The State of Mobile Payments According to Google

I don’t know for certain whether or not Google has the world’s biggest data repository, although I suspect that it does. What I do know for certain, however, is that the search giant has been more willing to share its information trove with the rest of us than any other organization of comparable size, whether of a corporate or governmental variety. Moreover, Google has not only made all that information available for external use, but the company has gone into the trouble of building sophisticated tools to allow us to play with it and create customized reports to fit our needs. And it’s all free!

Lest this starts to sound too much like a paid advertisement (or is it too late?), and before I move on, let me insert a caveat. I think that Google’s stranglehold on the search industry is a huge problem and one that cannot be easily solved. There are many aspects to this issue and I have no intention of going into each one of them here. However, as this is a business blog, I would just note that Google has gained sovereign power to decide who will be successful selling things online and who will die trying. And the company has not been shy in exercising its power through a myriad of updates to its search algorithm (each with its own embarrassingly infantile name) and penalties for websites deemed in non-compliance with some vaguely defined rule or other. Yet, although the status quo is clearly unsustainable, it is going to remain in place for the foreseeable future and we’ll all have to live with it.

Now let me go back to Google’s data trove. Through its Trend tool, the search giant is giving us access to the search volumes for each term we may be interested in and it shows us how that volume has evolved over time. Well, today I decided to look into how some of the most widely talked-about mobile payments concepts have fared over time and it has been a fascinating experience, which I thought I’d share with you.

Google Trends on Mobile Payments

Before I dive in, let me note that I’ve decided to alternate between global trends and U.S. ones, as some of the search terms I’ll be looking into are relevant exclusively to the U.S. market. However, you can adjust the settings as you wish below. (Actually, no, you can’t. It turns out that he embed code Google Trends is giving me doesn’t work in WordPress and I have no time to look for a workaround. So you’ll be getting images instead. I hope Google fixes the thing quickly.)

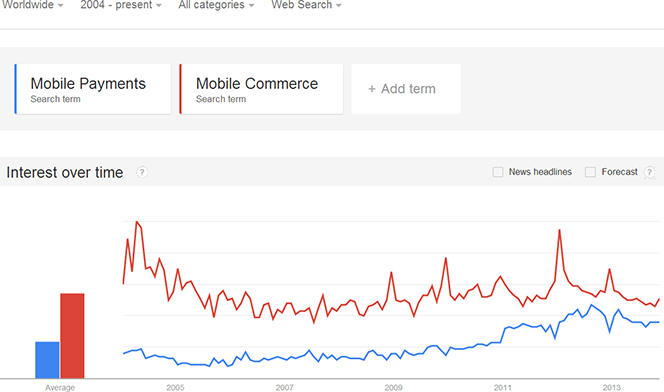

1. Mobile payments and mobile commerce. I thought the starting point should be a look at the evolution of search volumes for these two terms and was surprised to learn that mobile commerce has consistently been the more popular search, although mobile payments have been slowly catching up. Here is the chart:

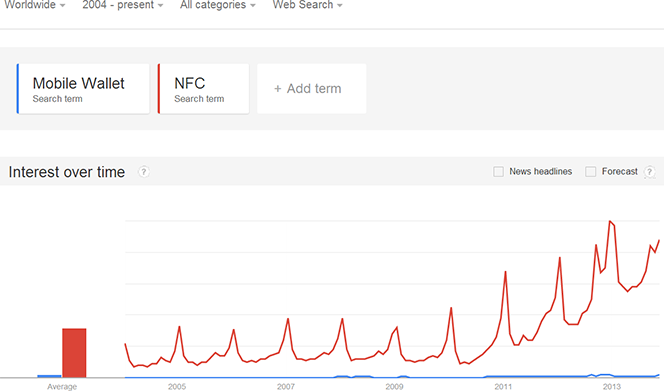

2. Mobile wallet and NFC. Mobile wallet has surely been the most hyped-up m-payments-related concept and NFC has been the technology chosen by its biggest proponents to make it happen. However, when I charted the interest the two terms have generated over time, I was very surprised to discover that “mobile wallet” was almost invisible in comparison. Here it is:

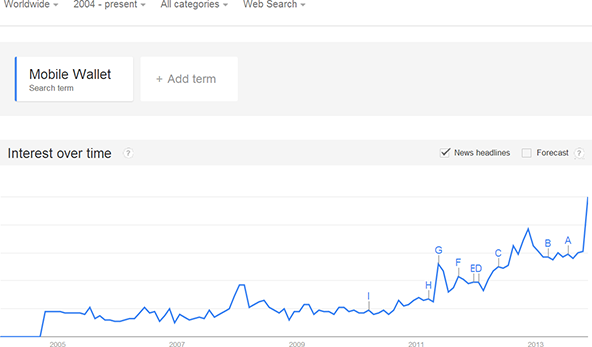

So I felt compelled to show you the mobile wallet search volume in a separate chart. And yes, interest is skyrocketing:

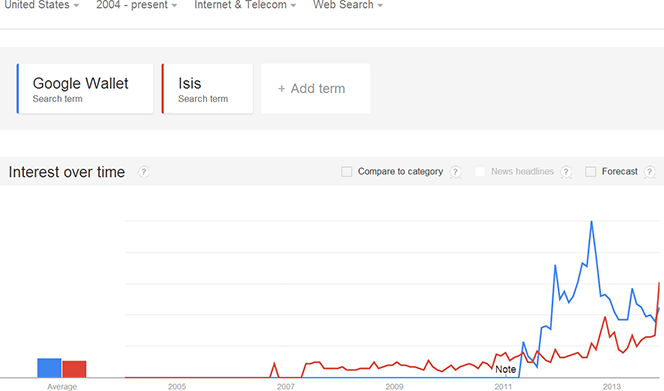

3. Google Wallet vs. Isis. As these are the two biggest NFC-based mobile wallet hopefuls, I naturally pitted them against each other. I looked solely in the U.S. and then exclusively into the “Internet & Telecom” category to eliminate from the results searches for Isis the goddess and other non-related things; it seems to have worked. Until recently, Google Wallet has been generating much more interest than Isis, but the joint venture has been quickly gathering speed since its official, and much-delayed, launch.

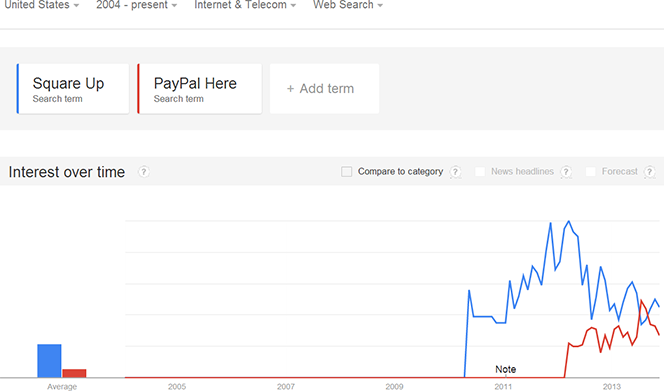

4. Square vs. PayPal Here. When I shifted my attention to the brightest m-payments star and its biggest competitor, I had to once again focus my attention to the “Internet & Telecom” category and that seemed to work. Looking at the chart, it’s tempting to conclude that Square’s star is fading, but I’ll give it some more time. In any case, PayPal has managed to catch up with its rival.

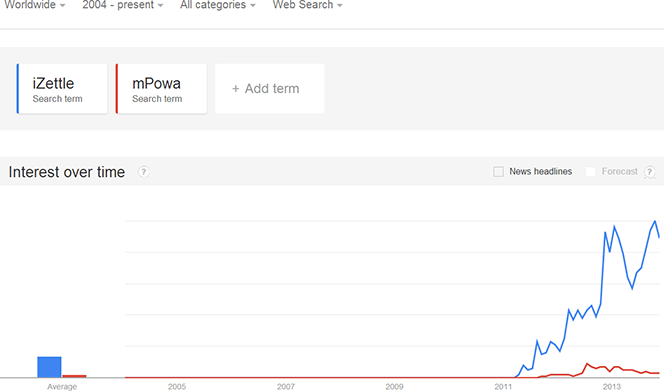

5. Square’s European clones. The biggest Square copycats across the Atlantic are iZettle and mPowa. Here is how they compare:

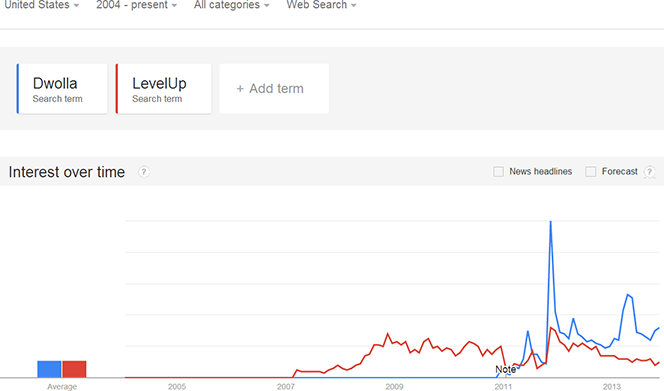

6. Dwolla and LevelUp. These two companies don’t have much in common, other than the fact that they seem to be the two most popular mobile payments start-ups in the U.S. not named Square. Dwolla specializes in fast and cheap (or free) person-to-person (P2P) bank transfers, while LevelUp has developed a QR-code-based technology for facilitating mobile payments. And they’ve been generating quite a bit of interest, although LevelUp’s fortunes seem to be declining:

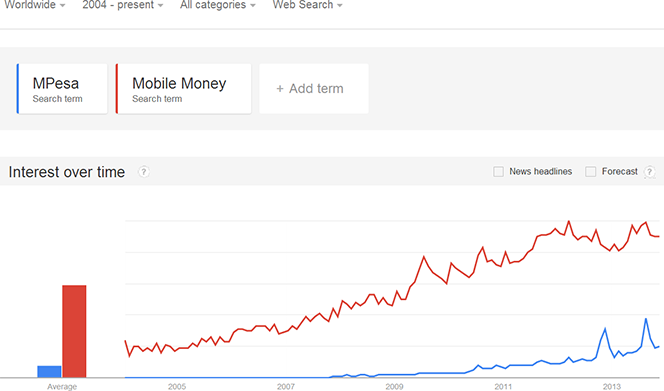

7. M-Pesa and mobile money. M-Pesa is one of the biggest business success stories to come out of Africa over the past decade, perhaps ever. Only six years after its launch, the company was processing payments worth about a third of Kenya’s GDP. Justifiably, M-Pesa has become synonymous with “mobile money”, which is why I placed the two terms in the same chart. Here it is:

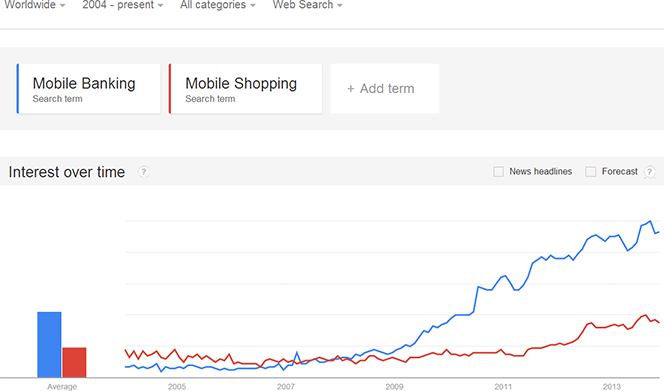

8. Mobile banking and mobile shopping. Interestingly, these two terms have generated almost identical search levels until about 2008. Since then, however, “mobile banking” has taken off, while “mobile shopping”, though clearly on the rise, has been lagging.

The Takeaway

Data about the shifts in a particular business-related search term’s volume over time is the most powerful indication of changes in consumer attitudes toward the business, product or service in question that I can think of. And Google Trend is surely the most reliable source of such data. I’m glad it’s free and will keep using it. I suggest you do the same as well.

Image credit: Wikimedia Commons.