Who Is Most Likely to Receive a Mobile Payment?

It is your utility provider, we learn from the Sixth Annual Billing Household Survey, just released by Fiserv, a technology provider to financial companies. The top reason American consumers would use their mobile phone when visiting a biller’s website, cited by three-quarters of the survey’s respondents, is to pay a bill and the top feature they look for in such a website or app is the ability to pay a bill. “If only that were half true for my e-commerce website”, I hear you say. Well, no one said that life was fair.

You may not be surprised to learn that Eric Leiserson, the survey’s author, finds Generation Y members to be leading the way in the explosive adoption of mobile channels for bill payments. After all, more and more of them are beginning to take on bill payment responsibilities and they are used to doing everything on their mobile phones. Naturally then, as Leiserson puts it, Gen Y members “are driving deliverables for billers based on distinct and specific bill payment preferences”. Let’s take a look at his findings.

How We Pay Our Bills

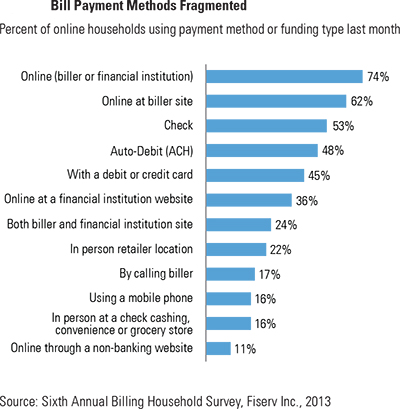

The share of U.S. households with internet connectivity (“online households”) that pay bills online was 74 percent, the same as in 2012, we learn. And whereas the share of online households that pay at least one bill a month by check fell from 61 percent in 2012 to 53 percent in 2013, the ratio of households which pay bills through mobile phones doubled from 8 percent to 16 percent. Here is the full breakdown:

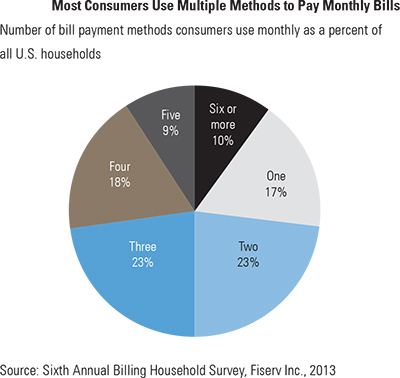

Most of us use multiple payment methods, with 83 percent using two or more of them each month and close to a fifth using five or more. Additionally, about a sixth of households (16 percent) change the way they pay bills on a monthly basis, citing availability of funds, payment due dates and amount due as the biggest reasons.

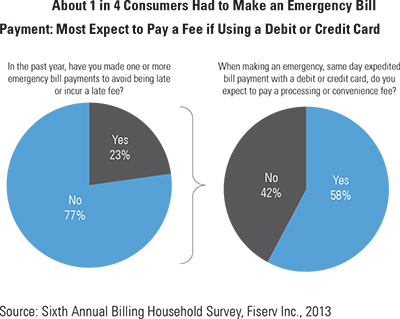

A third of households have missed a payment or paid a bill late in the past year. The survey respondents cited cash flow difficulties (47 percent), forgetting when a payment is due (39 percent) and waiting until the last minute (22 percent) as the primary reasons for their tardiness. Close to a quarter (23 percent) of consumers use emergency payments and more than half of them (58 percent) expect to pay a convenience fee when making an emergency payment with a debit or credit card. There is a big generational gap on this front: 25 percent more Gen Y than non-Gen Y consumers pay bills late and 43 percent more make emergency bill payments.

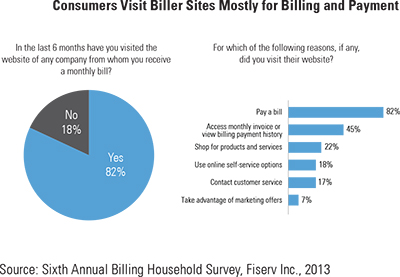

Why We Go to Billing Websites

This is a stat, which will shock no one: 82 percent of consumers who visit a website of a company from which they get a monthly bill do so to pay that bill. About a third of consumers prefer not to register when paying a bill at their biller’s site, we are told, although I don’t really get this one: in order to pay my, say, cable or gas bill, I have to first enter my account with the service provider; how do I do that if I haven’t registered?

Mobile Bill Payments Are Exploding

More than half (57 percent) of online households now own a smartphone, up from 47 percent in 2012 and mobile bill payments are also increasing, only at a faster pace. As already noted, the share of online households which have made a mobile bill payment via app, mobile browser or text in the last month has doubled from 8 percent (8 million households) in 2012 to 16 percent (16 million households) in 2013. The increase was greater among smartphone owners, 30 percent of whom reported to have used their device to pay bills — an increase of 150 percent.

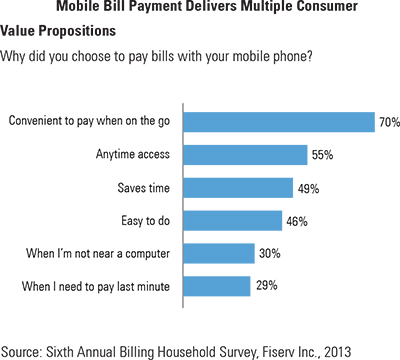

The primary reason consumers pay bills using their mobile phones, cited by 70 percent of the respondents, is convenience, followed by “anytime access” (55 percent), which could also fall under the “convenience” umbrella, and time saving (49 percent).

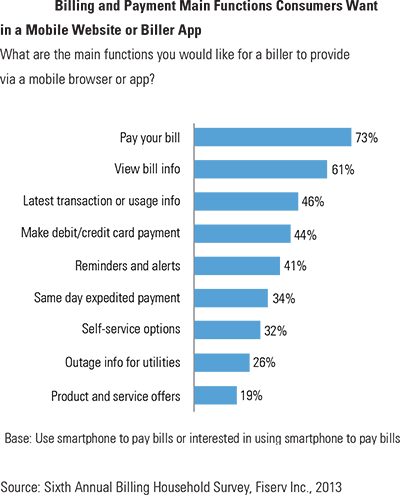

Close to a quarter (73 percent) of the respondents cite bill payment as the main feature they’d like a service provider’s website to offer, with the ability to view a bill coming in second at 61 percent.

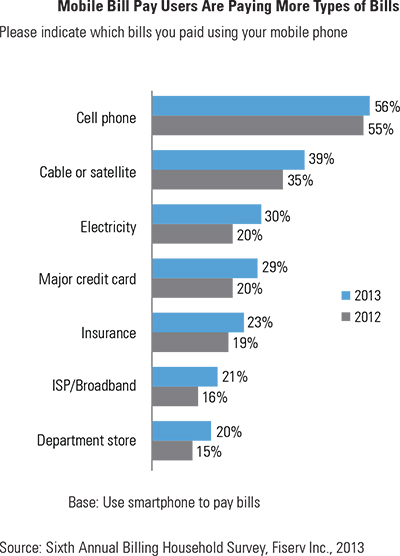

Perhaps the least surprising statistic the report has to offer is that consumers’ favorite bill to pay using their mobile phones is… their mobile phone bill, followed at some distance by cable or satellite and electricity bills. However, as you see in the chart below, the latter two bill categories are quickly catching up with the leader.

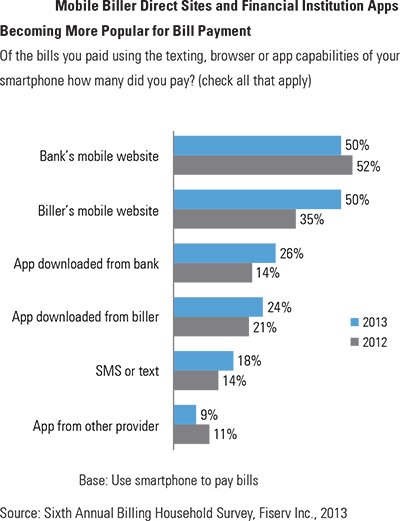

Similarly to bill payments initiated on desktops and laptops, mobile phone-initiated ones are typically made on a bank’s mobile site or the service provider’s one, rather than through a third-party service.

Tablets are quickly catching up with smartphones. A quarter of tablet owners now say they use their tablets to pay bills, an increase of 19 percent over 2012. Furthermore, 36 percent of tablet owners had used their tablets to visit a biller’s site in the previous 30 days, up from 30 percent in 2012.

When You Just Can’t Get Enough

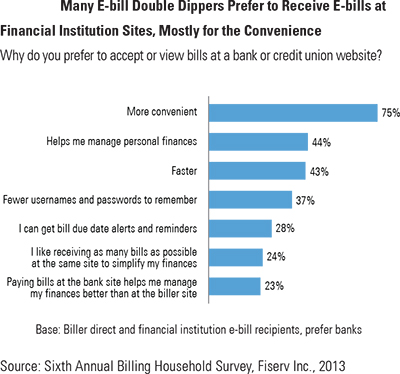

Different types of consumers use different channels to view and pay bills for different reasons and service providers need to accommodate the wide array of preferences, we are told. A tenth of online households who receive e-bills, get them at both the service provider’s and at their bank’s sites (hence, they are called “double dippers”). Many double dippers prefer to receive their e-bills at their banks’ website, because they find it more convenient (75 percent) or helps with their personal financial management (44 percent).

The Takeaway

The increasing adoption and usage of mobile devices is taking us into a post-PC era, the author concludes, adding that, to keep up with the evolution, billing and payment functionality, as well as channels and interfaces need to evolve accordingly. Websites should be optimized for mobile devices and apps should be built. Gen Y consumers, in particular, demand “lots of quick and convenient billing and payment choices and expect an easy, intuitive user experience”. Otherwise, “they will quickly abandon the biller’s site and utilize other more costly billing and payment services”. Needless to say, such behavior would keep the late-payment and missed-payment rates at unnecessarily high levels.

Image credit: Screenshot of Verizon’s account log-in page.