How to Manage Chargeback Reason Code 72

You do get your transactions authorized before processing them, right? Well, if you’ve been accepting credit cards long enough, you’ve probably learned what happens if you don’t – an automatic chargeback. In fact, there is a specific reason code assigned to chargebacks initiated when the issuer receives a transaction that was above the merchant’s floor limit, but for which authorization was not obtained or authorization was obtained using invalid or incorrect transaction data. That is Reason Code 72.

In this article I will examine the causes of Reason Code 72, the conditions for initiating this type of chargeback and will review strategies for preventing and responding to it.

What Causes Reason Code 72

Typically, Reason Code 72 is issued when the merchant:

- Did not obtain an authorization approval for a transaction or, in a face-to-face environment, obtained it after the transaction date.

- Included the tip in the authorization amount. As we’ve discussed in multiple articles before, an authorization should always be requested for the known transaction amount, not the transaction amount plus an estimated tip.

Be advised that authorizations for taxicab, limousine, bar, tavern, beauty / barber shop, health / beauty spa, and restaurant transactions are automatically valid for the transaction amount plus 20 percent, specifically in order to protect merchants from chargebacks where the transaction amount is disputed. The same is true for up to 15 percent additional amount for travel and entertainment merchants.

How to Respond to Reason Code 72

There are only two possible scenarios for responding to a Reason Code 72:

| If: | Then: |

| You did obtain an authorization approval. | Provide your processor with information about the transaction date and amount. |

| You did not obtain an authorization approval. | Accept the chargeback, as there is nothing to be done. Most processors will verify that a transaction was authorized and approved, before forwarding you the associated chargeback, so you will never see it. |

The time limit for Reason Code 72 is 120 calendar days from the transaction date.

How to Prevent Reason Code 72

Preventing this type of chargeback is entirely within your control. Here is what you should be doing:

- Obtain an authorization approval before completing transactions. An authorization request is automatically sent to the issuer when a card is swiped through (for mag-stripe transactions) or inserted into (for chip cards) a point-of-sale (POS) terminal and the dollar amount is entered. A sales receipt is then printed if the transaction is approved. If it is not approved, you will receive a “Decline,” “Call Center” or “Pick-Up” message on your POS device.

- Do not include the tip in your authorization request. Make sure that the authorization amount is equal to the check amount and the tip is excluded. So if the bill before tip is for $45.56, an authorization should be requested for $45.56. Contact your POS vendor and make sure that your POS terminal has been programmed to authorize only for the check amount before the tip is added.

- You are unable to get an electronic authorization because the card’s magnetic stripe cannot be read. You can request an authorization either by key-entering the transaction information or calling your voice authorization center. If your request is approved, make sure that the approval code is on the sales receipt. If you obtained a voice authorization, write the approval code on the receipt. Take an imprint of the face of the card on the receipt and have the customer sign it.

- The terminal cannot read the chip on the card. Follow “fallback” procedures and accept the EMV card by swiping its magnetic stripe through the reader, as prompted on the terminal screen. Be advised, however, that if your terminal is chip-capable, preference should always be given to chip reading, before a swipe is attempted.

- The floor limit is zero for all card-not-present transactions. This means that you should authorize all such transactions, regardless of the dollar amount.

- Train your staff. Staff should be trained on general authorization rules and procedures. In restaurants and other businesses where a tip is added to the transaction amount, everyone should be instructed to authorize only for the check amount and exclude the tip. For chip-capable terminals, training should be provided on fallback processing procedures.

The Takeaway

Preventing Reason Code 72 chargebacks is quite straightforward. All you have to do is request an authorization and do not process the transaction unless you receive an approval response. It’s really that simple. Try to minimize voice authorizations, as they bypass your processor’s system and cannot be used in chargeback re-presentments.

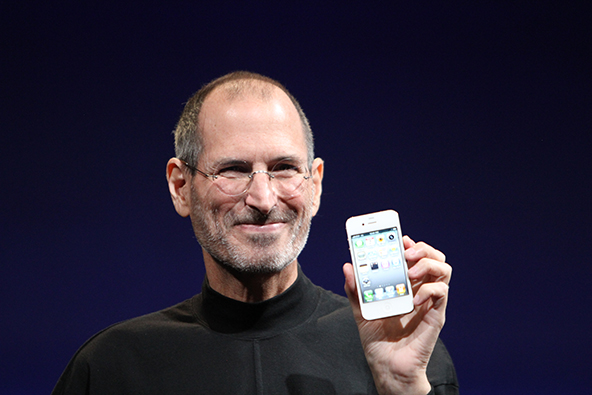

Image credit: Flickr / 401(K) 2013.

Indeed a very nice post. I love to read the latest stuff and happenings on credit card merchant industry. I just came across your blog and find it so informative that I subscribed the same in my reader. Hope you will be posting sure worthy stuff over the coming days. Thanks

Hello John,

I’m glad you liked the post. Feel free to jump in and share your own industry experience.