Tanzanians Had Enough of Banks Not Doing Their Job. What They Did Will Blow Your Mind.

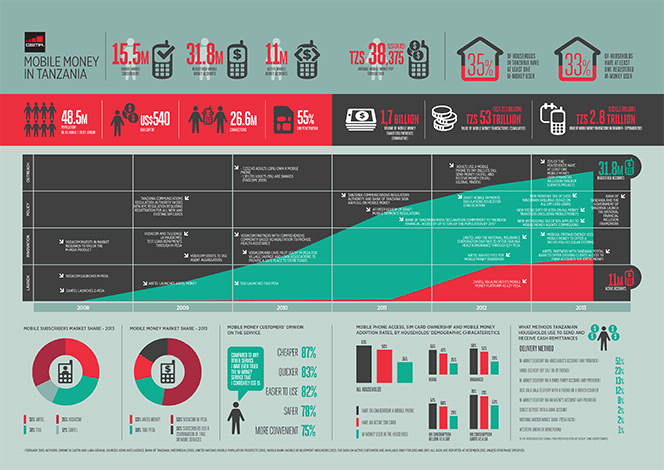

Tanzania has undergone a Kenya-like mobile money transformation, a new report from the GMS Association — an association of mobile operators and related companies — tells us. The largest East African country (and one of the poorest countries in the world), Tanzania has experienced an unprecedented uptake of mobile financial services in the span of five years, we learn. Whereas in 2008 practically no one had access to mobile financial services (MFS), by September 2013 90 percent of the country’s adult population did — an exponential increase, as the authors note. Moreover, about half of them are actively using such services.

And by the way, although this isn’t noted in the GSMA study, it should be said that Tanzania had started from a much lower base than its northern neighbor Kenya. Another paper, published over a year ago, told us that prior to the launch by Vodacom of M-Pesa — the first mobile money service in Tanzania — in 2008, 54 percent of adult Tanzanians hadn’t used any form of financial service, whereas the corresponding ratio for Kenya was only 38 percent. Furthermore, Kenya had a better developed financial system, with 1.38 bank branches per 100,000 inhabitants, more than twice as high as Tanzania ratio of 0.57.

But that lack of access to traditional financial services must have been precisely what had made it possible for M-Pesa to be so successful in these countries. That, and the cooperation of the relevant authorities: Kenya’s and Tanzania’s central banks have actively promoted the adoption of alternative financial services in their countries. In fact, Bank of Tanzania (BOT) has just launched a new program, which aims to expand financial access to more than half the country’s population by 2016 (up from 17 percent in 2012), with mobile financial services at its core. So let’s take a look at the researchers’ findings.

The Growth of Mobile Money in Tanzania

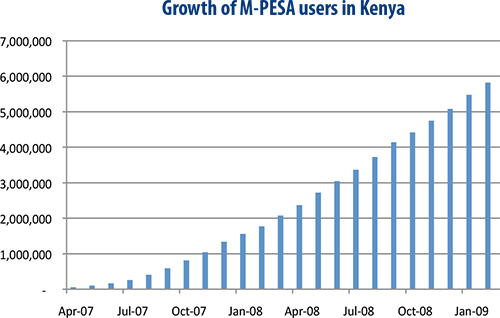

When Vodacom Tanzania launched M-Pesa in April 2008, one year after the extremely successful launch of the service in Kenya, the report tells us, people expected the service to take off in the same way and at the same speed. And, by the way, here is the early growth spurt in M-Pesa’s user base in Kenya (source):

But that didn’t happen in Tanzania. In its first 14 months, Vodacom registered 280,000 users who were transferring $5.5 million per month at about 930 agent locations, we learn, compared to the 2.7 million users and 3,000 agents registered in Kenya 14 months after launch. To improve customer uptake, Vodacom made some significant operational changes: “a flat fee for M-Pesa transfers, a simpler marketing approach, utility bill pay and the use of agent aggregators to grow its agent network”. And it has worked: since then, M-Pesa has taken off in Tanzania, three other mobile network operators (MNOs) have launched similar platforms and access to mobile financial services has increased significantly in the country.

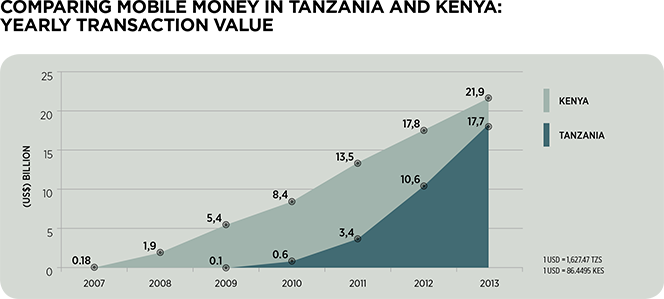

At the end of September 2013, there were more than 30 million registered mobile money users in Tanzania and close to 10 million active users (on a 90-day basis). At that time, about 715 million transactions valued close to TZS 20 trillion ($12.3 billion) had been conducted since mobile money was launched. Here is a comparison with Kenya:

Vodacom has had the highest number of clients, with just over half (53 percent) of households reporting that they use M-Pesa exclusively, followed by Tigo Pesa with 18 percent and Airtel Money with 13 percent of households. All Ezy Pesa subscribers also use M-Pesa (see infographic below).

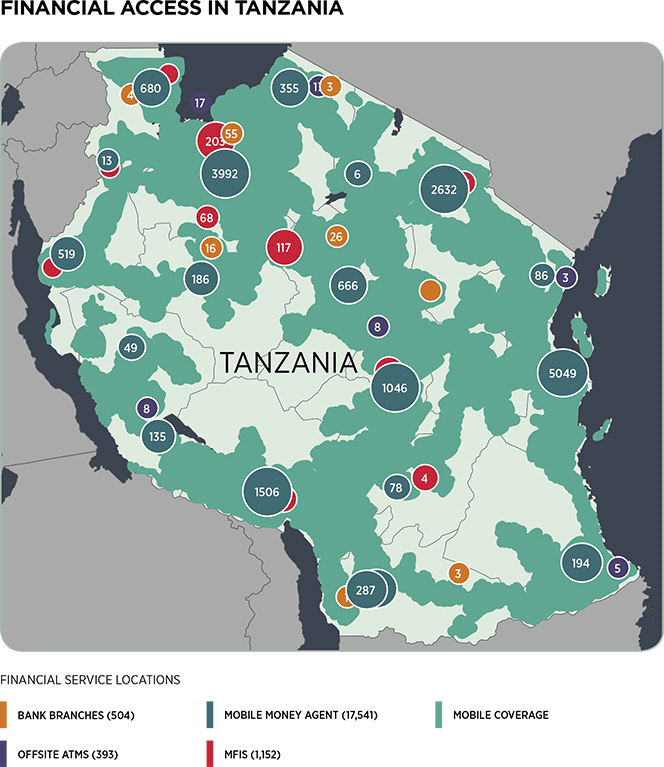

The agent network has also expanded. Mobile money agents, we learn, outnumber all other financial outlets by almost 10 to one. There are about 17,000 M-Pesa agents, which represent 87 percent of the access points Tanzanians use for financial services. M-Pesa agents also have greater reach than traditional financial outlets: they cover an area where 40 percent of the population resides. In stark contrast, ATMs, brick-and-mortar bank branches and microfinance institutions (MFIs together reach only 25 percent of the population.

Tanzania’s M-Money Business Model

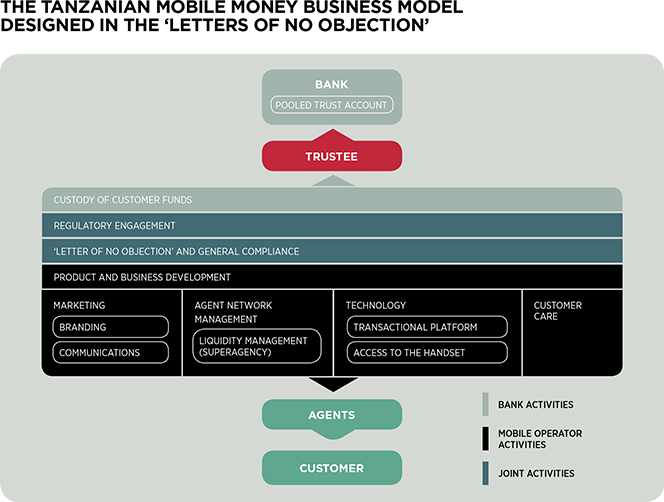

In Tanzania, we are told, the regulator (BOT) made a decision “to let regulation follow innovation and support financial inclusion while managing risks”, which “has enabled the country’s mobile money market to flourish”. In this context, the BOT has advised MNOs to partner with commercial banks to offer mobile money services, in response to which the BOT would issue “letters of no objection” to the partner bank, which specified the regulatory requirements for the provision of mobile money services.

The partner commercial bank would then maintain a trust account, through which the MNO would facilitate its customers’ mobile money financial transactions. MNOs were only allowed to have one bank partner and the entire value of its customers’ “float” (industry jargon for the virtual credit exchanged between users) would be kept in its trust account, so the value would be backed by 100 percent liquidity. To use the trust structure, the MNO would register a holding company with independent directors to act as a trustee. Here is a visual representation of the model:

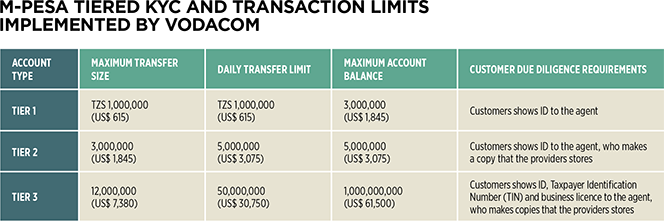

On the ground, the agents are responsible for facilitating cash withdrawals and deposits, registering users and the due diligence of new customers. They are also the first line of defense against fraud and money laundering. Customer identity in Tanzania is verified using various kinds of ID (voter registration cards, pension cards, passports and employee cards). Based on the ability to store a customer’s ID on file, customers get different levels of access to the service. Here is how Vodacom’s tiered structure looks like:

Finally, here is the excellent infographic, which GSMA has produced to present its findings (I know, you can’t see anything, so click on the image for a larger view):

Image credit: GSMA.com.