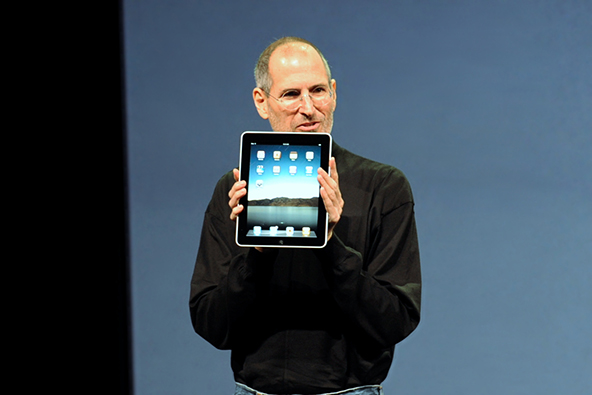

iPhone 5 and iPad 2 to Support Mobile Payments

Apple’s next iterations of the wildly popular iPhone and iPad will enable users to make payments simply by waving the device by a retailer’s point-of-sale (POS) terminal, according to a Bloomberg report.

The iPhone 5 and iPad 2 are expected to be released later this year and will incorporate near-field communication (NFC) technology that allows the transmission of information between enable devices at a distance of up to four inches, the report said, quoting Richard Doherty, director of consulting firm Envisioneering Group.

Apple has already built a prototype of the NFC-enabled payment terminal that would be needed to allow retailers to accept payments from NFC-enabled iPhones and iPads, according to Doherty. The tech giant may start giving away these terminals in an effort to promote the technology.

The news is not terribly surprising, as Apple has been rumored to be working on incorporating NFC into its gadgets for more than three months now, ever since it was first leaked that Steve Jobs and company had filed for several NFC patents.

Not willing to wait for Apple to design a permanent solution, Softbank, a Japanese mobile carrier, designed an adhesive NFC sticker that gets attached to the back of the iPhone 4 and functions independently from the device, allowing users to make payments wherever NFC scanners are present (and there are plenty of them in Japan).

In essence, NFC enables the substitution of the traditional swiping of a credit card through a POS terminal with the waiving of a phone by it. The payment amount gets instantaneously deducted from the account linked to the phone, which in theory could be anything from a credit card to a debit card to a bank account to the user’s mobile phone account itself.

So one of the possible scenarios is that Steve Jobs and company could turn the iPhone 5 and the iPad 2 into Apple-backed debit cards by providing users with “stored value” through the iTunes store. In effect, Apple would become a bank. While certainly probable, this scenario raises a slew of questions, to which we don’t know the answer. Would Apple really want to become a bank? If it does, would it be willing to put up with all the additional scrutiny and extra regulatory burden?

The Bloomberg article speculates about the possibility that Apple’s goal could be more modest – simply to reduce the amount of credit card processing fees the company pays on every purchase from iTunes by “encouraging consumers to use cheaper methods [e.g. bank accounts].” Yes, this is also a probable scenario, however modest goals are seldom pursued by Apple.

Whatever path Apple chooses to take, it will have plenty of company. NFC seems to be the hottest game in town, one in which all of Apple’s rivals are likely to compete. Google, the biggest of them all, was actually the first one to release an operating system – the Android 2.3 (a.k.a. Gingerbread) — that supports NFC-based mobile payments. In the U.S., the only phone that currently can be used for making NFC-based mobile payments — the Samsung Nexus S — runs on Android 2.3. Nokia and RIM (BlackBerry’s maker) have also said that they would release NFC phones in the near future.

Whatever path Apple chooses to take, it will have plenty of company. NFC seems to be the hottest game in town, one in which all of Apple’s rivals are likely to compete. Google, the biggest of them all, was actually the first one to release an operating system – the Android 2.3 (a.k.a. Gingerbread) — that supports NFC-based mobile payments. In the U.S., the only phone that currently can be used for making NFC-based mobile payments — the Samsung Nexus S — runs on Android 2.3. Nokia and RIM (BlackBerry’s maker) have also said that they would release NFC phones in the near future.

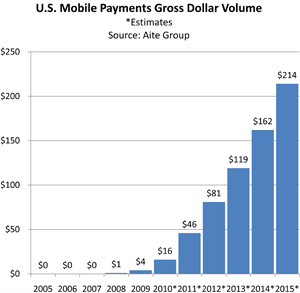

The mobile payments market as a whole is scheduled to grow to $214 billion in 2014, according to Aite Group, a research and advisory firm. The volume of NFC payments alone will reach $22.6 billion, the report forecasts. With so much at stake, expect the NFC launches to keep coming.

Image credit: Wikimedia Commons.