Shaping the M-Payments Future: Kenya vs. the U.S.

Mobile payments is about as broad a term as you can think of. It means accepting credit cards through a little swiping device that you plug into your phone. It also means paying for your Starbucks latte by having a QR code, displayed on your phone’s screen, scanned by the barista. It also means checking out of a grocery store by waving your phone by the POS terminal and having the two devices exchange payment data via radio waves, using near-field communication (NFC) technology. It also means buying things from a mobile website. It also means buying some virtual gadget and having it charged to your monthly phone bill via some direct billing service provider.

But the mobile payments services I’ve just named are primarily (almost exclusively) used in rich-world countries. That’s perfectly fine, however mobile payments are not restricted to the developed world, far from it. In fact, mobile payments usage, as a share of total population, is highest, by a margin, in Kenya—a developing country. M-Pesa—the company wholly responsible for Kenya’s huge success—counts half the country’s population as customers and claims that it handles transactions worth 43 percent of Kenya’s GDP. How has it achieved such a remarkable feat?

Well, M-Pesa has done nothing less than bring basic banking services to even the country’s remotest areas, enabling its users to safely and quickly exchange money with one another (including across borders) and even open up mobile equivalents to checking accounts. Imagine what difference such a service would have made for people whose sole pre-M-Pesa financial tool would have been cash money, with all its limitations and risks.

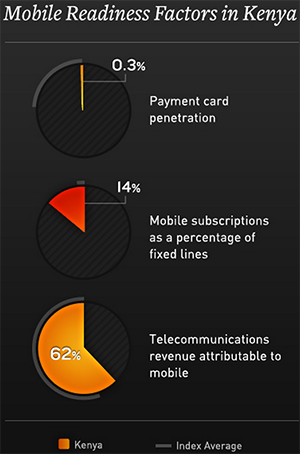

And yet, for all the revolutionary changes M-Pesa has brought to Kenya’s financial system, the country lags the United States in its overall mobile payments “readiness”, at least that is what MasterCard has calculated, using a variety of measures. MasterCard is also giving us some beautiful visualizations of its findings and I thought I’d share them with you.

Singapore Leads the Way

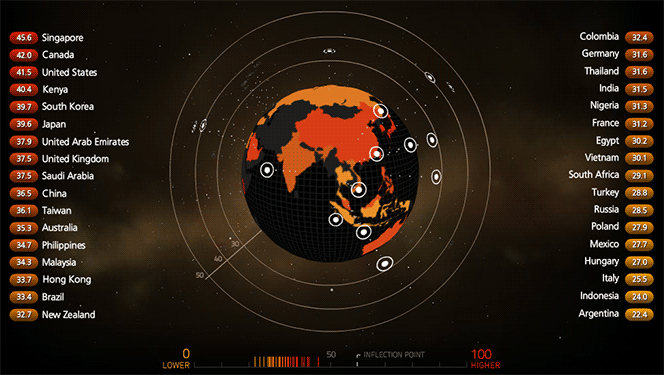

According to MasterCard’s Mobile Payments Readiness Index, the world’s leading country is Singapore, scoring 45.6 (on a 100 scale), followed by Canada at 42, the U.S. at 41.5 and Kenya at 40.4. Here is the full table:

The global average is 33.2, we are told. No two global markets are identical, MasterCard notes. Each one is driven by local conditions of financial services, infrastructure, environment and regulation. Consumers are typically attracted to mobile payments either for access to electronic payments (mainly in developing economies, where previously such access was unavailable) or for the convenience of mobile phone payments (in developed markets).

In the vast majority of markets, more consumers are currently using their mobile devices for m-commerce than for person-to-person (P2P) or point-of-sale (POS) transactions.

Kenya vs. the U.S.

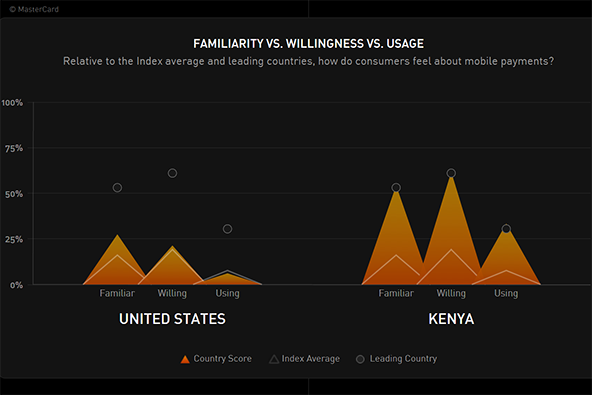

The United States, MasterCard tells us, with its overall score of 41.5, is the “great exemplar of one of the key findings of the MasterCard Mobile Payments Readiness Index: Scale matters”. However, important though scale may be, it can’t determine readiness on its own, in fact it is neither a necessary nor sufficient condition, we are told. Americans remain more aware of mobile payments than they are able to execute them.

Kenya ranks 83rd in the world as an economy, right after Guatemala and before Puerto Rico, MasterCard reminds us. Yet, when it comes to mobile payments, it is in the company of big, developed countries like the United States and Canada, as well as city-state stand-outs like Singapore. Why? Well, as already noted, the success of M-Pesa has been phenomenal, making Kenya, at least in terms of usage, one of the leading markets in the world. As MasterCard puts it, in Kenya, the m-payments story is “less about payment protocol than it is about the levels of usage and awareness M-Pesa has fostered there”. Quite so.

When it comes to key m-payment behaviors (as opposed to willingness and familiarity), MasterCard tells us, U.S. consumers “either run with the pack (POS), or lag behind (send money)—in the latter case, far behind much smaller and less vertically integrated countries”. The exception, mobile commerce, is a big one, the researchers note, but even there countries like China and Saudi Arabia do about twice as well.

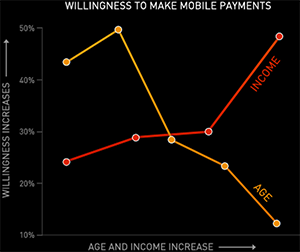

MasterCard’s explanation is what they call a “demographic disconnect”. By that the researchers mean that, in terms of usage, familiarity, and willingness, the U.S. population “skews male, young and affluent”. It’s the latter two factors that are the issue. As they put it, the “affluent have lots of disposable income, but how many of them are young?” Conversely, young users are ready to adopt mobile, but does their income match their willingness to spend? This “conundrum” is expressed visually in the graphic to your right.

MasterCard’s explanation is what they call a “demographic disconnect”. By that the researchers mean that, in terms of usage, familiarity, and willingness, the U.S. population “skews male, young and affluent”. It’s the latter two factors that are the issue. As they put it, the “affluent have lots of disposable income, but how many of them are young?” Conversely, young users are ready to adopt mobile, but does their income match their willingness to spend? This “conundrum” is expressed visually in the graphic to your right.

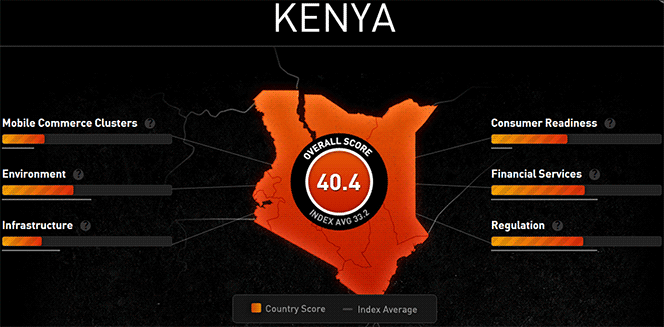

Kenya, for its part, faces altogether different challenges. Environment and infrastructure are both issues in this East African country. The success that mobile money has had there is attributable, as we too have noted many times on this blog, in large part, to the lack of a traditional infrastructure and mainstream payment services. Mobile, in the shape of M-Pesa, presented itself as a solution to a population that was in great need of a fast and secure method of payment. Kenya, as MasterCard notes, led its index in consumer readiness.

Kenya, for its part, faces altogether different challenges. Environment and infrastructure are both issues in this East African country. The success that mobile money has had there is attributable, as we too have noted many times on this blog, in large part, to the lack of a traditional infrastructure and mainstream payment services. Mobile, in the shape of M-Pesa, presented itself as a solution to a population that was in great need of a fast and secure method of payment. Kenya, as MasterCard notes, led its index in consumer readiness.

The researchers point to another important consideration for Kenya’s success: M-Pesa is a closed-loop system. This means that only M-Pesa (i.e. Safaricom) users—consumers and merchants—can exchange money with one another, which MasterCard reads as indicating that it is “early days in Kenya in more than one respect”. They go on to declare that, whereas Kenya may have “shown the way globally, but the country itself is also ripe for a more flexible and accessible payments structure that leverages all types of payments and permits multilateral entry into a broader-based financial services and telecommunications infrastructure”.

Now, I would be the first one to agree that the open-loop approach to mobile payments is the best (the only, really) way forward, and I have argued for it many times before. Yet, I would also note that some of the most successful m-payment platforms in the U.S. are also closed-loop systems. Starbucks, to take the most obvious example, only allows the coffee chain’s own prepaid card to be used for payment with its mobile app. It turns out to be incredibly difficult to create a completely open-loop m-payment environment.

Finally, here is the Kenya vs. the U.S. head-to-head m-payments infographic, produced by MasterCard for us:

Image credit: YouTube / M-Pesa.

The difference is huge when we compare Kenya and the US. Well, it is great that Singapore is leading the charge!