On CFPB, Debt Collection and Wasting Government Resources

Regular readers may recall that, back in July, the Consumer Financial Protection Bureau (CFPB) issued two separate bulletins to put debt collectors on notice about their debt collection practices. The bureau reminded debt collectors that under the Fair Debt Collection Practices Act (FDCPA) it was illegal to “harass, oppress, or abuse any person”, to “use false, deceptive or misleading representation” or to use “use any unfair or unconscionable means” in connection with the collection of a debt. The CFPB also informed card issuers that, even though their actions weren’t falling under the FDCPA’s remit, committing unfair, deceptive, or abusive acts or practices when collecting debt would nevertheless violate the Dodd-Frank Act. To make sure that the intended audience took the warning seriously, the CFPB started accepting debt collection complaints in its database.

Well, the CFPB has now released its first batch of debt collection complaints and the bureau proudly declares that, since it began accepting them, this has quickly become one of the top categories of grievances. However, for one thing, the number of complaints received during the first four months — 5,625 — is tiny, compared to the 200,000 the FTC had received in 2012. The explanation here may be that the CFPB’s database includes only complaints to which the named companies had responded. But more importantly, judging by the data, debt collectors have been doing a pretty good job at handling them. Let’s take a look.

What Bothers the CFPB?

So the bureau tells us that it was concerned with a number of issues, related to debt collection. The following categories were of particular interest:

- Information accuracy.The CFPB wanted to ensure that the information transferred from an original creditor to third-party debt collection firms and debt buyers, and from those parties to other debt collectors and credit bureaus, was accurate. In particular, they wanted to make sure that the debt collectors had the:

- Correct person and weren’t trying to collect money for debts from the wrong consumers.

- Correct amount and weren’t asking for more than what the consumer actually owed on a debt.

- Correct documentation, so that they could support their claims about a consumer’s indebtedness.

- Communication tactics.The CFPB wanted to ensure that debt collectors were treating consumers fairly and with respect and were particularly concerned with:

- Contact frequency: there were complaints that some debt collectors were continuously calling consumers or calling them too early or too late or at their workplace.

- Contact methods: the CFPB doesn’t specify its concern here, other than to note that, when the FDCPA was passed in 1977, the means of reaching a consumer were limited and that today consumers could be reached using email, smartphones, fax machines, and social media.

- Contact claims: the concern here is about debt collectors who falsely threaten to initiate a lawsuit or criminal prosecution, garnish wages, damage or ruin a consumer’s credit rating, seize property, get the consumer fired from their job, or have a consumer jailed.

Additionally, the CFPB wanted to ensure that consumers were provided clear and adequate information about their debts and legal rights. So how are debt collectors doing?

Debt Collectors Are Doing a Good Job

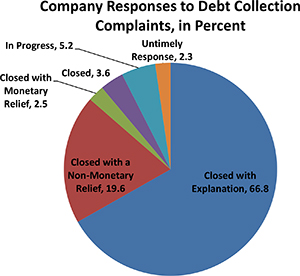

This is what the data from the 5,625 complaints published so far tell us. More than two-thirds — 3,760 or 66.8 percent — of the complaints have been “Closed with Explanation”. About a fifth of the total — 1,101 or 19.6 percent — have been “Closed with a Non-Monetary Relief” (for example, taking a consumer off a call list or editing the related entry in her credit report). Only 139 complaints — 2.5 percent of the total — have been “Closed with Monetary Relief” to satisfy the consumer and 200 — 3.6 percent — are simply marked as “Closed”. A further 294 complaints — 5.2 percent — are still “In Progress” and the remaining 131 — 2.3 percent — fall into the “Untimely Response” category. The chart to the right illustrates the full breakdown.

This is what the data from the 5,625 complaints published so far tell us. More than two-thirds — 3,760 or 66.8 percent — of the complaints have been “Closed with Explanation”. About a fifth of the total — 1,101 or 19.6 percent — have been “Closed with a Non-Monetary Relief” (for example, taking a consumer off a call list or editing the related entry in her credit report). Only 139 complaints — 2.5 percent of the total — have been “Closed with Monetary Relief” to satisfy the consumer and 200 — 3.6 percent — are simply marked as “Closed”. A further 294 complaints — 5.2 percent — are still “In Progress” and the remaining 131 — 2.3 percent — fall into the “Untimely Response” category. The chart to the right illustrates the full breakdown.

By and large, consumers were satisfied with the way their cases were handled. The vast majority — 5,371, or 95.5 percent of the total — reported to have received a timely response from their collection agency and only 880 consumers — 15.6 percent of the total — have disputed the response.

Now here is the CFPB’s full database of debt collection complaints:

The Takeaway

The CFPB clearly takes pride in the fact that its full database “currently contains more than 155,000 complaints on a wide variety of financial consumer issues, including mortgages, student loans, and credit cards”. Now that it has added debt collection to the list, the bureau is happy to report that the new item is “on par with mortgages in terms of daily complaint volume, with both accounting for approximately 30 percent of consumer grievances”.

Yet, it seems to me that this ground is already very well covered by the FTC. How many governmental agencies do we need to collect the same type of data? Moreover, as the CFPB itself notes, the existing legal framework is more than adequate when it comes to protecting consumer rights. Furthermore, consumers are telling the bureau that their disputes are properly handled. So yes, I think that debt collection is already properly regulated and monitored and the CFPB is wasting government resources and money here.

Image credit: Flickr / Consumer Financial Protection Bureau.