The U.S. Is Catching up with the Rest of the World in Mobile Payments

Long a laggard in the adoption of mobile payments, the U.S. is quickly catching up with the world leaders and is already home to several of the world’s biggest m-payments companies, including Square and PayPal, we learn from Business Insider’s report on the latest trends in the fast-growing industry. Moreover, high though it has been, mobile payments’ growth rate is set to accelerate further in the coming years, both in the U.S. and the rest of the world, we are told.

For the purposes of this report, Business Insider has defined mobile payments strictly as offline point-of-sale (POS) transactions processed by mobile devices or through a mobile phone number. That definition includes Square and its clones, where credit cards are swiped through a reader attached to a smartphone, as well as NFC-based services, where transactions are facilitated through the wireless exchange of data between an NFC-equipped smartphone and a POS terminal. Excluded are the mobile versions of e-commerce (called m-commerce), peer-to-peer payments and billing and money transfers. Let’s take a look at the author’s (Tony Danova) findings.

Smartphone Adoption Powers M-Payments Growth

The proliferation of smartphones and tablets has played a crucial role in the mobile payments adoption in the U.S. and Western Europe and that will continue to be the case in the years to come. The chart below uses Business Insider’s global smartphone shipments forecast as a pace-setter for overall mobile payments growth.

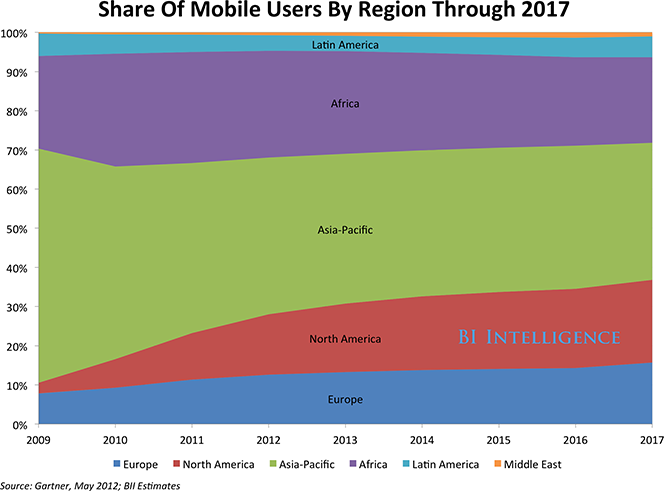

African and Asian countries, which pioneered mobile payments technologies relying on feature phones, are now seeing their shares of global m-payments users shrinking, as the shares of U.S. and Western Europe are expanding, driven by the fast adoption of the smartphones, which are powering Square and the NFC-based services that are becoming popular in these regions. And that trend is set to continue, as the chart below illustrates:

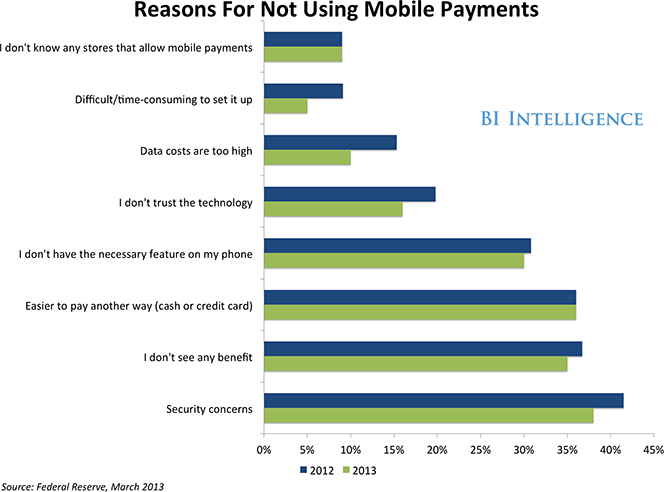

Security Is Biggest Reason for not Using M-Payments in The U.S.

That is what Americans have consistently been telling pollsters. According to a Federal Reserve survey taken in March of 2013, and quoted in the BI report, 38 percent of the respondents placed security at the top of their list of concerns, down by about five percent from the ?áSeptember 2012 result, but still quite high. Here is the full list:

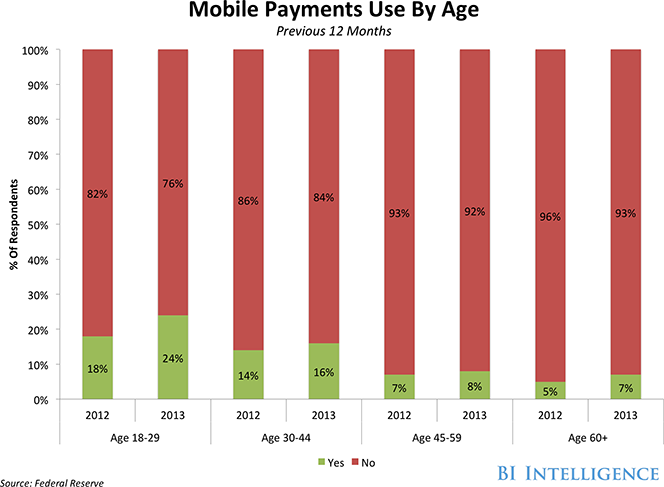

Younger, Affluent Americans Most Eager Adopters

No surprises here. In the U.S., the biggest growth in mobile payments adoption, by age group, was registered among consumers between 18 and 29 years old, 24 percent of whom have now used m-payments. Here is the full chart:

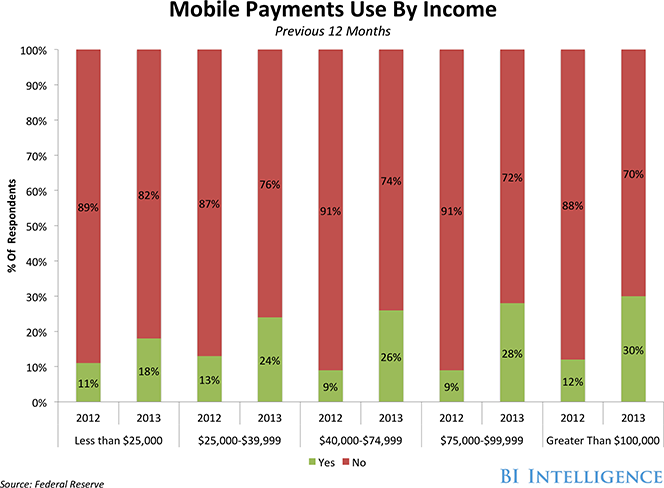

When income level is considered, there is a direct correlation between mobile payments adoption and income. Here is the chart:

However, we are reminded that young consumers adopt mobile payments independent of income level.

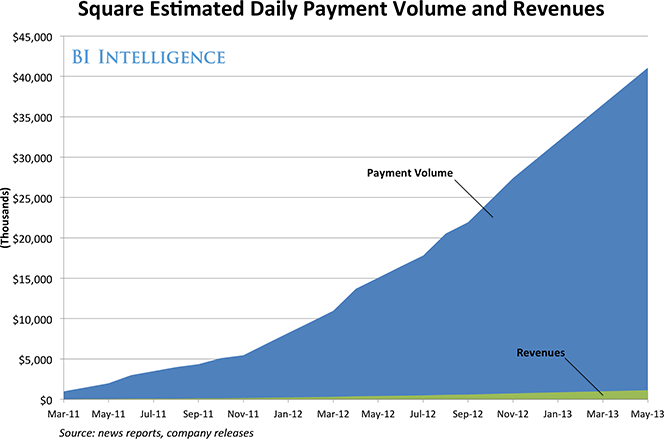

Square Leads the Pack

The report’s author predicts that card-reader-based mobile payments services will win over their NFC-based rivals, for several reasons. Firstly, Square and its clones immediately addressed a huge niche market of very small merchants that was previously unserved. Secondly, NFC requires compatible phones and POS systems, of which there are still few available. Finally, whereas NFC-compatible POS terminals are costly, Square-like readers are shipped for free.

Well, I would point out that, whereas Google Wallet and Isis have indeed been underperforming rather spectacularly, many of the nation’s biggest retailers have banded together and are close to launching an NFC-based mobile payments project on their own. Merchant Customer Exchange (MCX), as the Wal-Mart-led initiative is called, will be launched on such a huge scale that it will very probably surpass Square’s volume within months of going live. After all, the merchant partners in the exchange will presumably finance the retrofitting of their POS systems to make them NFC compatible and the number of NFC-compatible smartphones, though still very small, is growing quickly.

Still, as of now, Square is the “star of the software-based mobile payments companies”, as Danova puts it. Here is a chart of Square’s estimated daily processing volumes, going back to March of last year:

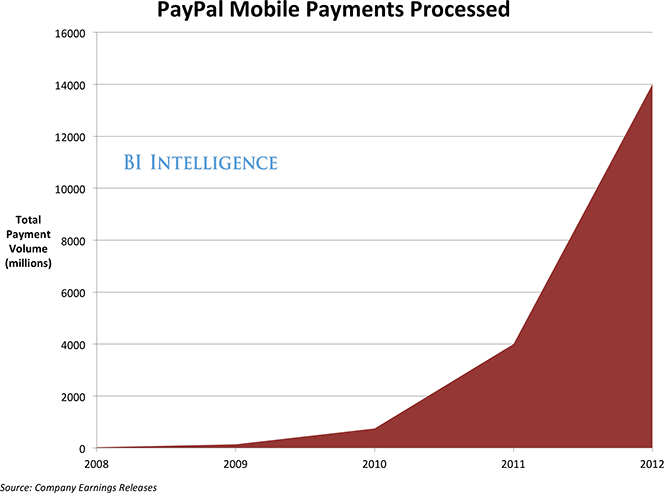

PayPal Has Tripled Its M-Payments Volume since 2011

Finally, here is a chart showing the spectacular growth of PayPal’s mobile payments volume. However, most of this volume comes from mobile commerce transactions processed on the platform of PayPal’s parent — eBay — not on PayPal Here — the processor’s Square clone. Still, it is hugely impressive.

The Takeaway

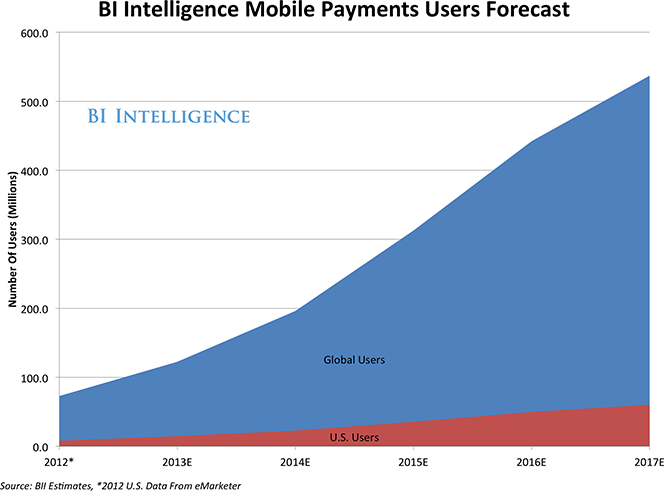

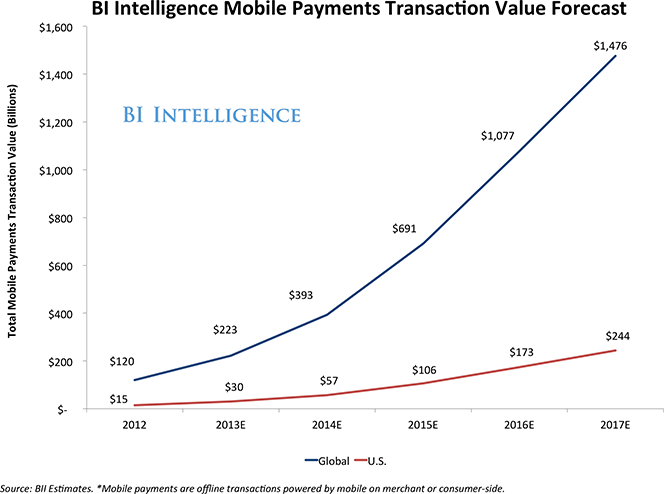

So mobile payments will continue to grow at an incredibly fast rate in the coming years. Danova predicts that, by 2017, the total value of card-reader-based and NFC mobile payments transactions will reach about $1.5 trillion, up from $120 billion in 2012. In the U.S., the respective numbers are $244 billion in 2017, up from $15 billion last year. The number of mobile payments users will also explode — from less than 75 million global users in 2012 to more than 500 million in 2017. In the U.S., by 2017, 60 million people are expected to be making mobile payments. Here is the chart:

Image credit: Google.

This macro analysis misses the point of how long it takes to change behavior. The only two things that have worked, Square and Starbucks are simply based on a pain point (Square, no way for the flea market merchant to take a card) and ingrained behavior (showing a barcode to the cashier, which deducts from a stored value).

Both of them rely on known use cases 1). you pull out a magstripe credit card and 2) you move money into a stored value account and just show a bar code.

In contrast “wallets” e.g. Google and Isis are trying to solve non-existent problems. In fact their real problem is fear, the fear of being left out of the value chain. History has shown that to be a poor starting point.