How to Manage Chargebacks Caused by Missing Transaction Information

Visa’s many different types of chargebacks are organized into six general categories, based on their underlying causes. Today I will review the first one of these groups — chargebacks caused by non-receipt of transaction information — and I will do the same for the other five in subsequent posts.

I will give you the definitions of each chargeback in each group, which will help you understand exactly what took place and how the card issuer sees the situation. This is important, because the issuer, either acting on its own or prompted by the affected cardholder, is the one who initiated the chargeback in the first place. I will then review what can be done to remedy the chargeback and prevent future occurrences. You will also learn under what circumstances there is no available remedy and you should just accept the chargeback and move on, rather than spend time and money fighting a lost cause. Let’s get started.

Reason Code 60: Illegible Fulfillment

This code designates chargebacks resulting when the card issuer requested and received a copy of a sales receipt, but the account number and / or transaction amount is illegible.

1. Most common causes for Reason Code 60:

- The POS terminal’s printer ribbon was worn and the ink was too light.

- The printer’s paper roll was nearing its end, at which point the paper becomes colored making some of the payment information illegible.

- The copy was made on colored paper.

- The carbonless paper of the original sales receipt was mishandled, covering it in black blotches and making copies illegible.

- The original sales receipt was copied at a reduced size, resulting in blurred or illegible copies.

- The submitted document was not a copy of the sales receipt at issue.

2. Managing Reason Code 60 chargebacks. When the issuer requests a copy of the transaction receipt in question, they should receive it within 7 days for U.S. transactions and 120 days for international ones. If you are late, you will lose the dispute by default. Your response will depend on the particular circumstances and the actions you have taken (or not) so far:

- If a legible and complete copy of the transaction is available, send it to your acquirer, who will resubmit it to the issuer.

- If the sales receipt you have on file is illegible, accept the chargeback. Do not issue a credit to your customer at this time, as the chargeback has already performed this function.

- If the sales receipt is incomplete and the transaction is fraudulent, you have no re-presentment rights, as the cardholder cannot be expected to accept a fraudulent charge. You should accept the chargeback.

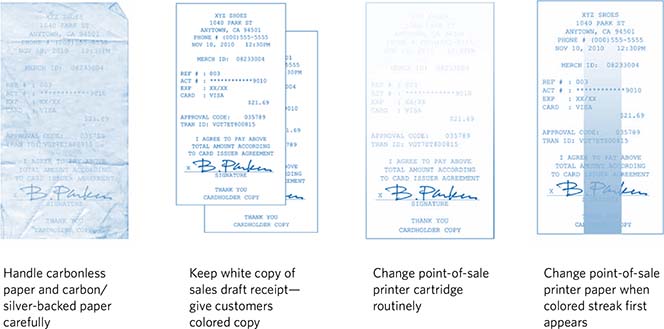

3. Preventing chargeback Reason Codes 60. Most of these chargebacks can be prevented by sticking to the following guidelines:

- Make copies of your sales receipts at the same size as the originals. Reduced size can produce images that are difficult to read.

- Change the printer ribbon regularly to avoid making hard-to-read copies of sales receipts.

- Change the printer paper as soon as the colored streak first appears to ensure the legibility of sales receipt.

- Keep the white copy of the sales receipt to ensure better quality copies in the future. Give the colored copy to the customer.

- Handle carbonless paper and carbon-back paper carefully. Carbon-back paper looks black when copied. Any pressure on carbonless and carbon-back paper during handling and storage results in black blotches, making copies illegible. Always keep the top copy.

- Place your company’s logo in a way that does not block transaction information on your sales receipts.

- For fraud-related retrieval requests, provide a copy of the signed sales receipt. However, you are not required to respond to retrieval requests on chip-read and PIN processed transactions.

So, preventing Reason Code 60 mostly depends on the proper handling of your sales receipts. A good rule to follow here is that if you can read the copies of your sales receipts, issuers will also be able to read them and you will never see a Reason Code 60.

Reason Code 75: Transaction Not Recognized

This code is used to designate chargebacks initiated when a cardholder claims that she does not recognize a transaction posted on her account.

1. Most common cause for Reason Code 75: the merchant’s name or location, as reflected on the cardholder’s billing statement was either incorrect or unrecognizable to the cardholder.

2. Managing Reason Code 75 chargebacks. You have 120 days for fulfilling a copy request from the transaction processing date. Unlike your response to other chargeback types, which is mostly determined by the particular circumstances and may require taking different actions, your response to a Reason Code 75 is quite straightforward and will invariably consist of providing the following documents and information to your acquirer and from there to the issuer:

- Sales receipt.

- Shipping confirmation or delivery receipts.

- Description of the item or service purchased.

Make sure that any copies you make of these documents are legible and that your acquirer receives them within the stated time frame or you will lose the re-presentment.

3. Preventing chargeback Reason Code 75. Provided that the dispute which led to a Reason Code 75 was filed in good faith (and you should assume that it was), the immediate cause would have been that your business’ name or location, as shown on the cardholder’s billing statement, was either incorrect or unrecognizable to the cardholder. Both of these issues can be resolved by setting up your “billing descriptor” correctly.

The billing descriptor is managed by your processor and determines how your business name appears on a cardholder’s credit card statement and transaction activity log. It consists of your business name and phone number and its length is usually restricted to 25 characters, excluding the phone number. Processors typically set up the billing descriptor to show your “Doing Business As” (DBA) name, however longer names are abbreviated.

There is a good reason to use your DBA, as opposed to your legal name, in the billing descriptor, because it is the most recognizable one to your customers. For example, if your legal name is ABC Inc, but your store’s name is DEF Market, your customers will know you as DEF Market and will probably have no idea what ABC Inc is. So if your billing descriptor is set up to display ABC Inc, you should brace yourself for a wave of disputes.

Make sure that your DBA is displayed on all of your marketing materials, invoices, sales receipts and any other documents used in your ordinary course of business. To avoid confusion, restrict the usage of your legal name, if different, to the areas where you are required to state it.

Be advised that you are protected from a Reason Code 75 chargeback if the transaction was posted with an Electronic Commerce Indicator (ECI) 5 (i.e. cardholder is fully authenticated) or ECI 6 (cardholder is not participating in?áVerified by Visa). So make sure you are in compliance with the ECI process to benefit from this protection.

Now, a Reason Code 75 chargeback can often result from a bad-faith cardholder dispute. However, when that happens, your acquirer will usually resolve the disputes on its own, so long as you have followed required processing procedures and your billing descriptor is properly set-up, so you will never see them. That is exactly what should be happening and if you actually start seeing such disputes, your first reaction should be to take a close look at your transaction processing procedures and contact your processor to make sure your billing descriptor is set up correctly.

Reason Code 79: Requested Transaction Information not Received

Visa eliminated this code and now requires that issuers file a dispute for the true reason instead (for example, fraud). This reason code is now only valid if the retrieval request was made for Reason Code 33 — Request for Legal Process or Fraud Analysis — if the issuer needs to obtain a copy of the receipt for legal proceedings or for law enforcement investigations.

Image credit: Flickr / Images_of_Money.