Who Is Overindebted in Britain and Where Do They Live?

About a fifth of Britain’s adult population — 8.8 million people — is overindebted, with just over four million of them struggling to pay their bills for more than a year, we learned from a recent report from Money Advice Service, a consumer advisory organization. The overindebted population is spread disproportionately across the U.K., with a general skew towards the cities of the north of England and in Northern Ireland.

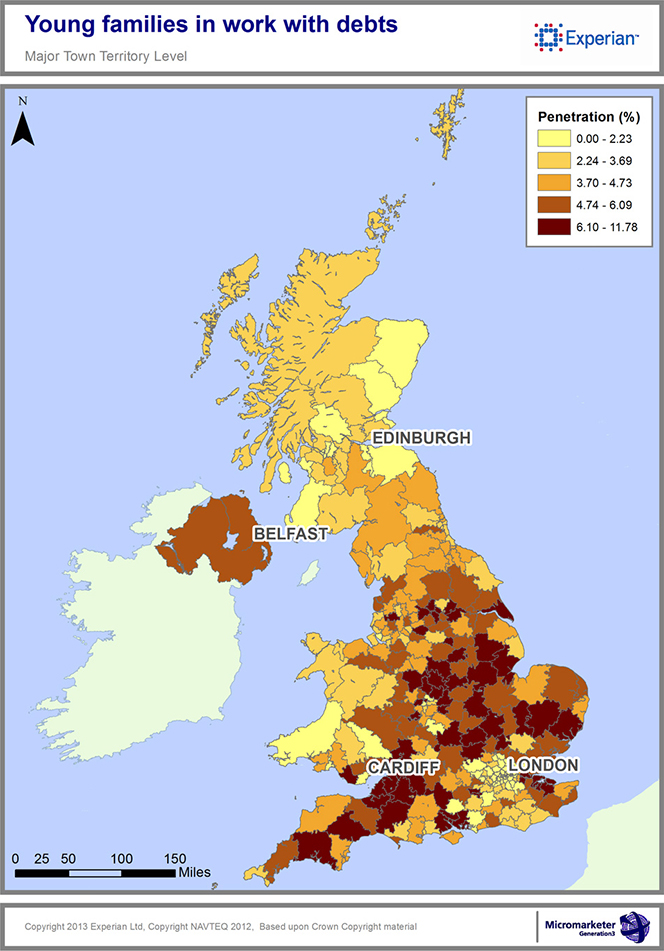

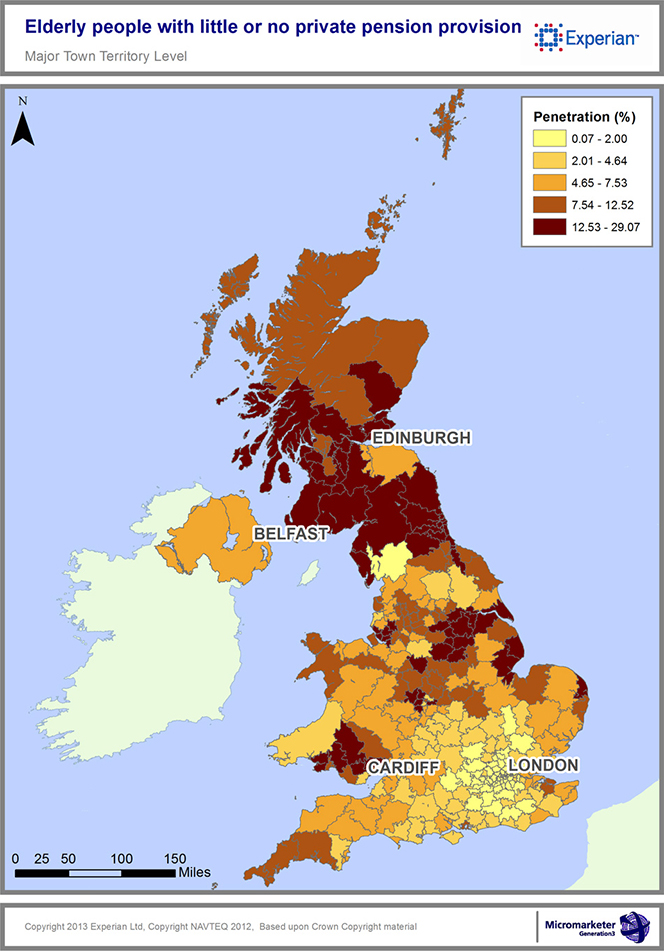

Then this morning, credit reporting bureau Experian, which supplied some of the data used in Money Advice Service’s report, has released a series of heat maps of the U.K., which illustrate the levels of concentration of indebted Britons as a whole and segmented in groups by age, income and marital status. The most striking contrast that I observed was between the geographical concentrations of indebted young families in work and elderly people with little or no private pension. Whereas members of the former group are most heavily concentrated in the south of England, heavily indebted elderly people are mostly to be found in the North of England and, especially, Scotland. But let’s take a closer look at the data and the heat maps.

Who Is Overindebted in the U.K.?

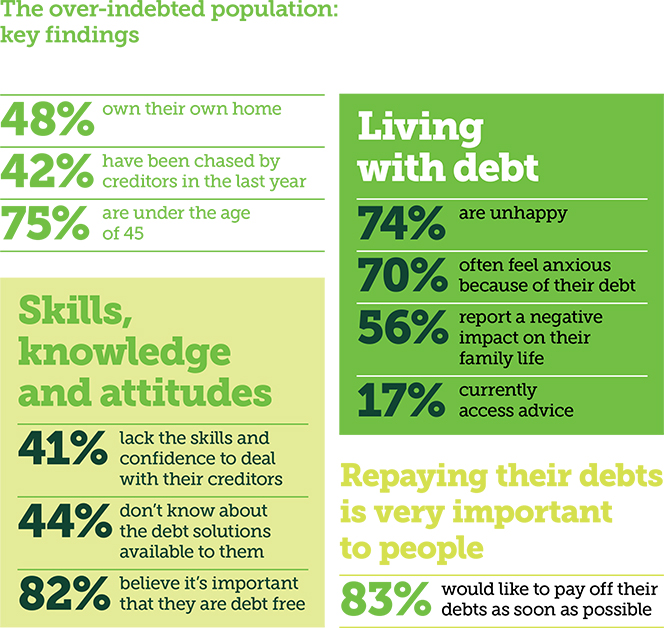

As already noted, 8.8 million Britons are overindebted, with 48 percent of them feeling that being in debt is preventing them from buying the basics. The majority of Britain’s overindebted population is of working age, with 58 percent in work and 48 percent living in privately-owned homes. Half of them have an annual household income of less than ?ú20,000 and, at 64 percent of the total, women are overrepresented.

When the population is segmented by age, the ratio of the debt strugglers peaks at the 35 – 44 age group — 32 percent — and then it falls for older people and particularly for those aged 55 and above.

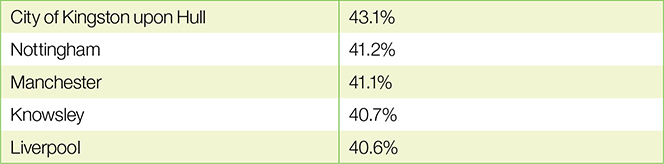

Geographically, Britain’s overindebted population is overrepresented in the cities of the north of England and Northern Ireland. More than 40 percent of the total population of the top five overindebted areas is struggling with debts, as seen in the table below:

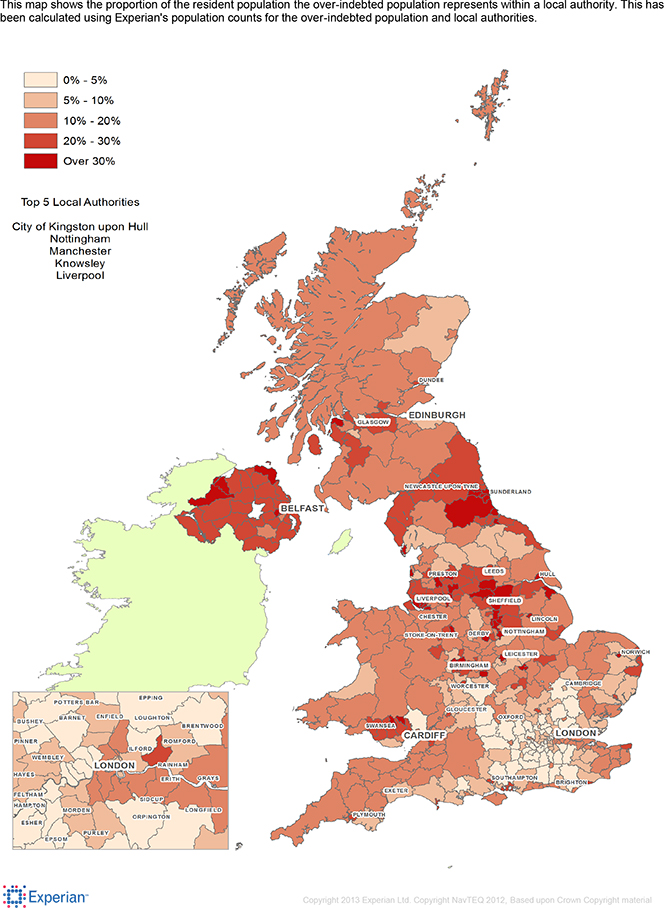

The part of Britain with the lowest share of overindebted people is the South East, with Richmond upon Thames having just 1.2 percent of its population struggling with debt. Here is the picture across the whole country:

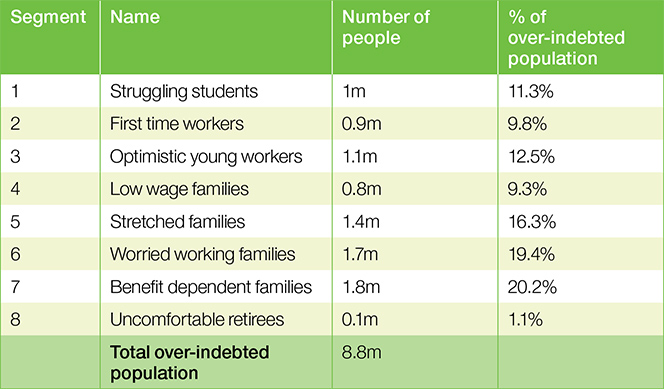

Money Advice Service’s researchers have segmented Britain’s overindebted population into eight groups, which are broken down by size in the table below:

And here are the report’s key findings:

Heating the Maps

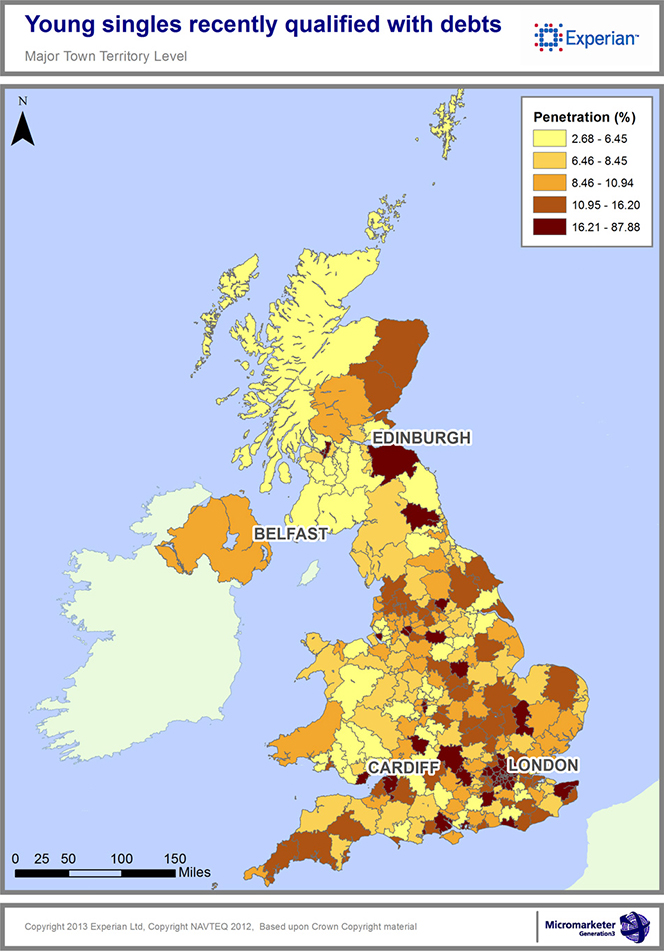

Below you can see the four heat maps Experian has just produced. The first covers young singles:

Now here is how young families in work are coping with debt across Britain:

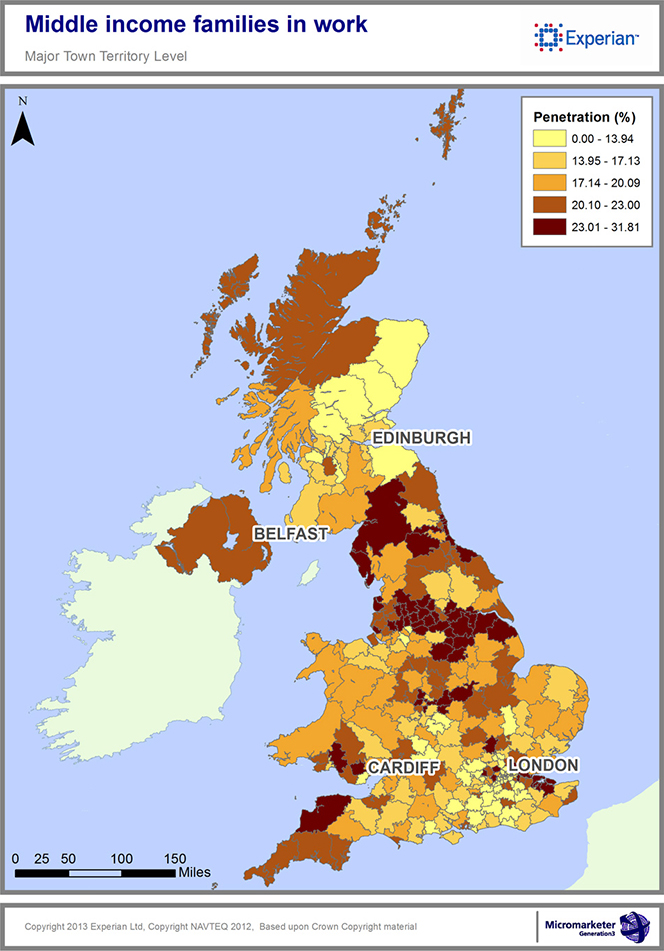

Here is how middle income families in work are doing across the U.K.:

Finally, here is how elderly people with little or no private pension provision are faring across the country:

The Takeaway

The vast majority of Britain’s overindebted people feel anxious, stressed and unhappy with their situation and the repayment of their debts is very important to them, the Money Advice Service reports. We are told that 83 percent of the overindebted Britons would like to pay off their debt as soon as possible and 82 percent of them believe it’s important that they are debt-free. Evidently, however, good intentions are not enough.

Image credit: Wikimedia Commons.