Stricter Debt Collection Laws Reduce Credit Availability

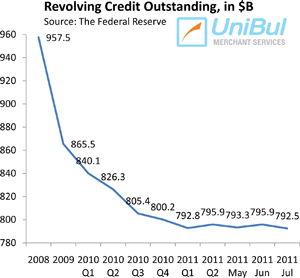

That is one of the main findings of a new paper by Viktar Fedaseyeu, a visiting scholar at the Federal Reserve Bank of Philadelphia. The author develops a state-by-state index of the tightness of debt collection laws and finds that even marginally stricter regulation leads to a substantial reduction of the number of new revolving lines of credit — available credit card balances.

Having stated the mandatory caveat that his results “do not imply that credit expansion generated by more efficient debt collection is welfare improving, and further research is needed to shed light on this issue”, Fedaseyeu nevertheless goes on to state the obvious: that “robust contract enforcement can help explain the existence of large and active retail credit markets”. Therefore, the author suggests, “financial regulation that institutes strong consumer protection must be balanced with creditor rights in order for the latter to extend consumer credit in the first place”. It’s a reasonable advice. Now let’s take a closer look at the paper.

Debt Collection at a Glance

Debt collection is a big industry and Fedaseyeu cites some top-line numbers from ACA International — the largest trade group representing collection agencies in the U.S. — to give us a sense of just how sizable it is. According to the latest available data, the total amount collected in 2010 was $54.9 billion, we learn, of which $10.3 billion (or 19 percent) was retained by third-party debt collection agencies as commissions. As of March 2010, the industry employed 148,479 debt collectors who contact millions of Americans every year. In the first quarter of 2013, we are told, 14.6 percent of American consumers had at least one account being processed by debt collectors. That is an incredibly high number.

Of course, no review of the collection industry would be complete without a look at its dark side and Fedaseyeu’s paper is no exception. Citing data from the Federal Trade Commission (FTC), the author reminds us that third-party debt collectors generate more complaints than any other industry. In 2010 alone, the FTC received 140,036 complaints about third-party debt collectors, which is more than a quarter (27 percent) of all complaints received from consumers in that year. Unsurprisingly then, debt collectors get sued a lot. In 2009, American consumers filed 10,128 lawsuits against debt collection agencies, which accounted for 5.4 percent of 185,900 original civil cases filed in the U.S. District Courts in 2009. So, as the author observes, “debt collectors are a very visible presence in the lives of American households”.

The debt collection industry functions in a fairly straightforward fashion. Creditors turn to collectors after a loan has been in default for a certain period of time — typically after 180 days for credit card loans (“fresher” debt is typically worked on in-house). At that time, the defaulted account is written off (charged off) of the creditor’s books as a loss. There are two ways to collect on such accounts. Most debt collection agencies work on behalf of the original creditor, to whom they return the proceeds, after retaining a commission for their efforts. However, other debt collectors buy debt from the original creditors (for a fraction of its face value) and keep all revenues they can generate for themselves. This sub-industry is termed debt buying.

A Numbers Game

Debt collection is a human-intensive process, Fedaseyeu reminds us, therefore the frequency with which a debtor is contacted by a debt collector depends on the number of debt collectors. So, all things equal, a higher density of debt collectors should improve contract enforcement. Therefore, factors that affect the number of debt collectors, as a share of the debtor population, should also affect the strength of contract enforcement in consumer credit markets and, by extension, influence credit supply. And the author is able to back his reasoning with numbers:

One additional restriction on debt collection activity reduces the number of debt collectors per capita by 15.9% of the sample mean and lowers the number of new revolving lines of credit by 2.2% of the sample mean.

…

I also find that stricter regulations of debt collectors decrease recovery rates on charged-off unsecured credit cards (by 1.1 percentage point, or 8% of the sample mean for each additional restriction on debt collection activity), which appears to be the primary transmission mechanism by which debt collectors affect credit supply.

This “transmission mechanism” is fairly simple:

Overall, stricter debt collection regulations reduce the number of debt collectors, making them less able to exert pressure on debtors. This reduces recovery rates and makes lenders less willing to provide credit in the first place.

Fedaseyeu is careful to note that regulations of third-party debt collectors do not affect secured consumer credit, which makes it unlikely that his results are “driven by some unobservable factors that affect the credit cycle (since those factors are likely to influence all types of credit at the same time)”.

The Takeaway

Here is how Fedaseyeu summarizes his findings:

The results reported in this paper show that consumer credit markets have developed a mechanism for lender protection and that this mechanism has a direct effect on credit supply. I show that this mechanism retains explanatory power even after controlling for consumer credit scores and credit inquiries, which means that consumer credit risk is not the only driver of credit access.

But then the author is quick to ensure that he remains politically correct:

At the same time, my results do not imply that credit expansion generated by more efficient debt collection is welfare improving, and further research is needed to shed light on this issue.

Still, Fedaseyeu manages to muster the courage to say the right thing:

In terms of policy implications, my results indicate that financial regulation that institutes strong consumer protection must be balanced with creditor rights in order for the latter to extend consumer credit in the first place.

I agree.

Image credit: Wikimedia Commons.