How Would You Respond if You Were Forced to Pay a Debit Card Fee?

A new study by Javelin Strategy & Research, a consultancy specializing in the financial services and payments industries, examining the effects of the recently enacted Durbin Amendment on consumer payment behavior attempts to answer this question, among others. To do that, the company relies on the results of a survey of 3,000 Americans, conducted by the way in October of last year, when the country was still in the grips of the huge backlash caused by Bank of America’s ill-conceived introduction, and eventual abandonment, of a $5 debit card fee.

So the survey’s results should be looked at through the prism of the debit fee uproar and anyway, what people tell researchers does not always match their actions. Still, we do get an insight into the recent evolution of the American consumer’s sentiment towards the use of bank cards and other payment methods. And we also learn about some widespread delusions along the way. Let’s see what we can make of the data.

70% of Americans Would Switch to another Payment Method

That’s what Javelin’s survey tells us Americans would do if their bank started charging them a debit card-related fee. What would they start using instead? Here is the breakdown:

- 32 percent would switch to cash.

- 25 percent — credit cards.

- 13 percent — checks.

Just over a quarter of the respondents (26 percent) said they would counter a debit fee by switching banks, presumably giving their business to ones that do not charge such a fee.

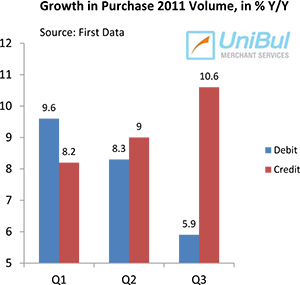

It has to be said right here that, even though banks eventually decided against charging a debit fee, the aggregate volume of debit card transactions in the U.S. has been growing at an ever decreasing rate, while the exact opposite is true for credit cards. The chart to the right is showing you these dynamics, using the latest available data.

It has to be said right here that, even though banks eventually decided against charging a debit fee, the aggregate volume of debit card transactions in the U.S. has been growing at an ever decreasing rate, while the exact opposite is true for credit cards. The chart to the right is showing you these dynamics, using the latest available data.

That, by the way, is precisely the type of a trend that U.S. banks have wanted to establish ever since it became certain that debit card interchange fees would be cut. So you might say that, although they lost the debit-card-fee fight, they may still win the war. Which brings me to the delusion point.

Who Benefits from the Durbin Amendment?

Perhaps the most unexpected piece of statistics to come out of Javelin’s survey is that 70 percent of the respondents told the researchers that they thought that the banks were the ones benefiting from the new limits on the debit interchange fees. This response again reminded me of the fact that the survey was taken at the height of the anti-bank backlash, but that notion is nevertheless very, very wrong.

The Durbin Amendment did exactly the opposite of what so many Americans have told Javelin. By limiting the debit interchange fees — the fees issuers charge to merchants for processing transactions involving debit cards — the Durbin Amendment slashed bank revenues by about $7 billion a year (that is our estimate, Javelin’s is $12.2 billion). As these billions, whatever the exact amount, are for the most part to be collected by the merchants, the Durbin Amendment is in effect redistributing revenues from the financial industry to the retail one.

Now, you may say that this is all good, because banks are finally getting exactly what they deserve. Well, the problem is that the card issuers could not just stand by and calmly accept their comeuppance. What they did instead was that they started looking around for ways to make up for the lost revenues. And as many of us predicted even before the debit reform took place, finding such new revenue sources could not leave consumers unharmed. That is exactly what happened. Debit card related fees may have been abandoned, but free checking is virtually gone, overdraft fees are up to $35, which is as high as the CARD Act would allow them to go and banking has overall become more expensive. And yes, consumers are worse off than before the Durbin Amendment was enacted.

The Takeaway

The data show that Americans have been turning away from debit card use long before banks began tinkering with debit fees. Credit cards have picked up most of the slack, although prepaid card use is also on the rise.

So, much to the chagrin of many consumers, their payment preferences are shifting precisely in the direction that is most favorable to the card issuers, whose credit card interchange revenues were left untouched by the Durbin Amendment. Of course that may soon change too, thanks to a huge anti-trust case filed by millions of retailers aiming to push credit interchange fees down. We’ll have to wait and see.

Image credit: Etsy.com.