The Clash of Credit Card Titans: How China UnionPay Is Surging Ahead

It’s infographics day here at UniBul. I’ve just run into a good new graph, which prompted me to do some digging into our own archive to supplement the information visualized in it. The graph gives us some numbers about credit card ownership and use in the U.S. One statistic that jumped out at me in particular was the incredibly high share — about a quarter of the total — of credit cards which belong to payment brands other than the big four in the U.S.: Visa, MasterCard, Discover and American Express. I have supplemented the data illustrated in this graph with some global statistics, with an emphasis on China, for perspective.

Credit Cards in the U.S. and China

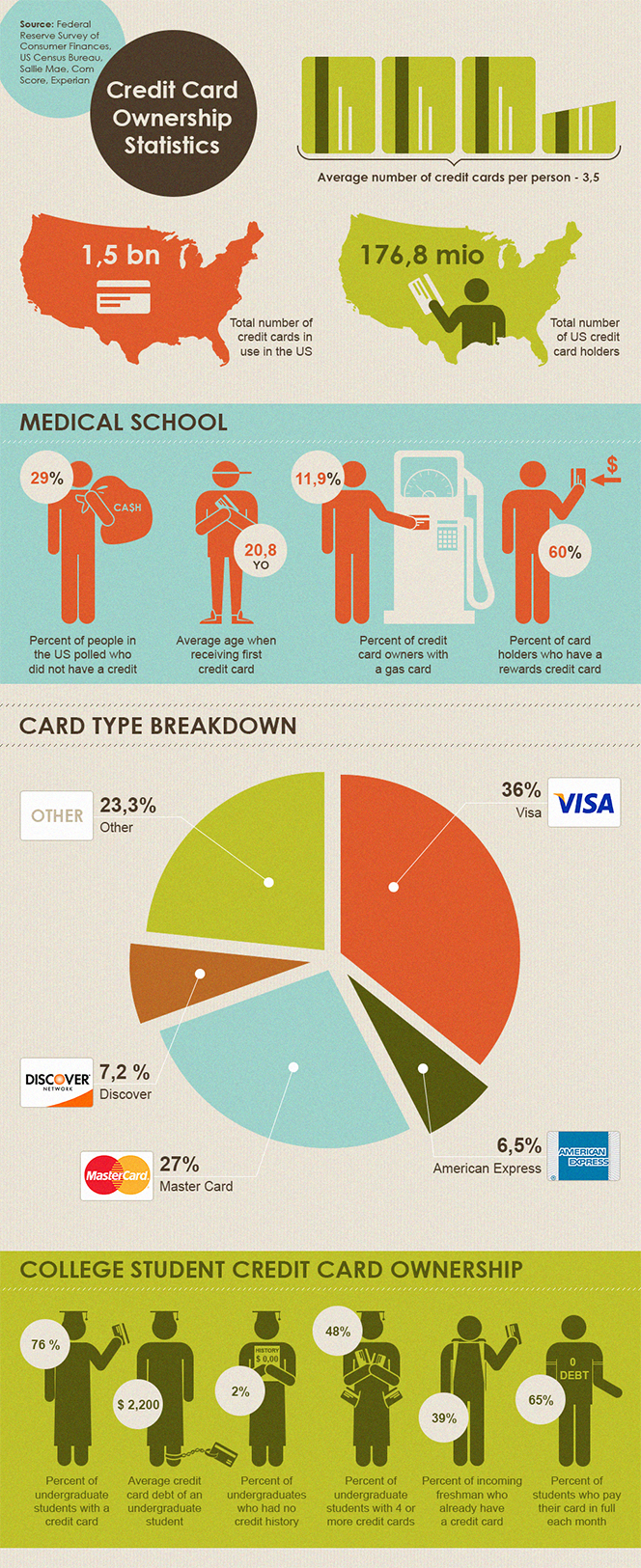

So the infographic below gives us some top-line statistics, nicely visualized by Mydebt24. By the way, if you are wondering why the total number of U.S. cardholders (listed at 176.8 million) doesn’t square with the total number of credit cards in the U.S (listed at 1.5 billion), given that the average American cardholder holds 3.5 cards, that is because the number of cards includes debit, as well as credit rectangular pieces of plastic.

But the more interesting part of the graph is the one that presents a breakdown of U.S. cards by brand. As you can see, Visa and MasterCard are leaders by quite a margin, but there is a surprisingly large share of “other” cards. I wish the authors had given us a more detailed breakdown to include at the very least the biggest of these “other” brands.

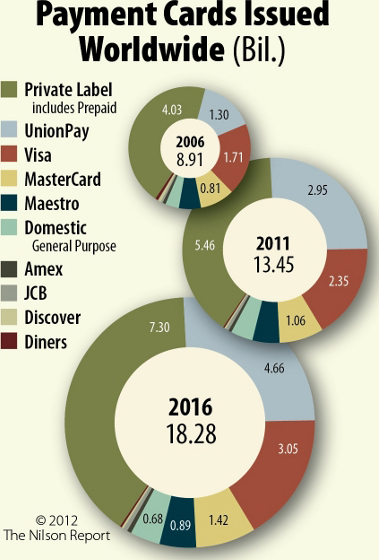

Now let’s take a look abroad. First, here is a breakdown of the number of credit cards issued worldwide. You can see that, as early as 2011, UnionPay — the Chinese credit card champion — had already taken the global lead and is only set to expand it further in the coming years.

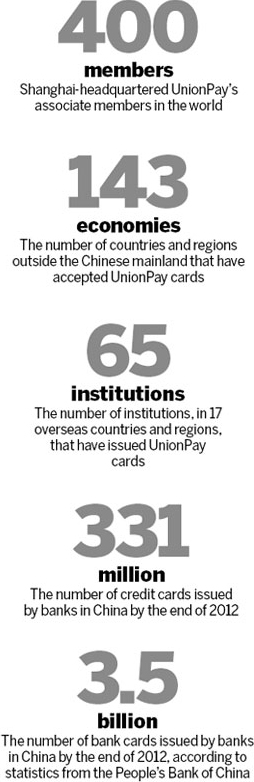

And the Chinese card market has been growing at an incredibly high rate in recent years. According to official statistics from the People’s Bank of China, Chinese banks have issued a total of 331 million credit cards in 2012, a 16 percent increase from 2011’s total. As a result, one in four Chinese consumers had credit cards last year, a 19 percent growth from the previous year. The total number of bank cards issued by Chinese banks, the vast majority of them bearing UnionPay’s logo, at the end of 2012 was 3.5 billion, up from 2.95 billion at the end of 2011, an increase of 18.6 percent. Here is a visualization of these numbers:

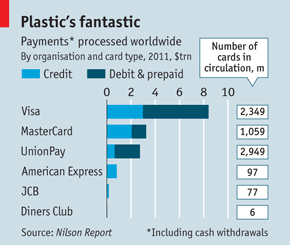

Finally, courtesy The Economist, here is how the top global brands measure up by processing volume and card numbers, broken down by credit and debit. As you can see, both Visa and MasterCard were ahead of UnionPay at the end of 2011, but the Chinese company has probably overtaken MasterCard by now and is likely to surpass Visa in as few as 2 – 3 years.

Finally, courtesy The Economist, here is how the top global brands measure up by processing volume and card numbers, broken down by credit and debit. As you can see, both Visa and MasterCard were ahead of UnionPay at the end of 2011, but the Chinese company has probably overtaken MasterCard by now and is likely to surpass Visa in as few as 2 – 3 years.

Note that, in 2012, the average volume of bank card transactions in China was 5,894 yuan ($962.5) per person, up 6.6 percent from 2011 level. The average transaction value was 2,312 yuan ($377.5), down 2.6 percent. Furthermore, and to give you a sense of the Chinese card market dynamics, in 2012 the number of card transactions rose by 46 percent and ATM withdrawals increased by 26 percent, China Daily told us citing statistics from China UnionPay. Oh, and all this volume is processed by UnionPay!

Image credit: Flickr / SimonQ.