Is Transferwise Safe for Large Amounts?

Is Transferwise Safe for Large Amounts? Are you worried about receiving or sending money through Wise? Are you sure that TransferWise is secure and safe for your transfers and money? Is there something you have to worry about?

Well, I have used Wise since 2017 and have had hundreds of transactions. In this article, I will try to present the information about Wise security.

Let`s start.

TABLE OF CONTENTS:

- Is Wise Safe?

- Is Transferwise Safe for Large Amounts?

- What is the Maximum Amount I can Transfer with Transferwise?

- How You can send Large Amounts of Money via Wise?

- How Can Wise Be So Cheap?

- How Safe is Wise?

- Wise Review: Pros & Cons

Is Wise Safe?

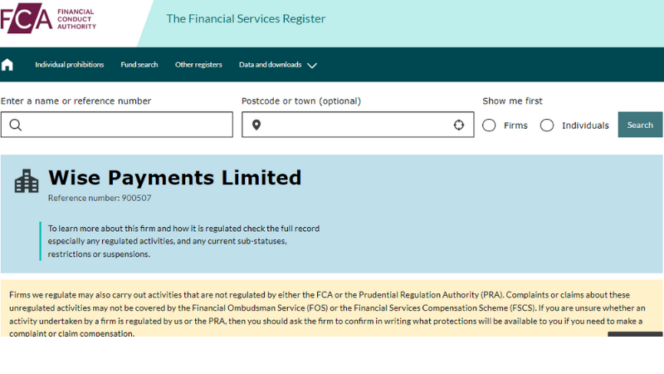

A Wise account is secure to transfer and receive money internationally. It is protected by strong security and encryption that keeps personal data safe. Also, it is being monitored by financial authorities across the globe to ensure safety.

They must adhere to the strict rules set by the regulatory bodies in each nation they operate. Those authorities are FCA within the UK and FinCEN in the US.

Financial regulators worldwide control Wise, including:

- Australia

- Belgium and EEA

- Canada

- Brazil

- India

- Hong Kong

- Indonesia

- Singapore

- Malaysia

- Japan

- New Zealand

- United Kingdom

- United Arab Emirates

- United States

These financial regulatory bodies protect their customers and the market they operate in by keeping an eye on Wise to ensure they meet their standards for regulatory compliance. If they determine that Wise does not follow the rules of their organization, they take action to safeguard the consumers’ interests.

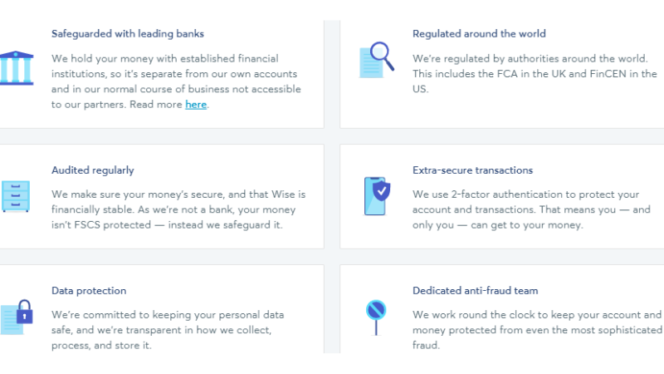

Wise is safe because:

- Regulated around the globe (FCA, FinCEn) and regularly audited

- Leading banks protect it

- It uses 2-factor authentication (2FA) and encryption for logins for extra secure

- It requires a password to make a transaction

- By law, they have to ‘safeguard’ your money

- Uses 3D security for card payments

- Dedicated in-house security anti-fraud team

- It gives real-time notifications to alert immediately

Additionally, Wise isn’t new. It’s been around since 2011. If it wasn’t a secure platform, it’d be tossed into the trash heap of dying technology platforms sometime in the past.

Today, over 12 million customers worldwide move around $6 billion of their money with wise accounts. Also, Wise covers 53 currencies, 80 countries to which you can send money.

Is Transferwise Safe for Large Amounts?

Wise is safe, but it’s crucial to remember that there are possibilities of encountering issues when dealing with large amounts. This does not happen with every transaction, but it is possible. Note that the daily transfer limit is 1 million dollars.

I have been using Wise since 2017 and use both accounts (business and personal).

I’ve transferred thousands of dollars (70K and more) via Wise in multiple transactions and I did not face any difficulties. On Reddit, you can find information about the amounts that some users have been transferred. For instance, some have transferred large amounts (300K-500K) without facing any issues. Most of the transactions are from 10K to 50K again without issues.

Some customers said that their transaction was smooth and without issues; however, some users said they had problems. But if you do not panic and contact the support team, everything can be resolved.

Sending large amounts of money can be difficult at times, not just due to Wise but also to problems in your financial institution or your currency and the country you’re in.

So If your goal is to receive or send small amounts, like $10,000 or less, I suggest you consider giving Wise an attempt without hesitation.

What is the Maximum Amount I can Transfer with Transferwise?

If your account is located in one of the Wise licensed states or a country other than the US, you can transfer:

- 1,000,000 USD per transfer on personal and business accounts

- 15,000 USD per day using a bank debit

- 2,000 USD per 24 hours and 8,000 USD per 7 days using debit or credit cards

If your account address is in Nevada, Guam, or the Virgin Islands, you can send:

- 50,000 USD per transfer on a personal account and 250,000 USD per transfer on a business account

- 250,000 USD in a year on a personal account and 1,000,000 USD in a year on a business account

- 10,000 USD per day using bank debit (ACH)

How You can send Large Amounts of Money via Wise?

This guide contains ways to transfer larger amounts of money. The following steps are for sending amounts greater than 100,000GBP or equivalent to their currency.

- Get verified

- Check your bank limits

- Decide how you want to send

- Get your documents ready

- Setting up your transfer

- Paying for your transfer

- Tracking your transfer

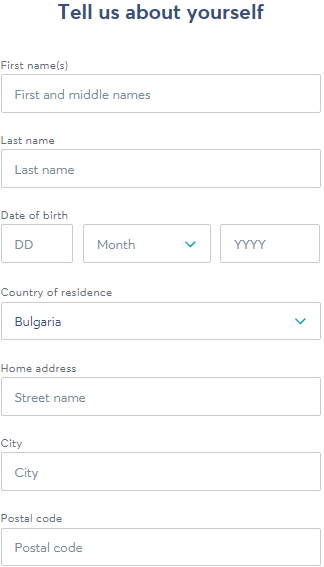

Get verified

Whether you use Wise as a personal or business account, you must be verified before you can make a transfer. Especially if this transfer is a large amount.

You’ll need to log in to your Wise Personal Account to the Wise Business account to get verification.

The process of verification for both types of accounts is different. Verifying a personal account is straightforward compared to a business account. But with the business account, you’ll be able to access more features.

To be verified on a Wise private account, you’ll need to upload a picture of one of the following three things:

- National ID card

- Passport (photo page only)

- Driver’s license

To verify your Wise business account, you’ll need to:

- Business registration

- Industry

- The location where you’re situated

- Social Presence

- Name

- Date of your birth

- Country of residence.

Keep in mind that sometimes it takes time to create a business account. You may receive a message that there are currently many requests from this country. In this case, Wise invites the user to join the Waitlist.

Check your bank limits

Contact your bank first to check your limit. They might tell you to go to the bank’s branch to pay, so be prepared to do it on the day that you begin the transfer.

If you find it difficult to visit the bank on your own, you might prefer to pay in small amounts. Make this happen by using your currency and then adding the amount. If you can get enough, you can make the transfer.

Decide how you want to send

There are two options to transfer large sums. If you require funds quickly, you can choose to transfer immediately if possible. You’ll receive the current exchange rate, guaranteed for a specific time. You must ensure that your funds get to wise by the deadline. Otherwise, you’ll be unable to get the guaranteed rate.

If you have extra time to spare, preparing your transfer in advance will be better. This will allow you to prepare everything ahead of time, such as checking your documents. Then, you can monitor the exchange rate and then send it when you’re prepared. It’s not available for transfers made from EUR, BRL, or SGD due to limitations on holding these currencies in Wise.

Get your documents ready

Wise will ask you for additional documents based on your amount if you’re sending large amounts.

They often request your bank statement or other documentation that shows where your money came from.

Bank statement

- Your name and account number

- The amount of money transferred into your account

- The money leaving your account when you sent it to Wise

- Any movement of funds between other accounts, if that happened

Other documents

- Property Sale – example, sales contract;

- Inheritance – example, Will;

- Salary – example, Employment contract;

- Investments – example, Statements;

- A loan – example, Loan agreement;

Setting up your transfer

- Select the source of your payment. Directly from your bank or with money has already been added to the Wise account.

- Enter the amount you wish to transfer. Then Wise will tell you the cost.

- Determine the way you’d like to transfer your funds. This is the time to decide whether to transfer as fast as possible or plan your transfer.

- Enter your recipient’s details. Double-check these details to ensure they’re correct.

- Upload your documents. Check that your documents are covered at every point.

- Examine the details of the transfer. Check to see if you’re satisfied with the transfer. Once you’ve clicked, confirm it is difficult to alter any details.

- Select the payment method you prefer.

- Transfer payment. This screen contains Wise bank’s information and your transfer reference number on it. Print these out or note them down.

Paying for your transfer

In this step, visit your bank and pay unless you’ve made another arrangement through your institution or paid smaller amounts.

After you’ve made your payment, it may take as long as 2 days for Wise’s funds to be received. It’s contingent on the currency you’re sending it from and how quick your bank’s process is. When Wise receives your funds, they will email you an update and begin processing the transfer.

Tracking your transfer

When you’ve made the transfer, Wise will keep you up on the progress of your transfer by sending you emails with the status of each step. You can also see the status of your funds at any time by logging into the account you have and then clicking the transfer.

If Wise needs any additional details from you during this process, they will send you a secure URL to upload the documents.

How Can Wise Be So Cheap?

Wise can be 7-8 times cheaper than banks and 3x less expensive than PayPal. But how are they doing this?

First of all, Wise is not a bank-based payment service. It’s an E-money structure, which means that your account with Wise can be described as an account for electronic funds.

Most banks and currency exchange companies claim to have very low or even cheap fees, but this isn’t true. They charge a markup on exchange rates, which amounts to a huge hidden cost to the transfer, and you might end up paying more than what you ought to. Especially when you transfer money abroad to a different bank than yours.

However, Wise has bank accounts across the globe that are linked through its innovative technology. It allows customers to store and convert funds in 54 currencies to make receiving and sending money much easier and eliminate the markups added to exchange rates. This will enable you to receive the highest rates you can get. So, yes, Wise is much cheaper choice.

For example, if you wish to transfer pounds to the US, login to your account and pay with your currency local to you, which is pounds. Wise will transfer dollars to the recipients via their account, which means that money doesn’t cross any border.

Wise Review: Pros & Cons

Wise Pros

- There are no hidden charges. TransferWise is transparent in its charges, and you’ll know what you’ll pay and the current exchange rates.

- Cheap. Wise is a far less expensive option than sending money through banks, PayPal or exchange businesses and is likely to be 3-8x less costly.

- Convert money in 53 currencies – Allowing you to keep and convert funds in more than 50 different currencies and for absolutely no cost. It’s as simple as opening new accounts and obtaining all the account information from Wise, including the name of the holder and address, account numbers, routing codes, and the type of account.

- Interface. It is a user-friendly and straightforward interface except for their website and a Wise mobile app.

- Minimum transfer amount. Wise offers a minimum amount to transfer, which means you can transfer as little as $3 internationally or 1 cent in the same currency.

- Fast registration. The registration process for Wise isn’t too difficult. You can register your account within only a few minutes.

- Keep track of your transfer at every step. Keep track of the transfer at every step of the way and check the progress of your transfer at any point via the Wise site or application.

- Different payment options for your convenience. Wise accepts various payment methods depending on what currency is being used.

- Get alerts on rates. Wise offers a rate tracker to keep track of the current exchange rate direct in your inbox.

Wise Cons

- Transfers to bank accounts only. There’s no alternative to sending a cheque or cash pick-up.

- Debit Card. Wise’s debit card is accepted in a handful of countries.

- Not all currencies are supported – Wise doesn’t work with all currencies. It allows you to transfer money into your account from 19 countries, hold and convert funds in more than 50 currencies, and take money from other users with limited currencies.

- Sometimes, transfer speeds are slow. Usually, I receive my money in just a few minutes, but I’ve also experienced slow speed transfer (6-24 hours), depending on the amount.

- Some people complained about account deactivation. Some people complained about account deactivation. Unfortunately, you can see these stories of deactivation at virtually every financial institution. Suppose a transaction is identified as being anti-money laundering, that is. In that case, the institution is legally obliged to stop your bank account’s access and is legally bound not to explain why they have frozen accounts in the first instance. This creates a lot of unhappy situations where clients are unable to access their funds and feel as if their provider has scammed them. Transferwise is fully regulated and won’t take your money.

Wise is not a secure means of sending money as their website claims, so you should never send more money with them than you are willing to lose.

The problem is that Wise can only prove that they have sent the money, and not that the money has been deposited in the recipient’s account. This is problematic because if you are paying upfront for goods or services, the recipient of the transfer can just state that they never received the money and there is nothing Wise can do to prove otherwise.

Further, even if the money genuinely didn’t arrive, Wise will not reimburse you because you can’t prove that the money didn’t arrive. Good luck with trying to get wise to do anything about it. If you google “consumeraffairs/finance/transferwise” you will see what a nightmare their customer service department is.