U.S. Credit Card Default, Delinquency, Repayment Rates Set New Records

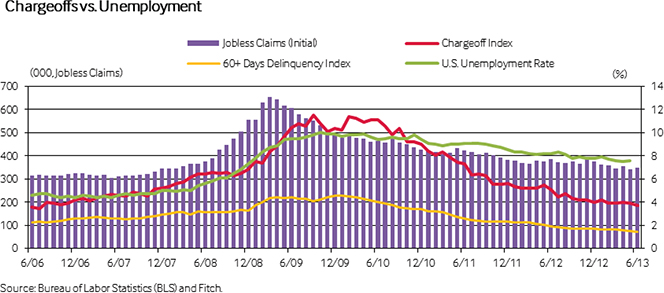

The default rate on U.S. consumer credit cards continued to fall throughout the second quarter of this year, in line with expectations, according to the latest data (registration required) released by Fitch Ratings — a credit ratings agency. The headline delinquency rate also maintained its downward trajectory in the second trimester of the year, we learn, and both indices have set new records in the process. Five of the six biggest U.S. card issuers reported lower delinquency and default rates in May — the last month for which regulatory filing data are available — with the sole exceptions being American Express, whose late-payments rate was unchanged at an extremely low 1.1 percent, and Discover whose charge-off rate rose by a single basis point.

The credit card monthly payment rate (MPR) rose for a third consecutive quarter and had the highest quarterly average ever recorded since Fitch began keeping track of it. And at the end of June, the MPR was much higher than the average for the trimester. It amazes me to see how, almost five years after the financial crisis set off the consumer debt deleveraging process, Americans continue to maintain their credit card debt repayment discipline and set new records almost every month. Let’s take a closer look at the latest Fitch data.

Credit Card Charge-offs down to 3.71%

Credit card charge-offs continued to fall during the second quarter of this year, ending the quarter at 3.71 percent — a seven-year low, Fitch tells us. The average for the trimester was 3.87 percent — 26 percent below the average of 5.23 percent for the second quarter of last year and 66 percent below the peak reached in 2009. Yet, Fitch still expects that the fall in charge-offs will “plateau in the near term before trending higher later this year”.

Fitch’s charge-off (default) rate is measured as a ratio of all individual credit card accounts with unpaid balances that a card issuer no longer expect to be repaid by its cardholders, in relation to the total number of open accounts in that lender’s portfolio. Charge-offs occur either through contractual delinquencies or through a bankruptcy of the cardholder, the agency reminds us, and are written off of the lender’s books as losses, typically at 180 days after the last payment on the account has been posted or 60 days after a notification of the bankruptcy has been received.

Credit Card Delinquencies Fall to 1.63%

Having set new all-time records in each of the first three months of the year, the credit card delinquency rate fell again in the second quarter, averaging 1.48 percent for the period. That was down from an average of 1.63 percent in the previous quarter and was lower by 27 percent than the rate recorded at the end of the second quarter of last year. The late payments rate ended the quarter even lower at 1.40 percent — an all-time low.

Fitch’s delinquency rate is measured as a ratio of the credit card accounts on which payments are past due by 60 days or more, in relation to the total number of open accounts. Delinquencies are an important early indicator of charge-offs, as a large portion of these occur further down the line through contractual delinquencies (the rest are the result of bankruptcies).

Monthly Payment Rate up to 25.30%

My favorite early guide to the future trends of both the credit card delinquency and default rates is the monthly payment rate (MPR). The MPR is measured as the ratio of the total amount of credit card debt which American cardholders are repaying at the end of each month — payments applied to the principal, as well as finance charges and fees — in relation to the total outstanding balance at the beginning of the month.

During the second quarter of this year, the MPR averaged 24.43 percent, up from 23.42 percent in the previous trimester, and was the highest average ever recorded. Even more impressively, the MPR ended the quarter at 25.30 percent — the highest monthly ratio ever measured since Fitch’s Prime Credit Card Index was launched in 1991 and an improvement of 13.50 percent from the same period a year ago. To give you an idea of just how much higher credit card debt repayment now is on consumers’ financial priority list, consider that historically the MPR has hovered in the mid-teens.

The Takeaway

Fitch’s latest report provides yet another strong indication that the post-Lehman credit card debt deleveraging process is still very much under way. Yes, Fitch does expect delinquencies and defaults to level off sometime later this year and then climb slightly upwards, but the current levels are extremely low and a modest uptick wouldn’t change the picture all that much. Moreover, for as long as the MPR maintains its current levels, Americans’ credit card accounts will remain in good shape.

But won’t Americans, as the unemployment rate (hopefully) keeps falling and consumer confidence keeps rising, become more relaxed once again and abandon their newly-developed credit card spending discipline? Well, this is certainly a possibility and it is precisely what took place in the heady pre-crisis days, as the chart above shows. I guess we will have to wait and see.