How to Get Lower Credit Card Processing Rates for Your Hotel

The lodging industry is classified as high risk by Visa and MasterCard, which often makes it difficult for some hotels to set up a merchant account on reasonable terms. This is particularly true for smaller businesses and new hotels, with no previous card processing experience. The reason, as ever, is that lodgers have historically generated higher-than-average levels of charged back transactions. Well, whereas there is not much you can do about your industry’s chargeback history, you can certainly take control of your own credit card processing performance to ensure that your merchant account provider gives you the best available terms of service.

What you have to do is follow faithfully a simple and straightforward set of card acceptance rules. For the most part, these are the same rules every merchant should follow when taking cards for payment anywhere, but there are some procedures and programs, which are specific to the lodging industry and which you should know how to manage. In particular, most chargebacks and customer disputes related to hotel transactions have to do with authorization issues and additional charges. Here is how you should manage them.

How to Authorize Card Payments at Hotels

1. When to request an authorization. Authorization is the process through which a card issuer approves or declines a transaction. An authorization approval can be obtained electronically using your point-of-sale (POS) terminal or, if the system is down, by calling your acquirer for a voice authorization.

U.S. hotels are required to authorize all of their transactions. Non-U.S. hotels are required to obtain authorization in the following circumstances:

- The total transaction amount is above your floor limit.

- The card has not been signed.

- You’ve produced a handwritten sales draft with no card imprint.

- The card has expired.

- The transaction looks suspicious or otherwise unusual.

For transactions below their floor limit, non-U.S. hotels have the option of doing one of the following:

- For magnetic stripe card transactions, obtain an authorization approval.

- For chip card transactions, either obtain an offline approval or request an online authorization.

- Do not request an authorization approval, but compare the card number to the current Card Recovery Bulletin (CRB). This action is no longer required for merchants using chip terminals or under certain circumstances, so check with your acquirer to confirm the status in your location.

Furthermore, if operating in the U.S., you should not be using a $1 authorization check to verify if the cardholder’s account is in good standing. Instead, you should use the $0 Account Number Verification Service.

2. What to do when your guest extends her stay. Authorization approvals are valid for the estimated length of your guest’s stay. When a guest stays longer than the initially estimated period, you should process an incremental authorization request for the additional transaction amount that you expect to be generated during the extended period.

To process an incremental authorization request, first confirm with your guest the estimated length of the extended stay and then follow standard authorization procedures for the additional amount. If your incremental authorization request is declined, contact your customer and ask for another form of payment.

If your guest’s stay extends beyond 2 weeks, you should settle the transaction and obtain authorization for a new transaction.

3. Types of authorization.

A. Estimated authorization. When your guest arrives to check in, you should estimate her total charges and obtain an authorization for the estimated amount. Your estimate should be based on:

- Expected length of stay.

- Room rate including tax.

- Incidental charges such as room service, telephone calls, and parking.

B. Final authorization and the 15% rule. When your guest checks out, authorization is required in the following circumstances:

- There was no previously estimated authorization and the actual transaction amount is above your hotel’s floor limit. In that case, you should authorize the actual transaction amount.

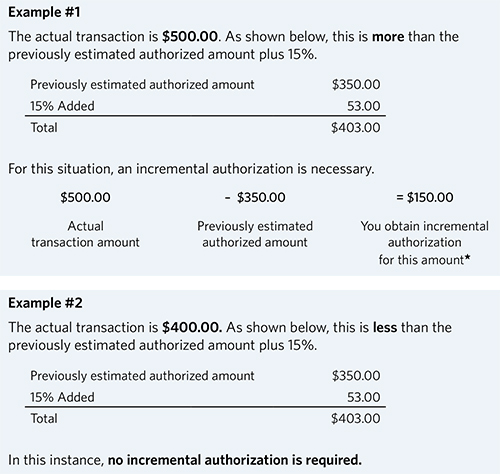

- There was a previously estimated authorization amount. In this case you need to apply the “15-percent rule” to determine whether or not an incremental authorization is required. To do this:

- Add 15 percent to the previously estimated authorization amount.

- Compare the total (the sum of the previously estimated authorization amount plus 15 percent) to the actual, final, transaction amount.

If the actual transaction amount is greater than the sum of the previously estimated authorization amount plus 15 percent, an incremental authorization is required for the difference between the previously estimated authorization amount and the actual transaction amount.

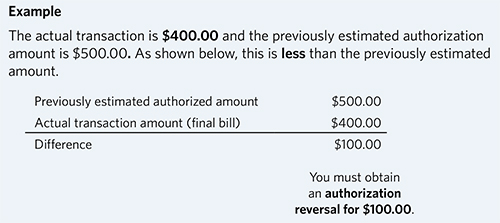

4. How to handle authorization reversals. If the final transaction amount is lower than the initially estimated authorization amount, you are required to process an authorization reversal for the difference between the initially estimated authorization amount and the actual one.

You are also required to process an authorization reversal for the entire initially estimated authorization amount when a transaction is subsequently voided or cancelled.

5. The authorization process at a glance. Here is how you should complete an authorization request:

- Swipe the card, wave the card or insert it into a chip card reader at the POS terminal or obtain a card imprint.

- Request an authorization approval for the estimated charges.

- Take the appropriate action based on the authorization response, as shown below.

Authorization Response Action Approved – Record the authorization code on the sales receipt. – Inform your guest of the authorized amount.

– Ask your customer to sign the hotel agreement.

Declined or Card Not Accepted Return the card to your customer and ask for another form of payment. Call, Call Center or Referrals Call your voice authorization center for instructions. Pick Up Keep the card, but only if you can do so safely.

If you are unable to process the card or the authorization system is down, you can manually key-enter the account number and take an imprint of the card, unless it is an unembossed card. If this is the case, ask for another form of payment.

For U.S. domestic transactions, if the magnetic-stripe cannot be read and a manual imprint of the card cannot be obtained, include the card security code in your authorization request. - Make sure the authorization response code is present (printed or written) on your sales receipt, in case a copy is requested by your acquirer.

Before completing the transaction, always check the card’s security features and make sure that the card is valid and has not been tampered with. You should also compare the signature on the sales receipt to the one on the back of the card to make sure they match.

How to Manage Delayed and Amended Charges

If you need to apply any additional charges after your guest has checked out (for example, room service, telephone or mini-bar use), you can amend your customer’s bill, provided your customer has agreed to be held responsible for such charges when she signed the service contract. So make sure that, at the time of check-in, your guest signs an agreement to pay for any delayed or amended charges as defined by your terms and conditions.

Below are the steps you should take when billing for delayed or amended charges. This process assumes that the new amount is greater than your hotel’s floor limit. However, even if it is lower than your floor limit, it is strongly recommended that you obtain an authorization approval anyway.

- After your guest has checked out, deposit a separate sales receipt for the delayed charges and write the words “signature on file” on the signature line.

- Obtain an authorization approval, if applicable (again, it is highly recommended that you do so):

- Enter the card details.

- If the card is declined, contact your customer and request another form of payment.

- Keep the transaction receipt and attach a copy to your guest’s record.

- Mail or e-mail the information about the additional charge to the cardholder. This should include:

- The sales receipt with the words “signature on file” on the signature line.

- A copy of the sales draft with a detailed explanation of the additional charges.

If you don’t send the sales receipt for the amended charges to your customer, you should brace yourself for a dispute and a chargeback. Finally, you cannot submit a separate or amended sales receipt for loss, theft or damage to the room — such events should be reported to the appropriate authorities.

Image credit: Wikimedia Commons.