How China UnionPay Is Beating out Visa and MasterCard at Home and Abroad

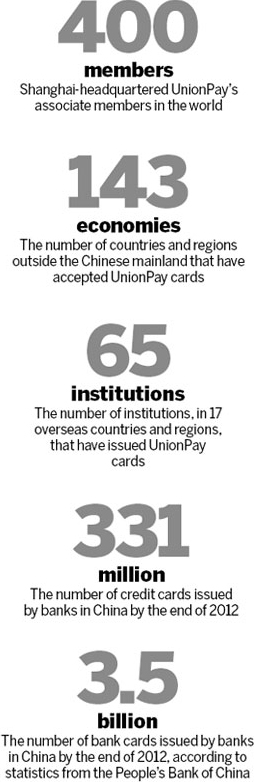

Just ten years after it was founded, China UnionPay — the Chinese national bank card association — now has more payment cards in circulation than any of its long-established Western rivals, has overtaken MasterCard to become the second-biggest card processor by volume and will soon surpass Visa to take over the number one spot in this category. Perhaps even more impressive is the speed with which the Chinese national payments champion is becoming a truly global brand, with presence in 143 countries and regions around the world.

Well, this morning we get updates on each of these trends. China Daily is reminding us that “China has experienced a boom in the use of bank cards over the past two years, especially credit cards” and is giving us the latest official numbers on UnionPay’s blistering growth in the processor’s home country. The Financial Times, for its part, is reporting that UnionPay is beating out rivals Visa and MasterCard in Burma (Myanmar) — a pristine credit card market, which has just opened up to the global payment brands. While reading these two reports I couldn’t help but feel as if I were watching UnionPay’s rise to world dominance in fast-forward mode. It’s rarely that we get to see anything like that occur in real life and it’s truly fascinating.

China UnionPay by the Numbers

Citing official statistics from the People’s Bank of China, China Daily tells us that in 2012 alone, Chinese banks had issued a total of 331 million credit cards, exceeding the number of newly-issued debit cards — perhaps the first time that has occurred, although we don’t know it for certain. That figure represents a 16 percent increase from 2011’s total, we are told, and as a result, one in four Chinese consumers now have credit cards, a 19 percent growth from the previous year.

Citing official statistics from the People’s Bank of China, China Daily tells us that in 2012 alone, Chinese banks had issued a total of 331 million credit cards, exceeding the number of newly-issued debit cards — perhaps the first time that has occurred, although we don’t know it for certain. That figure represents a 16 percent increase from 2011’s total, we are told, and as a result, one in four Chinese consumers now have credit cards, a 19 percent growth from the previous year.

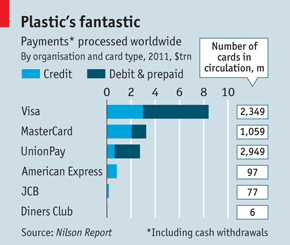

The total number of bank cards issued by Chinese banks at the end of 2012 was 3.5 billion, up from 2.95 billion at the end of 2011, an increase of 18.6 percent. About 44.4 percent of the Chinese residents with bank accounts own one or more bank cards, we learn. Even more impressively, on an annual basis, the number of card transactions rose by 46 percent in 2012 and withdrawals from automatic telling machines increased by 26 percent, China Daily tells us, citing statistics from China UnionPay, which is the only organization allowed to process yuan-denominated card transactions in China. The chart above was produced by The Economist, using data from the Nilson Report — a payment industry newsletter — to illustrate the global balance of power in 2011. Given its growth rate, UnionPay may already have more bank cards in circulation than Visa and MasterCard combined and it looks as if it may overtake Visa in the processing volume category within as few as 3 – 4 years.

In 2012, the average volume of bank card transactions in China was 5,894 yuan ($948.3) per person, up 6.6 percent from the previous year’s level, we learn. The average transaction value was 2,312 yuan ($372), down 2.6 percent.

In 2012, the average volume of bank card transactions in China was 5,894 yuan ($948.3) per person, up 6.6 percent from the previous year’s level, we learn. The average transaction value was 2,312 yuan ($372), down 2.6 percent.

I suspect that it should come as no surprise to many of you to learn that a big reason why Chinese cardholders like credit cards seems to be the same as the reason Americans like them — convenience. China Daily shares with us the observation of one Chinese restaurateur:

The trend is that an increasing number of consumers prefer swiping cards to dealing in cash… Some customers do not carry much cash and are happy to pay without hesitation by swiping their card even if they are just buying a cup of tea for 10 yuan [$1.61].

Sound familiar? Some time ago I mused over the possibility of the Chinese using their credit cards as the Americans do, but I didn’t suspect how quickly that would start turning into reality.

The Battle for Burma

It is incredible how quickly Burma has transformed itself from an international pariah into a country widely praised for its democratic reforms and one which, as The FT’s Jake Maxwell Watts informs us, is “southeast Asia’s latest golden investment opportunity”. Naturally, as ever more foreigners are visiting the country — more than one million in 2012 alone, according to Maxwell Watts — the need for local merchants to accept credit cards has quickly become apparent.

MasterCard was the first of the big Western card companies to process an ATM transaction in November of last year, Maxwell Watts tells us, and has since then “dispensed over $1.7m to foreigners”. Then on the 4th of March of this year, MasterCard processed its first card payment in the country and plans to enable card payments at more 500 restaurants, hotels and stores by the end of the year. However, it turns out that UnionPay, which only entered Burma in February of this year, has nevertheless managed to take the lead and “already allows its cardholders to access 198 ATMs and 465 point-of-sale terminals.” There is not even a mention of American Express in the article.

The Takeaway

So, the numbers clearly indicate that UnionPay has become a major global player and the unmistakable message from The FT’s piece is that the Chinese card company is acting as such. And that is good news — increased competition will ensure that merchants and cardholders get the best deal available. I can only hope that the same kind of deal is also offered to Chinese residents. Some of you will remember that in July of last year the World Trade Organization (WTO) ruled that China was discriminating against foreign providers of credit and debit card payments. However, whereas since then it has become easier for foreign banks to issue cards in China, UnionPay still has a monopoly over the processing of yuan-denominated transactions. This protected status in the processor’s home market may eventually be lifted, but not before UnionPay has been allowed to build an insurmountable lead.

Image credit: Jiakhong.com.