

A look at CreditCards.com’s list of “instant approval” credit cards reveals that these are actually prepaid cards, so I’m not sure why they are included in a credit card list in the first place. Moreover, while the website tells us that approval for such a card usually requires “good to excellent credit,” each of the prepaid card offers they’ve listed explicitly states that “No Credit Check” is required, which is consistent with rules for prepaid card issuance. Prepaid is a type of card specifically designed to appeal to the “unbanked” and, far from requiring excellent credit, it is as sub-prime as it gets, which is why its average APR is higher than the national average. And we do know from Federal Reserve and other sources that prepaid is by far the fastest-growing type of non-cash payment methods in the U.S.

The “bad credit” category is much more unambiguously designating sub-prime card issuance. Here again we have plenty of data showing that there has been a huge increase in the number of cards issued to sub-prime borrowers. For example, Equifax — a credit reporting agency — told us that, while the total number of new credit cards issued in the first half of 2011 rose by 27 percent on a yearly basis, the number of cards issued to sub-prime borrowers (those with credit scores below 660) spiked by 64 percent for the period.

The Takeaway

So the data clearly tell us that the issuance of sub-prime credit cards is increasing at a much faster rate than the issuance of non-sub-prime cards (whose APRs are falling), pushing up the average national APR in the process.

Again, I’m not saying that the rise of sub-prime accounts for the entire post-CARD Act APR increase. It does not. Issuers clearly raised interest rates in anticipation of the CARD Act side effects and then kept doing it for a while. However, sub-prime card issuance is the primary driver behind the current APR rise.

Image credit: Bestcarcoverage.com.