On Pizza Deliveries, the Origins of Money and Bitcoin

Tim Sablik from the Federal Reserve Bank of Richmond has an interesting piece on Bitcoin, in which he takes us back to the digital currency’s mythical beginnings in May 2010 when a Florida programmer paid, rather improvidently, 10,000 bitcoins to get two large pizzas delivered to him. What was this guy thinking, paying today’s equivalent of $7.4 million for two pizzas!? And more importantly, did he get any toppings put on them or were they just plain cheese? Also, did he tip the delivery guy in bitcoins or in some fiat currency? If the tip was given in bitcoins, did the programmer pay the standard 20-percent rate (2,000 bitcoins) or did he gyp the delivery guy? Is the delivery guy still a delivery guy? Inquiring minds want to know.

Quite apart from the momentous delivery episode, and the “Pizza Index”, which it engendered, we are taken back in time to trace the “origins of money” and the various shapes it took over human history — cattle, shells, salt, etc. Of course, a quote from Adam Smith is prominently featured for good measure as well. Once the history part is covered, we move back to Bitcoin and the challenges the cryptocurrency faces on its way to world domination. Regular readers will have noted that this blogger is highly skeptical of Bitcoin’s potential — as far as I can tell, Bitcoin, while failing to serve its purported purpose as a medium of exchange, as a store of value it has created a perfectly ordinary bubble, of a kind we’ve seen many, many times over the centuries.

Well, if anything, Sablik’s piece reinforces my skepticism. The author cites a lawyer who, in his attempt to reassure Bitcoin doubters, informs us that Bitcoin is coming of age. “The grown-ups have entered the room”, the lawyer proclaims, and that “should give some comfort to the regulators that it’s not just a bunch of money launderers”. Can I just say that the thought that a bunch of financial types have gotten involved with a commodity with a hugely volatile price somehow fails to allay my misgivings? But I’ll let you draw your own conclusions. Here is Sablik’s article.

Digital Currency: New Private Currencies Like Bitcoin Offer Potential — and Puzzles

By Tim Sablik

It all started with a pizza delivery. On May 18, 2010, a Florida programmer named Laszlo Hanyecz posted in an online forum that he was interested in buying a couple of pizzas with bitcoins. Bitcoins were a new digital currency that had launched about a year and a half earlier. They existed only inside computers; the underlying software generated more virtual coins at a fixed rate and relied on cryptography to prevent fraud.

Software experts, unable to find any major flaws in the system, were intrigued. So were individuals looking for alternatives to government-issued currencies in the wake of the financial crisis and subsequent bailouts, which they viewed as an example of the kind of government excess that led to devalued currencies. While the bitcoins themselves had many of the trappings of real money, ultimately they were just bits of data in cyberspace. Could they really be used to buy anything?

Hanyecz wanted to find out. He offered 10,000 bitcoins to anyone willing to bring him two large pizzas. Some bitcoin trading among enthusiasts had occurred prior to Hanyecz’s offer, but there hadn’t been any real market for them. A few days later, Hanyecz triumphantly posted evidence of his successful transaction: a picture of two Papa John’s pizzas. It was an important moment for the currency, leading to the creation of a “Pizza Index” to track the dollar value of the 10,000 bitcoins Hanyecz used for his purchase. Bitcoin’s value has exploded since. In late November 2013, the Pizza Index breached $12 million, when a single bitcoin was briefly worth more than an ounce of gold. Growing value has also meant increased recognition and use.

According to CoinMap.org, a site that tracks Bitcoin acceptance, there are more than 400 physical stores in the United States that accept bitcoins as payment, and hundreds more worldwide.

“I’ve accepted bitcoins as payment in my legal practice,” says Patrick Murck, general counsel for the Bitcoin Foundation, a nonprofit working to promote wider use of the currency. “Sometimes you’ll go to a restaurant and split the check, so I’ll reimburse somebody in bitcoins. There’s a sushi joint in San Francisco that takes bitcoins. And the list is growing every day.”

But Bitcoin has also raised a number of questions. For regulators, the fact that transactions in digital currencies are virtually anonymous, like cash, raises the concern that these systems could be used to mask illegal activities. In May, the Financial Crimes Enforcement Network (FinCEN), which is part of the Treasury Department, designated Liberty Reserve, another digital currency, a “financial institution of primary money laundering concern” under Section 311 of the Patriot Act. This allowed authorities to shut down Liberty Reserve’s alleged $6 billion money laundering operation, the biggest in United States history, according to FinCEN director Jennifer Shasky Calvery.

So what is Bitcoin? A vehicle for criminal activity or the next step in the evolution of money? Or both?

The Origins of Money

Money has taken many different forms throughout history. Some early societies valued goods in terms of cattle, Native American tribes used shells, and for a time Roman soldiers were paid in salt (from which we get the word “salary”). Later, societies turned to precious metals like gold and silver for use as money. But how did goods like these become money?

Classical economists recognized that money arose out of a need to address the inefficiency of barter, which requires that each party has something the other wants. In his 1776 book The Wealth of Nations, Adam Smith observed that money arose initially as a commodity that “few people would be likely to refuse in exchange for the produce of their industry.” Having a good that everyone wants makes trading much easier; over time, such goods became universally accepted as media of exchange. Gold and silver, to take a common example, were initially valued for their beauty, and their natural scarcity meant they were always in demand, which helped them retain value. This made them useful as media of exchange. They also had a number of other properties that made them well-suited for use as money: They were durable, portable, and divisible into smaller units (it was much easier to make change out of gold than cows).

In the 19th century, British economist Henry Thornton observed that coined money came to be valued more as a measure of the value of other goods than for its inherent value as a precious metal. Therefore, it was more efficient for societies to convert to paper notes to track the value of exchange. These notes were originally “IOUs” that were redeemable for the precious metals, but eventually governments suspended redeemability in favor of fiat money — paper currency not backed by any valuable commodity at all.

So what gives modern money its value? One argument sometimes advanced by economists is that the value of fiat money comes from a memory of the value of commodity money. Under this explanation, if a country initially had a convertible commodity-based currency, and then the government discontinued convertibility (as the United States did in 1971), the currency would continue to circulate because the infrastructure and assumption of value were already in place. Other explanations stress the importance of users’ faith in the issuing entity. Legal tender laws could also be the key, since governments can create their own demand for paper money (through “fiat”) by making it the legal form of payment for public debts, or taxes. But these arguments all suggest that establishing a private currency with no past tie to a commodity or any government backing, like Bitcoin, should be difficult.

“Say you’re going around this primitive economy and you want to trade,” explains George Selgin, a professor of economics at the University of Georgia. “Someone shows up in the marketplace with a handful of little paper notes with a portrait and some numbers on them. You’re not going to look at those notes and say, ‘Oh, I bet everyone wants these.’ Until they’re adopted as money, they’re not anything. If they were money, then it would make sense for people to accept them. But who wants to go first?”

Getting off the Ground

At first glance, bitcoins lack the inherent value or government authority to get them off the ground as an accepted currency. But in surprising ways, they resemble the gold and silver coins of ancient times.

Upon registering, Bitcoin users are given a unique address and a computer file in which to store their bitcoins — their “digital wallet.” To send bitcoins to other users, you just need to know their address. Members of the community known as “miners” use computer resources to solve complex problems and verify transactions by adding them to the public record. Roughly every 10 minutes, this process generates new bitcoins, which are awarded to the miners. The difficulty of the problems scales to ensure that this rate remains constant even if the number of miners increases. The number of coins generated in these intervals decreases over time, however, such that the total supply will ultimately cap at about 21 million.

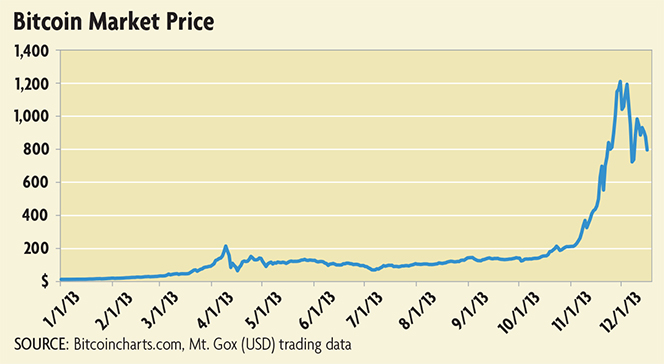

In that sense, one could think of bitcoins like gold and silver, which are discovered and mined over time and have a finite total quantity on the planet. And in terms of volatility, bitcoins more closely mirror the larger price swings of gold and silver than smaller movements of dollars and yen. The price of a single bitcoin soared from around $13 in January to $1,200 in November, an increase of more than 9,000 percent. In between, prices have fluctuated wildly, sometimes rising and falling by hundreds of dollars a day (see graph). But unlike gold and silver, bitcoins have no nonmonetary use or value — they’re just bits of computer data. This quality aligns more closely with fiat money, which also has no nonmonetary use or value — it’s just bits of paper. Bitcoins are not issued or backed by any government or central authority, however. The program is open-source and maintained by the entire community of users. And unlike a government, those users don’t have the ability to expand the money supply.

So how should economists think about Bitcoin? In an April working paper, Selgin suggested that there should be four categories for money rather than just two. He argues that even the traditional categories of commodity and fiat rely on two characteristics: scarcity and nonmonetary use. “A commodity money has nonmonetary use and is naturally or inevitably scarce; a fiat money has no nonmonetary use value and is scarce only by design,” writes Selgin.

This leads to two other possible forms of money: money with nonmonetary use that is not naturally scarce but can be made scarce by a central authority, and money that has no nonmonetary use but is naturally scarce. Selgin calls items in this latter category “synthetic commodities.” Prior to the first Gulf War in 1990, Iraq’s currency, the dinar, was printed in the United Kingdom using Swiss-engraved plates. After the war began, sanctions on Iraq prevented importation of these Swiss dinars, freezing their supply in Iraq’s economy. In response, Saddam Hussein’s government severed ties with the old dinars and issued its own dinars, which were of poorer quality and easier targets for counterfeiters. People preferred to keep using the Swiss dinars, despite the fact that they had no nonmonetary use and were no longer accepted or designated as legal tender by any government.

Selgin classifies bitcoins as synthetic commodities like the Swiss dinars, but even that currency had the benefit of government backing to get it off the ground. What led anyone to accept Hanyecz’s pizza offer? They may have simply believed that enough people would eventually accept bitcoins as money to make the transaction worthwhile. Recent developments in economic theory contend that the value of money comes in part from its ability to function as a recordkeeping device. But, more fundamentally, the value of money as a medium of exchange depends on individuals’ expectations that it will be widely accepted by other people in the economy. In a 1989 paper, Nobuhiro Kiyotaki of Princeton University and Randall Wright of the University of Wisconsin-Madison analyzed economic models in which certain goods arose naturally as media of exchange. They concluded that “the value of any medium of exchange, and especially fiat money, ultimately depends at least partially on faith.”

Building Bitcoin Business

Bitcoin’s growing value has started to attract the attention of entrepreneurs outside the original core of supporters. In July, Cameron and Tyler Winklevoss, known for their involvement in the history of Facebook, filed with the Securities Exchange Commission to create an exchange-traded fund for bitcoins. Their aim is to make it easier for people to invest in the currency. In a December report, Bank of America Merrill Lynch noted that Bitcoin could “emerge as a serious competitor to traditional money transfer providers.”

While Bitcoin seems to be generating new business opportunities each day, many investors still have questions. Chief among them: What are the actual financial rules that govern digital currencies?

“We don’t know that much,” says Reuben Grinberg, an associate in the financial institutions group at the law firm Davis Polk & Wardwell. Grinberg wrote one of the earliest academic papers on Bitcoin while in law school and now works with business clients interested in the digital currency. “To some extent, we’re in the same place we were when the Internet first started and people weren’t sure what laws were going to apply. Would we take existing laws and just apply them or come up with a whole set of new laws?”

Bitcoin is not the first digital currency to raise this question. E-gold, created in 1996 by Douglas Jackson, was a digital currency backed by real gold and other precious metals. It allowed users to instantly and largely anonymously send payments via the Web using commodity-backed cash. E-gold gained popularity with people seeking an alternative to fiat money, but it also attracted those who were interested in anonymously conducting illegal transactions and laundering money. In 2005, the FBI and Secret Service raided Jackson’s offices, and in 2007, he was indicted on federal charges of money laundering and operating an unlicensed money transmitting business.

Some similarities between Bitcoin and e-gold have made authorities and potential users wary. Like e-gold, Bitcoin users do not have to provide identifying information when they register. And like e-gold, Bitcoin has a history of being used to facilitate illegal transactions. In October, the FBI shuttered Silk Road, an online marketplace for illegal goods and services. Transactions on the Silk Road were conducted exclusively in bitcoins, and according to the FBI report, the site generated sales revenue of more than 9.5 million bitcoins during its lifetime.

As digital currencies become more prevalent, financial regulators have expressed concern that they could be used to hide illegal activity. The Bank Secrecy Act, as enforced by FinCEN, requires that financial institutions register with the government and follow certain anti-money laundering precautions, such as collecting data on users and transactions and reporting suspicious activity. According to guidance released in March, FinCEN expects administrators or exchanges of digital currencies to comply with these rules as well. To make the point clear, in May the Department of Homeland Security temporarily froze assets held by Mt. Gox, one of the primary Bitcoin exchanges, on charges that it was operating as a money transmitter without a proper license. Mt. Gox has since registered with FinCEN as a money transmitter and has taken steps to collect identification information from users.

Murck, the Bitcoin Foundation general counsel, thinks it is a good thing that regulators are clarifying their expectations for digital currencies, but he says there are still many misconceptions about Bitcoin.

“Bitcoin isn’t really anonymous,” he says. “It’s pseudonymous, and that means private. The difference is that there is a Bitcoin address, and that doesn’t necessarily tie to any identifiable information by its nature. But somebody could very easily link a person to a Bitcoin address, and once they’ve done that, they have full transparency to all the activity that’s ever happened on that address because the ledger is public.”

Murck’s biggest worry is that regulators move to clamp down on digital currencies before they have all the facts. In late May his organization was issued a cease-and-desist order from the California Department of Financial Institutions. Although he says the letter appears to have been a misunderstanding (the Bitcoin Foundation does not actually buy or sell bitcoins), it does raise the specter of oversight by state-level financial regulators — a potentially expensive proposition for a currency with global reach.

“Say there’s a big crackdown on Bitcoin from the regulatory and law-enforcement community here in the U.S.,” Murck says. “Most likely what that means for Bitcoin is that U.S. consumers and all the companies will go somewhere else. But if regulators and law enforcement drive all the good players out of the states, how much more difficult does their job become when everything moves overseas and goes dark on them?”

Calvery, the director of FinCEN, has said repeatedly that it is not their intention to regulate digital currencies out of existence.

“I think innovation in the financial services industry holds out great promise on so many levels for commerce and for social reasons like providing services to the unbanked,” she said in an American Banker interview following the issuance of FinCEN’s guidance. “But like any financial services, it comes with an obligation, and those obligations to protect the U.S. financial system from money laundering need to be taken seriously.”

Grinberg believes that the businesses now involved with Bitcoin are taking those obligations seriously. “The grown-ups have entered the room, and they are trying to follow the rules. On top of that, they often have a deep well of experience in the financial services industry, which should give some comfort to the regulators that it’s not just a bunch of money launderers,” he says.

Currency Evolved

For regulators and many businesses, this is still a learning period. The European Central Bank released a study on digital currencies in October 2012, concluding that “authorities need to consider whether they intend to formalise or acknowledge and regulate these [currencies].” In the United States, regulators have thus far been cautiously optimistic about Bitcoin. In written testimony submitted to a November Senate hearing, Fed Chairman Ben Bernanke said that digital currencies “may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.” Other countries, such as China, have restricted the use of Bitcoin, seeing it as a potential threat to financial stability.

Murck thinks Bitcoin still has some more growing to do before it is ready for mass consumption, but he is optimistic. Even if Bitcoin doesn’t end up as the digital currency of choice, there could be others. Litecoin, a digital currency “mined” like Bitcoin but with a higher virtual stock of 84 million coins, has been billed as the “silver” to Bitcoin’s “gold.” And there are others springing up seemingly every week.

Selgin sees potential opportunities for monetary policy using money based on a synthetic commodity, like Bitcoin. If economists and central bankers could agree upon optimal monetary rules, then it might be possible to design a digital currency that carries out those rules automatically.

“It does provide some interesting food for monetary thought,” he says.

Image credit: Wikimedia Commons.