Russia’s Consumer Lending Explosion

U.K.’s The Telegraph is tracking the ongoing explosion of consumer lending in Russia for us in a couple of articles this morning. It has taken the Russians a couple of decades of fitful post-Soviet development to start warming up to the concept of buying things on credit, and, while the current size of the consumer credit market is still relatively small, the growth rate is nevertheless mouthwatering and accelerating.

The scale of the Russian lending boom has prompted Chris Weafer — an investment strategist at Sberbank, Russia’s biggest bank — to speculate in one of The Telegraph’s articles on its sustainability and the possibility that a credit bubble is being inflated. The growth rate is “likely to ease a little”, Weafer’s predicts, but growth will continue in a “meaningful” way “for the foreseeable future”, he expects.

I am a bit less optimistic than Weafer. I think that the growth rate is very likely to be determined by the trajectory of the price of oil, a factor Weafer deems wholly irrelevant. The fact that the oil industry has contributed nothing to Russian GDP growth in the past few years speaks more to the state of the industry itself than to the independence of the rest of the economy. Moreover, there are plenty of other things that could go wrong and plunge the country into recession, wreaking havoc to the consumer lending industry in the process, some of which are not at all unlikely to come to pass. But let’s take a look at the data.

The Dimensions of a Bubble

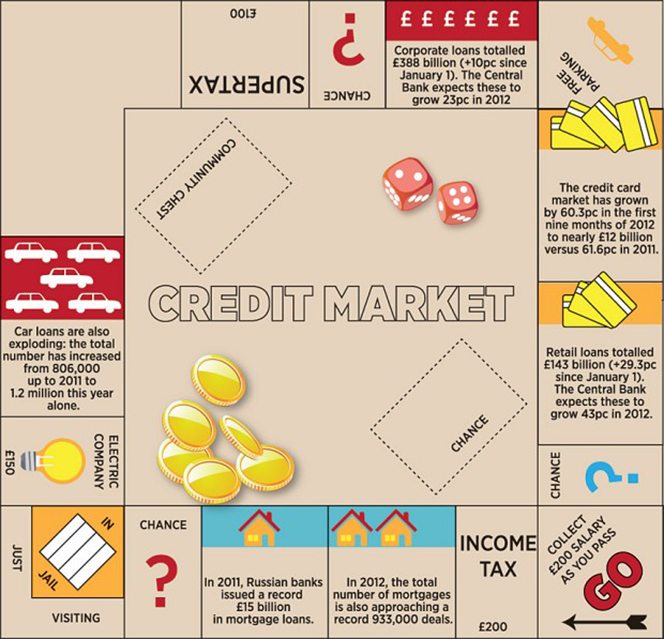

So here are the most interesting data:

- Retail lending growth is expected to have grown by 43 percent in 2012, on an annual basis.

- Credit card use has increased by 60.3 percent during the first nine months of 2012, to 590 billion roubles ($19.6 billion) from the same period in 2011.

- The number of car loans has grown by 48.9 percent, from 806,000 “up to 2011” to 1.2 million in 2012.

Here is all of the data, as published by Rossiyskaya Gazeta and presented by The Telegraph:

How do we explain the credit binge? Here is The Telegraph’s Ben Aris’ take:

Wages have continued to rise throughout the crisis, while unemployment currently stands at a 20-year low of 3.8pc. Add to this the fact that the average Russian has no debt to speak of, certainly when it comes to mortgages — everyone was simply given their apartment by the state in 1991 — and financial products such as credit cards have only recently taken off.

So, the average Russian is free to borrow heavily, with most of their income being disposable.

That seems a plausible description of reality.

Let the Good Times Roll

Credit bubbles typically benefit the wider economy in a huge way during the boom years and Russia is no exception:

The consumer-borrowing binge is also spilling over into other sectors of the economy directly connected to shopping. Supermarket chains are the first beneficiaries: the last thing consumers cross off their shopping list, even in tough times, is food. Most of Russia’s leading supermarkets are reporting 2012 revenue growth of up to 33pc year-on-year.

Car sales have also been strong, increasing year-to-date by 13pc, according to the Association of European Businesses. Indeed, Russia is on track to become the largest car market in Europe within the next five years.

Spending is also driving investment in commercial property: in November, Moscow was ranked the third most attractive investment destination in Europe for retailers by property professional services company Jones Lang LaSalle.

So there you have it. To me this looks like a classic bubble, but that is certainly not how Weafer sees it. As far as I can tell, he sees absolutely no reason why the music should stop anytime soon. Here is what seems to me to be the gist of his argument:

In addition, the post-Soviet generation is becoming a bigger part of the workforce, with western spending habits and lifestyle ambitions.

Previous demographic concerns have also been resolved as the birth rate increases, people live healthier lives and emigration is reversed. This year, Russia will see a net increase in the population for the first time since the early Nineties, and revised projections predict population growth in the coming decades.

In terms of debt expansion, there is no issue here either, for while the pace of growth is very high in absolute terms, it comes from a very low starting point. Russian households are among the least leveraged in the world and, as a legacy of the Soviet era, the country has one of the highest levels of unmortgaged property ownership in the world. So there is plenty of scope for further debt expansion without approaching risk levels.

I am eerily reminded of what Alan Greenspan was telling us right before the housing bubble burst here in the U.S. Am I the only one?

The Takeaway

So why am I not buying Weafer’s story? Well, to begin with, as he notes, oil and gas still account for half of tax revenues, so a substantial fall in the price of crude would have a hugely negative effect on the whole economy, to say nothing of the credit boom. And there are plenty of things that could trigger such a fall in the coming years. Even if the price of oil remains high, however, there are plenty of other things that could easily go wrong in Russia in the very near future, slowing down economic growth and putting an end to the credit binge in the process. Pervasive corruption and the lack of the rule of law immediately come to mind. Stubbornly persistent protests against Vladimir Putin’s style of government indicate that Russians may not be willing to put up with the status quo for too long. And if the Putin regime is to fall, there is no knowing what will follow.

Image credit: Wikimedia Commons.