How to Minimize the Credit Card Processing Fees You Pay

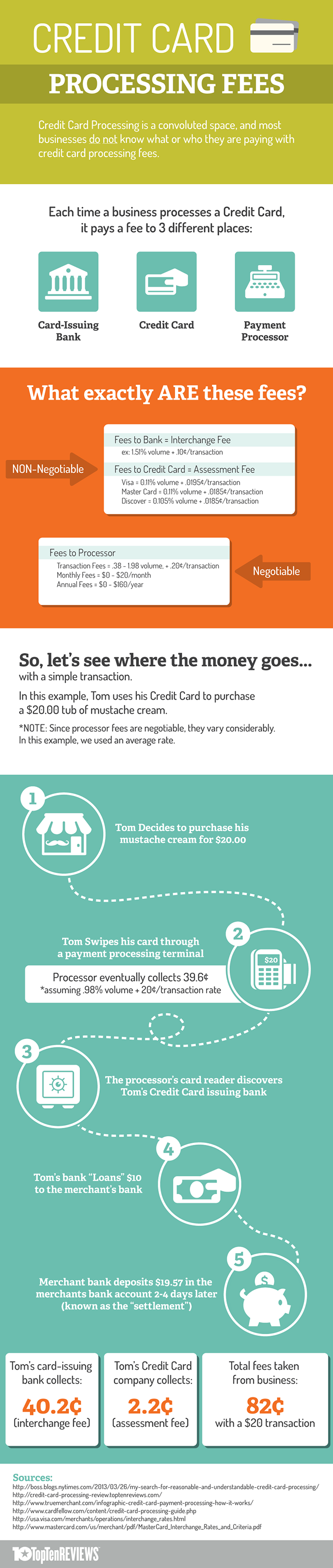

I came upon a very nice infographic this morning, which deals with an issue that is right into our own wheelhouse: the make-up of credit card processing fees. Regular readers know well that one of this blogger’s most prolific sources of complaints is the difficulty of explaining to inexperienced merchants the structure of the processing fees they pay, which is incredibly important if you are to make a knowledgeable decision about the type of pricing structure you will sign-up for. I do have some quibbles with this infographic, but I think that it nevertheless does a nice job of explaining what merchants pay and to whom, so I am hopeful that it might succeed where I’ve previously failed. Now let’s see what the graph is showing us.

Who Gets Paid and How to Minimize Your Fees

Via Love Infographics, Top Ten Reviews has produced a nice infographic to illustrate who collects the credit card processing fees paid by U.S. merchants for each processed transaction. Now, before we go any further, we should note that, with a minor exception (Discover’s assessment fee), everything shown in the graph below pertains solely to Visa and MasterCard transactions. American Express and Discover combine the functions of the card issuer and the payment processor (see the top of the graph), which considerably simplifies the process.

I was especially pleased to see that the authors had segmented the processing fees by “negotiable” and “non-negotiable” ones; in fact, this is the most important part of this graph. Disregard the specific interchange fee that you see in the “non-negotiable” section — it is for illustration purposes only and I wish the authors had stressed that fact more forcefully.

OK, why is this so important? Well, what this graph shows you is that the only component of the transaction fee (the so-called “discount fee”) you are charged for each card you take for payment, over which you have at least some control, is the processor’s fee. The interchange and assessment fees are just a fact of life — they are non-negotiable.

So what do you do with this knowledge? Well, the first thing to realize here is that interchange rates vary from one card type to another. So, whereas in the graph’s example, the interchange rate is 1.51 percent plus 10?ó, for another transaction it could be 0.05 percent plus 22?ó. And the only way you could take advantage of the varying interchange rates would be for these rates to be calculated separately for each individual card transaction you process, which can only be achieved through the interchange-plus pricing model.

How does interchange-plus work? Very simply: it adds the “non-negotiable” interchange rate, calculated for each individual transaction, to the “negotiable” processor’s fee, which is the same for each transaction. In contrast, in the case of the more prevalent tiered and flat-rate models, your processor gives you one or more (say, two or three) rates for all transactions, regardless of what each individual interchange may be.

Why is this a problem? Well, the processor needs to make sure that such rates are higher than the highest possible interchange rate at which any given transaction is processed — otherwise he’d be losing money on transactions whose interchange is higher than the discount rate, and he won’t do that.

So, if you are still signed up for some type of a flat-rate or tiered pricing model, it is about time you called your processor and asked him to switch you to an interchange-plus.

Image credit: Flickr / StockMonkeys.com.