U.S. Student Debt Problem Quickly Deteriorates

It is absolutely astonishing to watch just how quickly the nation’s student debt problem deteriorates. The latest Household Debt and Credit quarterly report issued by the Federal Reserve Bank of New York tells us that, even as the overall delinquency rate on outstanding consumer debt in the U.S. continued to improve in the last quarter of 2012, the ratio of past due student loan balances continued to skyrocket. Whereas in all other debt categories the delinquency levels have fallen substantially from their post-Lehman peaks and in most cases continue to improve, student debt delinquencies are exploding. All the while, outstanding student loan balances keep increasing and are now approaching $1 trillion.

The report’s headline news was that, following fourteen consecutive quarterly decreases, the overall level of consumer indebtedness rose modestly in 2012 Q4. It is too early to say whether the long-standing post-crisis debt deleveraging trend has now been reversed, we are warned, but if that is the case, the reversal would benefit the economy. Apart from the rise in the student loan total, auto loans and credit card debt contributed to the overall increase, while mortgages were flat. Let’s take a closer look at the NY Fed’s numbers.

U.S. Consumer Debt Up by $31B

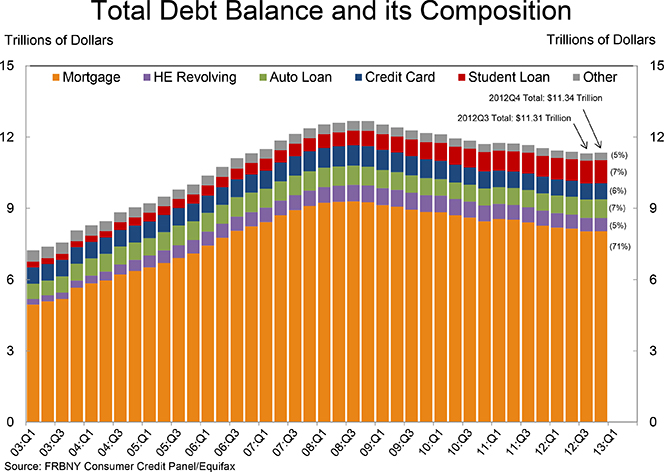

The NY Fed report tells us that the aggregate indebtedness of U.S. households at the end of 2012 was $11.34 trillion. That is $31 billion (0.3 percent) higher than the corresponding total at the end of the previous quarter. Yet, the new total is still much lower — by 10.6 percent, or $1.34 trillion — than the peak of $12.68 trillion recorded in the third quarter of 2008, at the end of which the collapse of Lehman Brothers set off the financial crisis. The slight rise is due to increases in the non-housing components of the total, with auto loans up by $15 billion, student loans up by $10 billion and credit card balances up by $5 billion.

Delinquencies Down to 8.6%

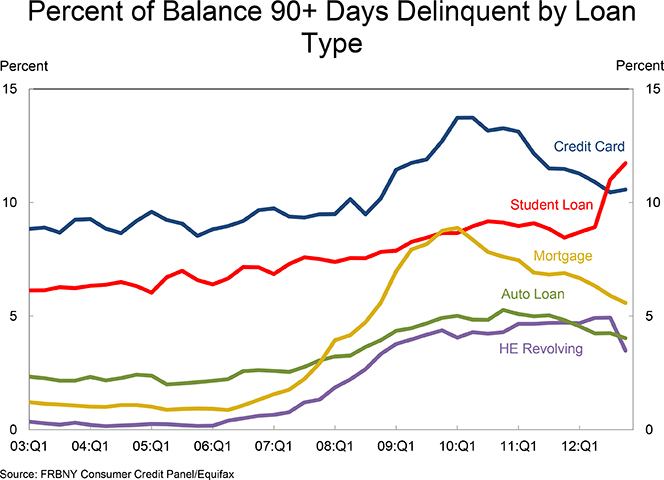

The overall delinquency rate fell in 2012 Q4, the NY Fed tells us. As of the end of December, 8.6 percent of all outstanding consumer debt — $978 billion in total — was delinquent, down from 8.9 percent in 2012 Q3 and 9 percent in 2012 Q2. Just under three-quarters — $712 billion — of that total was “seriously delinquent” — at least 90 days overdue. As you can see in the chart below, whereas the delinquency rates of mortgages, auto loans and home equity loans all declined, and the credit card one was pretty much flat, student loan delinquencies are rising at an incredible rate.

Credit Card Debt, Student Loans Up

Now let’s look at the credit cards and student loan numbers.

Credit Card Debt up to $679B

Credit Card Debt up to $679B

- Aggregate credit card limits were down by $9 billion — 0.3 percent — from the previous quarter.

- The number of open credit card accounts rose slightly to 383 million, 22.8 percent below the 2008 Q2 peak of 496 million.

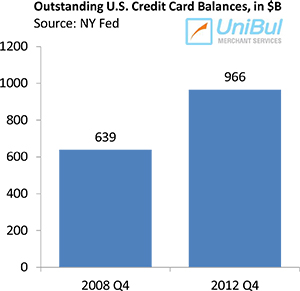

- Outstanding credit card balances rose by $5 billion to $679 billion, 22.2 percent below the 2008 Q4 peak of $866 billion.

- Credit card delinquencies — at 10.57 percent – were up from 10.45 percent in 2012 Q3, but are still 23 percent below the post-crisis peak of 13.74 percent, recorded in 2010 Q2.

Student Loan Debt up to $966B

Student Loan Debt up to $966B

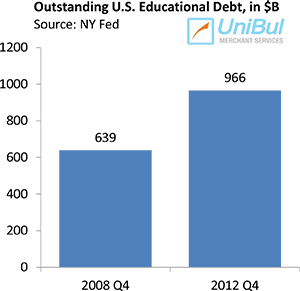

- Student loan debt rose by $10 billion to $966 billion.

- Over the course of the past four years, the student debt total has risen by $327 billion — an increase of 51.2 percent — while the other forms of debt have fallen by a combined $1.7 trillion.

- The student loan delinquency rate rose for a fourth consecutive quarter. The share of student loan balances delinquent by 90 or more days spiked to 11.7 percent, up from 11 percent in 2012 Q3 and from 8.9 percent in 2012 Q2. For perspective, the highest delinquency level reached prior to 2012 Q3 was 9.17 percent, recorded in 2010 Q3.

At the onset of the financial crisis in September 2008, the student debt total stood at $611 billion — lower by more than a quarter — 28.8 percent — than the credit card total of $858. By the end of 2012 there has been a complete turnaround and the student debt total was bigger by more than a quarter — 29.7 percent — than the credit card one.

The Takeaway

Here is how Andrew Haughwout, vice president and economist at the New York Fed, reads his report’s results:

The data provides early evidence that consumers may be reaching the end of the four year deleveraging cycle, though we’ll need to see if this is sustained in upcoming quarters. At the same time, we observed mixed developments, mortgage originations increased and fewer accounts entered the foreclosure pipeline but delinquency rates remain considerably higher than pre-crisis levels.

So there should be every reason to expect that delinquency rates would keep falling — and they are for all debt categories, but for student loans. And given the quickly rising college education costs and weak labor market, it is difficult to see how student debt delinquencies would start falling on their own anytime soon. So if there is no governmental action of some sort, the problem will just keep getting worse.

Image credit: Anticap.wordpress.com.