What Type of Customers Should You Target?

A new report from Experian, one of the three largest credit reporting agencies, analyzes the way price discounts affect American consumers’ shopping behavior. The authors note that, while nothing new by any means, discounting and promotional strategies have turned, in the wake of the financial crisis of 2008, into “endless promotions”. So, how is it working out for the retailers?

Well, the report finds that the state of perpetual price discounts is not only hurting retailers’ profits, but it is also confusing consumers who, being accustomed to continual promotions and sales, end up wondering whether they got the best deal possible or might a better one?á appear next week. Furthermore, the authors find, through their interminable sales events, retailers are giving deals to shoppers who neither seek, nor care much for them.

And here is what I found to be the most valuable part of the report: this group of deal-insensitive consumers is actually quite sizable. There are many consumers, the authors tell us, who rank price behind other key influencers of shopping experience, such as store environment and brand names, and who are perfectly willing to pay more provided their more highly prioritized needs are met.

And this, in turn, brings me to an issue I’ve addressed on this blog before, although from a slightly different perspective. Here at UniBul, we discovered long ago that servicing clients for whom price was the primary concern was both a thankless and unprofitable task. We only started making progress after we decided to focus on a specific market segment — high risk — which wasn’t well served and where cost considerations took a backseat to factors like service reliability, payout schedule, multi-currency support, etc. Of course, there are plenty of retailers which have adopted the same strategy, but they are in the minority. But let’s take a closer look at Experian’s findings.

Deal Seekers vs. Deal Rejectors

The report’s authors have divided the “deal-seeking continuum” into six segments:

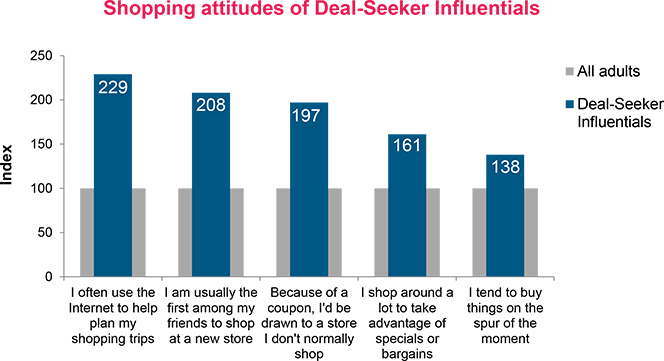

1. Deal-Seeker Influentials — always looking for the best online, offline and mobile deals. They tend to be young, highly educated and socially active consumers who love shopping, but don’t expect to pay full price. Deal-Seeker Influentials are about 2.5 times as likely as the average American to say that they trust the information they see about products on social media and buy a product when they have seen it advertised on social platforms. All of them have agreed with the statement “I am consumed with getting the best deal for a product or service”. Here is a chart showing their shopping attitudes:

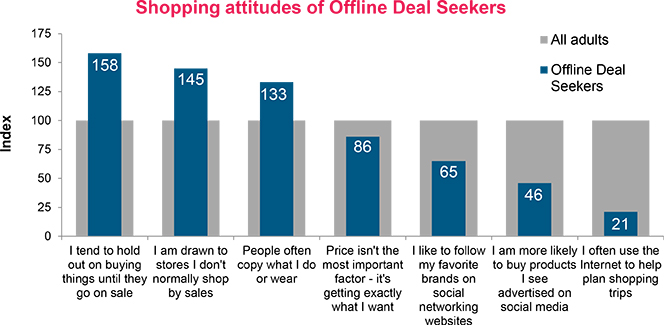

2. Offline Deal-Seekers — look for the best deals on traditional media. Predominantly over the age of 55, these shoppers would only look for a deal up to a limit. Most of them (63 percent) say that they head straight to the clearance rack when they enter a store but will not travel far to shop. They are highly social with many different groups of friends, but their influence in the digital domain is limited, as they are less likely than average to engage in social media.

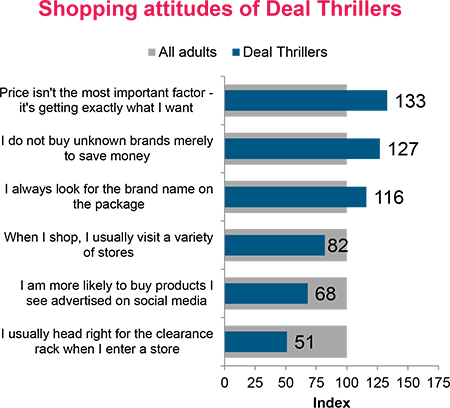

3. Deal Thrillers — love getting a deal, but are loyal to their brands too. These shoppers’ average age is 49 and they are 57 percent less likely than the average population to say that a coupon or sale would encourage them to try a new store. Consequently, they are less likely to use coupons at all.

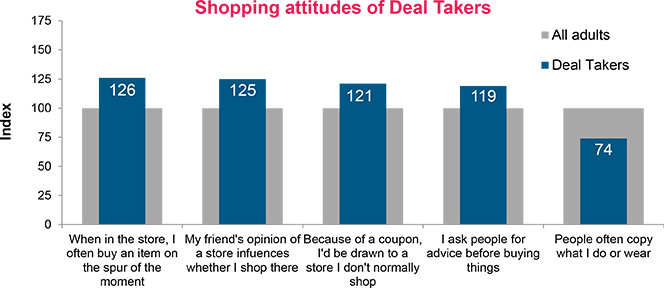

4. Deal Takers — social, but much less influential online than Deal-Seeker Influentials. Highly educated and affluent consumers, Deal Takers will accept a deal if offered, but are less likely to seek one out. Though not looking for a deal, they are nevertheless 24 percent more likely than the average consumer to try a new store if they are offered a sale and are 21 percent more likely to try a new store if they have a coupon. Deal Takers are also 31 percent more likely to click on links shared on social media and 17 percent more likely to pay attention to ratings and reviews.

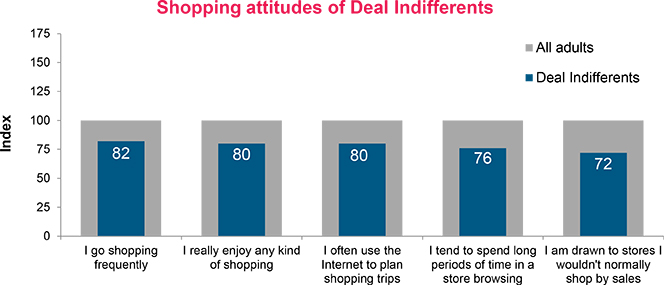

5. Deal Indifferents — get what they want, whether or not there is a deal. At about 30 percent of adults, they make up the largest segment of the population and are unlikely to change their behavior because of a deal. They shop when they need something and do not care if they get a deal. Therefore, sending coupons to Deal Indifferents would mean missing out on profits retailers could have otherwise kept.

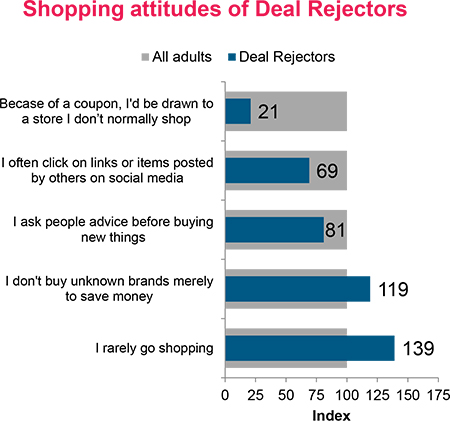

6. Deal Rejectors — not simply indifferent to deals, these consumers are rejecting them, placing convenience above all else. Deal Rejectors are 58 percent male, tend to be older and their purchase decisions are influenced to a much greater degree by convenience, service and brand names than by price. Of course, Deal Rejectors can afford to relegate pricing considerations so far down the list of purchase priorities, because they have higher-than-average discretionary income and are much more willing to spend it. They are also 59 percent less likely to trust information on social media, to the extent they pay attention to it at all.

The Takeaway

Experian’s report provides as good an insight into the merits of competing on price as an underlying business strategy as we can ask for. Yes, relying on such a strategy makes perfect sense for the Wal-Marts and Amazons of the world, but not for the smaller guys. Not only can you not compete with the big guys on price, but, for the most part, you don’t need to. As Experian’s report shows, most consumers’ purchasing decisions are primarily influenced by other factors. It would make sense, then, to focus primarily on meeting those other needs first. If you succeed, you would attract customers who might well stick with you for the long run. Surely, these are the best customers you can ask for.

Image credit: Wikimedia Commons.