The Chinese Payment Companies Are Colossal… But What They’re Up Against Is Epic.

Can you imagine how the U.S. payments industry would have looked like today if 15 years ago Bank of America, Chase, Citibank and Wells Fargo, in league with Visa and MasterCard, had managed to convince the relevant authorities to severely restrict PayPal’s ability to facilitate person-to-person payments? Neither can I, but I’m certainly glad I was spared that knowledge. The Chinese, however, may not be as lucky.

Much has been written about the heavy crackdown by the Chinese authorities on electronic payments in the country, which took place in the middle of March. The blow was delivered in two installments: first came the suspension of Starbucks-style 2-D bar-code-type payments and virtual credit cards and on the next day very low limits were imposed on transactions to and from PayPal-like e-payment accounts.

There has been a fair amount of speculation on the causes of the crackdown, but I hadn’t come across a serious attempt to make sense of what went on until this morning. Standard Chartered, a British bank, which does the bulk of its business in Africa, Asia and the Middle East (and has no retail operations in its home country), put out a report, which tells a story of a power struggle between the Chinese banking lobby and the upstart payments companies, which are operating the e-payment platforms that were affected by the new regulations.

The round went to the banks, which by the way happen to be the biggest in the world, and Standard Chartered suggests that they may well have won the war. In any case, the strict new rules will slow down the rapid growth of electronic payments in China, the researchers tell us. But let’s take a closer look at the report.

Coming Down Heavy

So here is what took place. First, on 13 March, the People’s Bank of China (PBoC) — China’s central bank — suspended all mobile phone-based and two-dimension (2-D) code payments, as well as virtual credit cards. This, the authors tell us, was a new business line announced by CITIC Bank only a couple of days earlier, after the bank had signed a strategic alliance with Tencent and Alibaba, China’s leading internet firms.

Explaining its action, the PBoC said that mobile-based, 2-D code payments and virtual credit cards violated information and financial asset safety requirements for customers and were anyway trespassing the existing regulatory banking framework. Companies involved in these businesses were to suspend their operations immediately and could not resume them until they could convince the regulator that adequate risk controls were implemented.

Then on 14 March, the PBoC went much further, issuing a “final draft regulation”, which reportedly contained “unexpectedly strict requirements on e-payment companies”. In this draft, the PBoC is said to have imposed a cap of ?Ñ1,000 ($161) on money transfers from a bank account into an e-payment account, with an annual aggregate transfer limit of ?Ñ10,000 ($1,610) per account. Additionally, the PBoC set a limit of ?Ñ5,000 ($805) per spending via e-payment accounts, with an annual aggregate purchase value limited, once again, set at ?Ñ10,000 per account. And here is the thing: any spending or money transfer above these limits would have to go through a bank account. Who do you think is the beneficiary here?

Now, it should be noted, as the authors do, that 2-D code payments is a new business in China and virtual credit cards have just been launched, so suspending these two channels will have virtually no effect on current online and mobile payment users. However, the e-payment channel (where Alibaba’s Alipay rules supreme) has hundreds of millions of users. Placing such low limits on money transfer and spending amounts will affect the daily business of e-payment companies, small businesses using the e-commerce platforms and online shoppers in a big way.

The Rise of Online Payments in China

The regulation of the e-payment industry was relaxed at the early stage, we are told, “because it was viewed as a new force driving the economy, which could only flourish in a relaxed regulatory environment”. And sure enough, flourish it did: over 200 e-payment companies were licensed by the PBoC for activities including online payment, mobile payment, prepaid card payment, digital TV payment, etc.

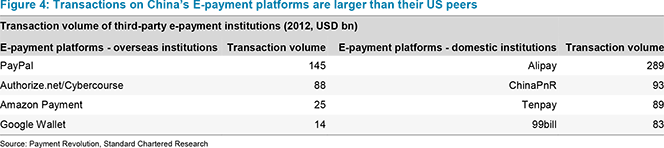

Alipay is the faraway leader. As it is built into parent Alibaba’s e-commerce platform, online shoppers do not have to be redirected to a separate website to settle payments. This helped fuel Alipay’s huge growth over the past few years. As you can see in the table below, Alipay’s transaction volume is now vastly larger than that of its U.S. peers, including PayPal.

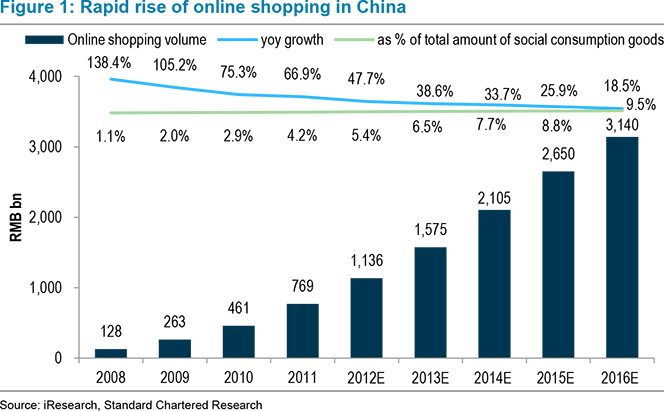

Here is how online shopping volumes have grown in China over the past half-decade, with projections going to 2016:

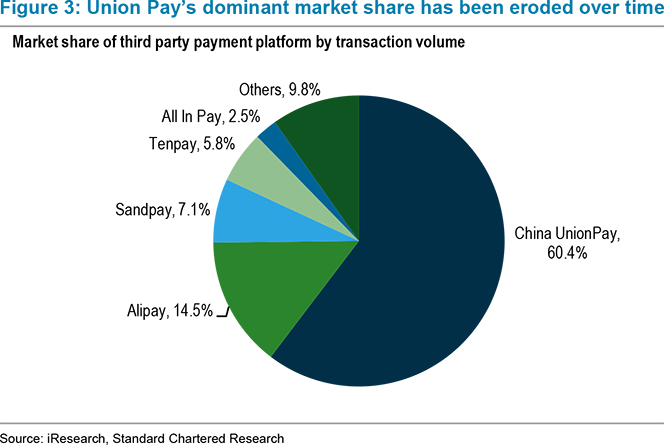

And here is a breakdown of China’s payment processing market:

What’s Eating the Chinese Banks?

The problem, for the big Chinese banks that is, was that they weren’t sharing into this growth, at least not as much as they might have wished. That, Standard Chartered believes, has prompted the banks and UnionPay (the Chinese payment card network, which is co-owned by around 80 financial institutions) to lobby the PBoC on the matter.

Initially, we are told, the relationship between the Chinese banks and e-payment companies “was generally harmonious”. Then the outbreak of the severe acute respiratory syndrome (SARS) in 2003 helped trigger the explosive growth in online shopping and e-payments. Web-based, third-party payment platforms, led by Alipay, took the small amount of C2C (P2P) retail transactions that the banks did not cover, which brought banks some additional fee income, without threatening their control over depositors.

Over time, however, an ever increasing number of shoppers settled their online payments via e-payment accounts, rather than online bank accounts, simply because it was convenient. Some e-payment companies then started to obtain information from banks on their retail customers and were using it to offer them more advanced products, which helped increase their loyalty. These products’ most irksome feature, from the banks’ viewpoint, was that they could be offered without any involvement by the banks. It is at this point, we are told, that the relationship between the e-payment companies and the banks and UnionPay started to deteriorate. But it got worse.

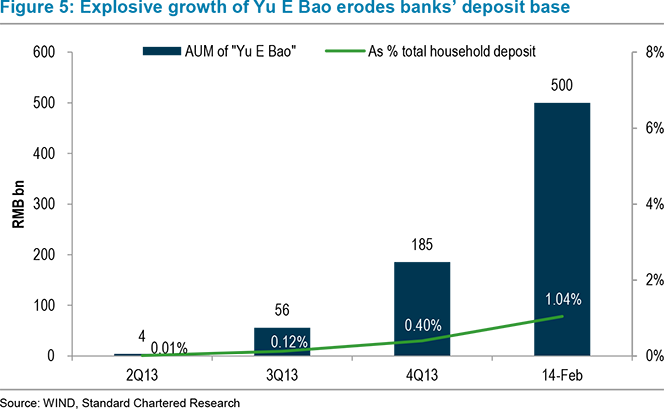

In the second half of last year, e-payment platforms started to cross-sell financial products to their users and muscled into the banks’ core territory. One example we are given is of Yu E Bao, a web-based money market fund distributed via Alipay, which pooled many small-value retail deposits and packaged them into a large interbank deposit. The rate for these larger interbank deposits tracked the interbank market rate and was much higher than the regulated deposit rate.

Since its launch in June 2013, Yu E Bao has achieved an average 6 percent annual return, we are told, compared to the meager 0.35 percent for demand deposits and 3 percent for one-year deposits. This attractive return and the convenient subscription and redemption fuelled the fund’s fast growth. The fund’s assets under management (AUM) reached ?Ñ500 billion ($80.5 billion) in only eight months, we learn, but its high returns effectively lifted the banks’ funding costs. In response, in early March 2014, three state-owned banks boycotted Yu E Bao’s interbank deposits and, as it quickly became evident, they were just getting started.

On top of all that, Alibaba and Tencent allied themselves with CITIC Banks to launch a virtual credit card, further worsening the already sour relationship with the country’s big banks. The problem with these virtual credit cards, from the banks’ perspective, was that they bypassed several credit card business rules and avoided the UnionPay system, cutting the banks out of the process.

Taking all that into consideration, the researchers go on to conclude that “the enormous lobbying power of the banks, which was perhaps forgotten by supporters of e-finance, turned the tables in a surprisingly quick manner”. I see no reason to disagree.

The Takeaway

So what does the future hold for e-money in China? Here is how the researchers see it:

We expect more rules to be issued restricting the expansion of e-finance. In particular, we wonder what the regulator plans to do with Yu E Bao, and will be watching developments closely. Alipay is licensed by CSRC to distribute investment funds. As of mid-February, Yu E Bao had accumulated 80mn retail investors, and we believe the social costs of shutting it down would be too high for PBoC to consider doing so. However, given restrictions on the amount of money transferred into Alipay, Yu E Bao’s AUM is likely to be constrained at it’s the current level, or perhaps slowly decline if investors start to pull out.

So, they believe that the Chinese e-payment platforms have suffered a sound defeat and the status quo is permanently altered. If that is indeed the case, the biggest loser will be the Chinese consumer.

Image credit: a screenshot of Alipay.com’s home page.