What Do We Say about Mobile Payments?

MasterCard has just released its second annual analysis of the mobile payments-related conversations it tracks on various social media platforms. This time, however, the pool of analyzed data is vastly larger than it was in the first iteration of the survey. The payments company tells us that it, in cooperation with Prime Research, a PR consultancy, had tracked “more than 13 million social media comments across Twitter, Facebook, online blogs and forums around the world”, compared to only 85,000 conversations in the first study.

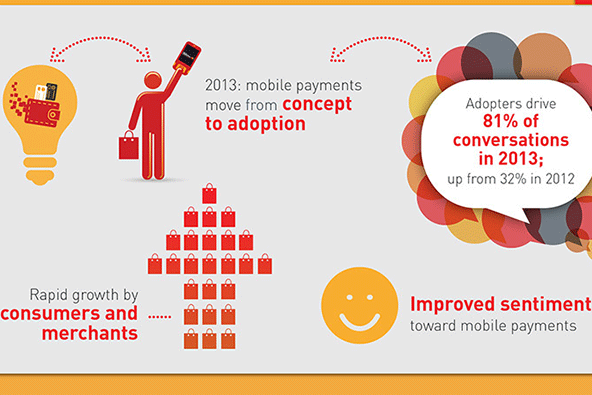

The researchers’ objective is to determine what consumers across the world — both adopters and non-adopters — feel about mobile payments. And they find that sentiment toward mobile payments has improved considerably and consumer usage has grown, as has merchant acceptance. Merchants have scored an 88-percent positive rating among consumers, MasterCard tells us, and many of them are touting m-payment acceptance as a competitive advantage. Their conclusion: as consumers are increasingly turning to mobile payments, merchants who fail to accept such payments may find themselves at a disadvantage.

The researchers have illustrated their findings in a nice infographic, which I thought I’d share with you.

What Do Consumers Say about Mobile Payments?

The authors see 2013 as the year when mobile payments have transitioned from “concept to adoption” and expect the trend to intensify in 2014, which, we are told, may be “the year when long-term mobile brand and shopping allegiances are formed, which means those considering mobile payments may be well served by getting on board”. Here are their main findings:

- The confusion over mobile payments expressed by consumers in the 2012 study has been replaced by discussions about the quality and resilience of the various platforms, we learn. So consumers have now moved from questioning whether to use mobile payments (the third most discussed topic in 2012) to choosing which one of them to use (the second most discussed topic in 2013).

- M-payments adopters now drive most of the conversation (81 percent), whereas non-adopters drove 68 percent of them last year. The researchers’ interpretation is that consumers have shifted from discussing mobile payments to trying out the available options.

- Consumer sentiment towards mobile payments has improved significantly among adopters (up to 74 percent in 2013 from 58 percent in 2012). Non-adopters’ attitude has remained virtually unchanged (up to 79 percent in 2013 from 76 percent in 2012).

- Consumer sentiment towards the transaction experience has also improved (up to 63 percent in 2013 from 34 percent in 2012). Yet, we are also told that transaction experience ranks just as high as a frustration point for users, so clearly there is room for improvement.

- Merchant acceptance is the most talked-about subject, generating 15 percent of the total m-payments conversation and 48 percent of merchant-related conversation. Both consumers and merchants are found to be supportive of mobile payments (86 percent), which the researchers expect, reasonably, to lead to yet more merchant adoption in 2014. Merchant availability has gone from a barrier to entry for non-adopters in 2012, we are told, to the most often discussed positive topic overall in 2013.

- Merchants account for 22 percent of social media conversations and enjoy an 88-percent positive sentiment rate. Close to 90 percent of merchant conversations are driven by those who have implemented mobile payments solutions. Non-adopting merchants, for their part, are mostly turning to social media for mobile payments advice from other merchants.

- Merchants who accept mobile payments single out convenience as a key driver with a 97 percent positive / neutral rating. They see the benefits of mobile payments as a differentiator for their businesses.

- Questions about security have led to a negative rating of 66 percent, which prompts the researchers to conclude that consumer education efforts will be critical to the success and adoption of mobile payments.

- Confusion exists, we are told, on how fraudulent and otherwise unauthorized mobile payments will be handled. Naturally, MasterCard is quick to note that consumers using the payment network’s cards for mobile payments are protected from fraudulent purchases through the company’s zero-liability policy.

Overall, the researchers’ analysis of the 13 million relevant social media posts from March 2013 to December 2013 found that the majority of them were driven by sharing of news stories, which was also the case in the previous year. Once again, the vast majority — 92 percent — of the posts were either positive or factual and only 8 percent were negative in tone, which, the researchers note, is a reflection of the original content as it appeared in traditional news outlets. Out of the total of 13 million comments, 5,000 of the more substantive posts were subjected to human-content analysis, which had offered deeper insights.

Now here is the infographic itself:

Image credit: MasterCard.