On ‘Click Frenzy’, Holiday Shopping and the U.S. vs. Australia

Did you know that Australia’s equivalent of our Cyber Monday was called “Click Frenzy”? Well, neither did I. Nor did I know that the British were calling their own Cyber Monday, well… Cyber Monday. But that’s why the good people at IBM’s Digital Analytics Benchmark Hub are keeping tabs on those things for us and have even produced a report to tell us how the online shopping extravaganzas in the three countries compared to one another. And some of their findings may come as a surprise to you.

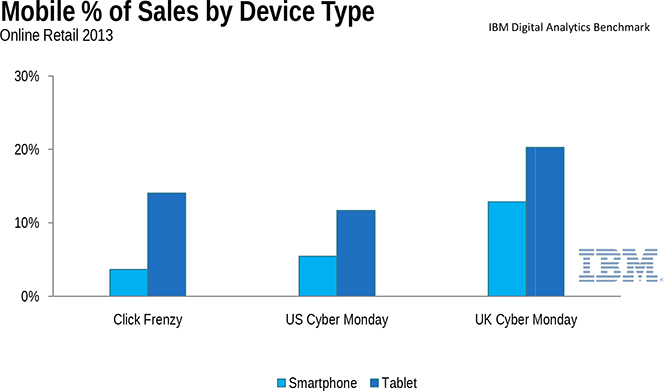

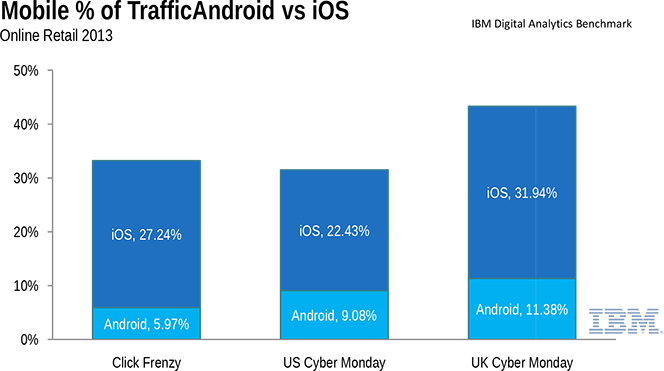

For example, it turns out that both in the U.K. and Australia mobile traffic and sales have grown faster this Cyber Monday / Click Frenzy than in the U.S. The U.K. led the field (by quite a margin, too) in these two categories and also in mobile’s share of overall online sales. Let’s take a look at the report.

Australia’s Click Frenzy

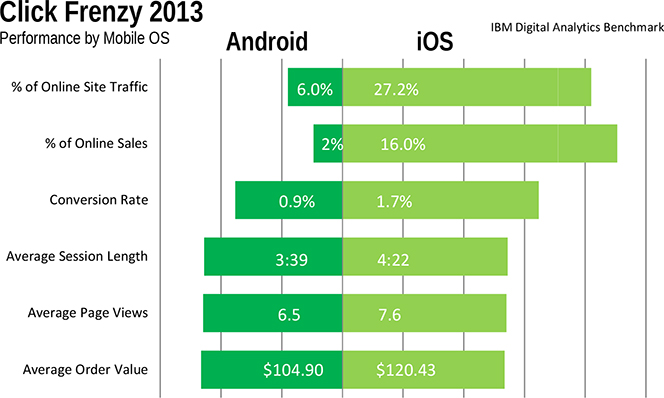

Here is Click Frenzy 2013 by the numbers:

1. Online sales grew by 16.3 percent from last year.

2. The biggest spike in online sales occurred just after dinner (around 9.30 pm) on the evening before Click Frenzy. On the following day, sales started to rise at around 7:00 am, peaking at around 11:30 am and remaining strong for the remainder of Click Frenzy.

3. As already noted, shoppers took advantage of early-bird specials, which led to a 20-percent increase in online sales on the day before Click Frenzy (18 November compared to 11 November).

4. The average order value was $131.13, down by 4 percent from last year’s average.

5. Tablets were both the browsing and buying mobile device of choice. As seen in the chart below, Aussie shoppers spent more time and money on sites, viewed more pages per session and converted to sales at a higher rate on tablets than smartphones.

6. On Click Frenzy, iOS users viewed more pages per session, had higher average order value and converted to sales at a higher rate than Android users.

Click Frenzy vs. U.S. Cyber Monday vs. U.K. Cyber Monday

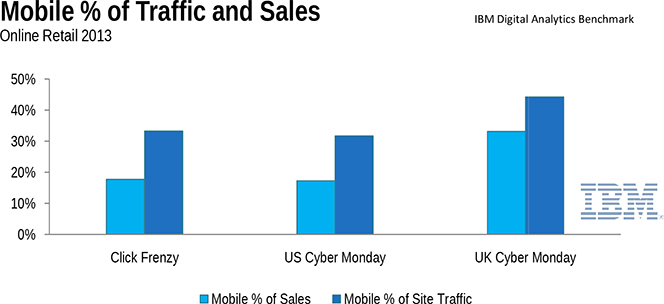

1. In Australia, mobile traffic jumped to 33.3 percent of all online traffic on Click Frenzy, an increase of 35.8 percent over the previous year. Mobile sales made up 17.7 percent of all online sales, an increase of 43.1 percent over 2012.

In comparison, at 31.7 percent and 17.2 percent, respectively, U.S. Cyber Monday mobile traffic and sales were slightly lower than Click Frenzy’s. However, in the U.K., Cyber Monday had the highest share of mobile traffic and sales, soaring to 44.3 percent and 33.2 percent, respectively.

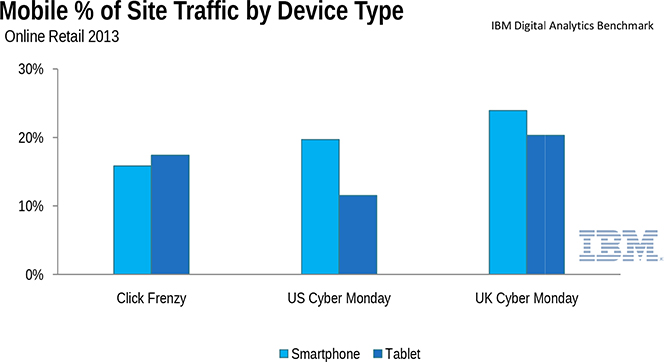

2. Tablets drove 17.4 percent of all online traffic on Click Frenzy and smartphones made up 15.9 percent of the total. In contrast, for both the U.S. and U.K. Cyber Mondays, smartphones generated more traffic than tablets. In the U.S., 19.7 percent of all online traffic was driven by smartphones and 11.5 percent was generated by tablets. Similarly, in the U.K., 23.9 percent of the traffic was generated by smartphones and 20.3 percent by tablets.

3. Tablets accounted for a significantly higher share of sales than smartphones in all three countries. In Australia, tablets made up 14.1 percent, compared to 3.7 percent for smartphones.

4. Apple’s iOS-based devices drove higher shares of traffic and sales than Google’s Android in all three countries in the study. In Australia, iOS drove 27 percent of online traffic and 16 percent of online sales while Android accounted for only 6 percent of online traffic and a tiny 2 percent of online sales.

5. The average order value was higher for iOS than Android in Australia and in the U.S. On Click Frenzy, the average iOS order amount was $120.43, compared to $104.90 for Android. However, at ?ú83.85, in the U.K. Android’s average order value was slightly higher than iOS’s ?ú79.98.

The Takeaway

So, for the most part, the three English-speaking countries examined in IBM’s report exhibited similar shopping trends on Cyber Monday / Click Frenzy. Whether that is good or bad depends mostly on your point of view, I guess. Surely, though, the coming of age of smartphones and tablets as viable online shopping tools, ones that rival laptops and desktops, must be music to retailers’ ears.

Image: a screenshot of Amazon’s 2013 Cyber Monday Deals Week page.