Does Going to College Make You Richer?

That is the question tackled by Renee Haltom in the latest edition of the Federal Reserve Bank of Richmond’s Econ Focus. On the face of it, it seems to be a no-brainer: the median person with a bachelor’s degree earns about $48,000 a year, 78 percent more than the $27,000 for someone with a high school degree. And the difference is even more striking when one looks at the unemployment statistics: 3.4 percent of people with a bachelor’s degree or more were unemployed in November 2013, compared to 7.3 percent for people with only a high school diploma.

Yet, as the author reminds us, not everyone earns the median. Moreover, the gap between the earnings of college graduates at the top decile of the income distribution and the median has widened substantially over the past three and a half decades. Whereas in the late 1970s the top 10 percent of graduates (on the earnings scale) made around $963,000 more in their lifetimes than the median, they now make $2.3 million more, adjusted for inflation.

And all the while college education has been getting dearer: the cost of college has been growing more than twice as fast as inflation in the last 30 years. So where does that leave us? Well, Haltom’s solution is that students make “smart investments”, as one of the most important decisions is how much to pay for college, especially if education will have to be financed with student loans. But I think she glides a bit too casually over what seems to me to be at the core of her “smart investment” concept: selecting the type of field, which would promise you a job with a high enough salary to enable you to easily repay your debt. After all, all things equal, paying off a $150,000 debt would be a much easier task with a starting salary of, say, $100,000 than paying off a $50,000 debt with a starting salary of $37,000 (which is what one college graduate with an interdisciplinary degree in religious and women’s studies, cited in the article, could hope for).

And no, I am not suggesting that everyone’s objective in going to college should be to become an investment banker — that’s never going to happen, anyway. However, if we were telling kids that they should take financial considerations into account when deciding what to study, rather than just blithely telling them that they should pursue whatever makes them happy, perhaps more of them would adjust the scale of their personal preferences to balance them with the financial prospects of each field under consideration. Oh, and as a side effect, graduates with degrees in religious and women’s studies would become scarcer and better paid. But here is Haltom’s full article, so you can draw your own conclusions.

Has College Become a Riskier Investment?

By Renee Haltom. The article was originally published in the Federal Reserve Bank of Richmond’s Econ Focus for the third quarter of 2013.

The payoff has become more uncertain — but you’re probably still better off going.

Countless studies over 50 years nearly all say the same thing: Going to college will probably make you richer. You don’t even need a fancy study to see it. It’s visible in the basic data: The median person with a bachelor’s degree earns about $48,000 per year, compared with $27,000 for a high school graduate, according to the U.S. Census Bureau. College grads also have lower unemployment — as of November, 3.4 percent for people with a bachelor’s degree or more, and 7.3 percent for people with only a high school diploma.

But not everyone earns the median. Some college graduates become CEOs, while others can’t even find jobs in their field of major.

Unequal outcomes from college have always been a fact of life, but there is evidence that the dispersion of outcomes has increased. Economists have known this to be true at the top of the ladder for some time. In the late 1970s, the most fortunate 10 percent of graduates made around $963,000 more in their lifetimes than the median, but they now make $2.3 million more, adjusted for inflation, according to a recent study by Christopher Avery at the Harvard University Kennedy School of Government and Sarah Turner at the University of Virginia. And according to new evidence, there is now more variance on the downside too

For example, in 1970, just 1 percent of taxi drivers and roughly 3 percent of bank tellers had a college degree. The number rose to about 15 percent in 2010, even though the key skills in those professions did not change much over time, according to a study by Richard Vedder, Chistopher Denhart, and Jonathan Robe at the Center for College Affordability and Productivity, a Washington, D.C.-based nonprofit. A survey by consulting firm McKinsey & Company suggests that as many as 120,000 of the nation’s 1.7 million 2012 college graduates who wanted to work elsewhere took jobs as waiters, salespeople, cashiers, and the like.

There’s also the fact that graduates are having an increasingly hard time repaying their student loans. Delinquency rates on student loans have jumped in the last year, and are now higher than those for mortgages, auto loans, and credit cards. Student loans are hard to discharge even in bankruptcy, suggesting that many of these people are truly unable, not just unwilling, to pay them.

Some of the increased downside risk can be chalked up to the Great Recession, but other new research suggests it may be a longer-term trend. And it is becoming scarier to take the college gamble: The cost of college has grown more than twice as fast as inflation in the last 30 years. An investment adviser would say that risk, not just return, should determine your investments. If the cost of college is rising and the payoffs are more uncertain, should fewer people be going?

Betting on Brains

The labor market has always paid a premium for college graduates, and that premium has grown sharply over the past 30 years or so. Economists say that is mostly due to “skill-biased technical change” — technology has been reshaping the distribution of skills needed by employers. For example, employers have demanded a larger number of highly educated workers to match their increasingly sophisticated technologies, as well as shrewd thinkers to function in increasingly complex and connected global markets. A college degree can serve as both proof of learned skills and a signal of innate analytical ability. Skill-biased change aids most those already at the high end of the distribution of ability and preparedness, which is why it is widely viewed as one of the leading explanations for growing income inequality.

The gains add up over a lifetime: The median college graduate makes almost $2.3 million over their lifetime, compared with $1.3 million for someone with only a high school diploma, according to a study by Anthony Carnevale, Stephen Rose, and Ban Cheah at the Georgetown University Center on Education and the Workforce.

But recent research indicates that skill-biased technical change may have hit a plateau. In a working paper this year, Paul Beaudry and David Green of the University of British Columbia and Benjamin Sand of York University found that the demand for skilled workers has actually been falling since the tech bust in 2000. But you can’t see this by comparing the earnings of college graduates with non-graduates. Their study follows a branch of research that says it is the tasks you perform, not the education you have, that determine your income: whether you are performing cognitive, routine, or manual work.

The reason that distinction matters is that it shows that skill-biased technical change hasn’t necessarily left low-skilled workers in the dust. Work by Daron Acemoglu and David Autor, both at the Massachusetts Institute of Technology, among others, has shown that technology has increased opportunities for people at the top and bottom of the skill distribution — that is, people performing both highly cognitive work and manual or service-based tasks. Who’s been hurt are people in the middle — those performing routine tasks like clerical, office support, and some sales work — whose jobs have been automated or outsourced out of existence.

What Beaudry and his co-authors found is that the demand for cognitive skills — the managerial, professional, and technical jobs typically held by college graduates — reversed around 2000. They can’t say for certain that it’s because skill-biased technical change has run its course for now, but “the timing on all fronts just fits so closely with the 2000 tech bust that we think that’s the most credible way of reading it,” Beaudry says. They looked at young workers, for whom emerging labor market trends are often most visible. In the 2000s, high-skilled workers have increasingly taken manual jobs — they’ve gone into household services, physical labor, and other jobs typically held by people without a college degree — bumping many low-skilled workers out of the market entirely. For a while this phenomenon was unfelt because of the housing boom, Beaudry says, but real wages for high-skilled workers have actually been falling for a decade or more.

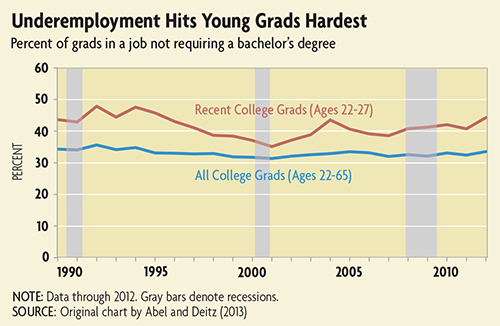

Their story meshes with a recent study from Jaison Abel and Richard Deitz at the New York Fed. They found that young college graduates are taking low-skilled jobs now more than any time in recent history. The proportion who are “underemployed” dropped dramatically over the course of the 1990s as the tech boom readily absorbed new high-skilled workers (see chart). But during each of the jobless recoveries in the 2000s, underemployment of recent college grads rose sharply, Deitz says. It is now as high as it was in 1995, before the tech boom really amplified the effects of skill-biased technical change.

All About the Benjamins

Before 18-year-olds start burning their acceptance letters, however, they should know that the college premium is still very much intact.

How is that possible? The true value of an investment takes into account the opportunity cost — what you could make under the best alternative. Beaudry says graduates taking low-skilled jobs are flooding that market, pushing down wages for jobs typically held by people with only a high school education. So even though real wages for cognitive tasks have fallen by 2 percent since the 2000s due to declining demand, they have fallen by 8 percent for manual tasks due to an abundance of labor.

College graduates even tend to earn more if they take the same job as someone with only a high school education. The average college-educated food service manager earns $1.5 million over his lifetime, but just $1 million with only a high school diploma, according to the Georgetown study that calculated lifetime earnings. The average college-educated cashier makes $300,000 more over his lifetime than with just a high school diploma.

In short, the income you can expect to earn out of college may be falling, but it’s an even better investment nowadays compared with stopping at high school. The college premium is actually rising, Beaudry says, “just not for a nice reason.”

In fact, only 14 percent of people with a high school diploma earn more than the median worker with a college degree, the Georgetown researchers found. That the percentage is even that high is due largely to the occupations they choose. A high school-educated firefighter makes more than a college-educated museum curator on average, but that is because of factors like physical ability and risk.

What appears to be happening is that the gains from college that Gen Xers experienced are taking longer for millennials to achieve. Between 2009 and 2011, a startling 56 percent of 22-year-old college graduates took jobs that didn’t require a bachelor’s degree. The proportion falls rapidly from there, however. For 30-year-old college graduates, underemployment in that time frame was at the historical norm for all college grads. That number is about one-third — and has been remarkably steady over the last two decades, across booms and recessions alike (see chart). In Beaudry’s estimates, too, the wages for older college graduates have kept up pretty well, he says.

Beaudry’s advice to students? Be patient. “The process after college might be very long and hard, and you might take some jobs that don’t seem very attractive, but eventually you might get into the areas where you want to be working,” he says. “It’s about having your expectations aligned so that afterward you’re not completely disappointed and saying, ‘Wow, I was told this would pay off quickly.'”

College Dropouts

There is one group for whom college may not be worth the investment: people who aren’t likely to finish.

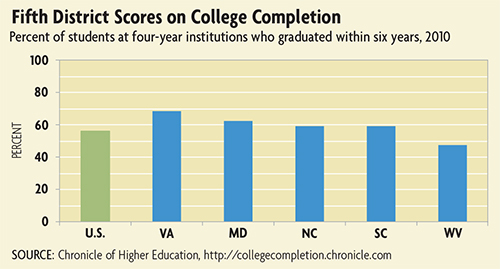

That is actually a sizeable group. Though college enrollments have been climbing steadily for decades — rising from one-third of 18- to 24-year-old high school graduates in 1980 to one-half in 2010 — completion rates have been stagnant for about 50 years. Only half of Americans who enroll in college get a degree, compared with more than 70 percent in many other developed countries. (The Fifth District performs well relative to the rest of the country. See chart. The University of Virginia has the highest completion rate among flagship universities at 92.7 percent of students graduating within six years.)

If you don’t graduate, the labor market basically treats you as if you hadn’t attended college at all, a phenomenon known as the “sheepskin” effect. You’ll earn a bit more for each additional year of college, but the large bump only comes with a diploma. According to U.S. Census figures, the average college graduate earns $26,922 more per year than the average high school graduate, but the average college dropout earns only $3,092 more.

Indeed, it’s possible for the dropout to end up financially worse off than the student who never attended. Of everyone who enters college expecting to get a bachelor’s degree, more than half leave with no degree and an average of $7,413 in debt, according to the study by Avery and Turner. Among only students who borrowed, the average debt burden for dropouts is $14,457.

Although the labor market doesn’t heavily reward fractions of a college experience, those years still might not be a waste. Most students don’t enter college knowing everything about their aptitude, tastes, and labor market prospects. Time in college provides that, even if it doesn’t result in a degree. The financial worth of the option to drop out at will, which can save one from the investment toward a career path they wouldn’t be better off taking, is called the “option value” of college.

The option value is especially important for students who are on the fence between low and high abilities, whose returns from college are the most uncertain. Kevin Stange at the University of Michigan Ford School of Public Policy recently estimated that the option value is worth 14 percent of the total expected return to college enrollment and is greatest — up to 35 percent — for marginal students. Without the option to drop out, some people who today have degrees despite entering college unprepared may never have enrolled in the first place, forgoing the primary engine of economic mobility.

It’s somewhat puzzling that the proportion of dropouts has remained steady over time despite the rising college premium. One reason, according to many critics of our educational system, is that too many students arrive unprepared. Another is that students have increasingly complicated lives, says Cecelia Rouse, dean of the Woodrow Wilson School of Public and International Affairs at Princeton University, and an economist who has studied the returns to education. “If you’re 18 and dependent on your parents, that really frees your mind and time to focus on your studies. But if you’re 25 with two children and an ex-husband, there are physical limits to the time you can spend on school.”

Rouse argues that our student population has gotten older and more nontraditional. The fraction of full-time students at four-year schools who work rose steadily from 1970 to 2000, according to Judith Scott-Clayton at the Teachers College at Columbia University. The average working student put in 22 hours per week before the Great Recession, when the number fell to eight hours per week.

The dropout phenomenon also matters to people not personally at risk. A student who graduated at the top of his high school class can’t assume he’ll do as well in college; for one thing, the least-qualified students may drop out or not matriculate at all. An average performer could easily end up closer to the bottom in college, Avery and Turner noted, which means he may need to expect less than the average salary — or be willing to work harder than he did in high school to compete.

Making Smart Investments

On balance, students still seem to think that college is the right choice, because they keep pouring in and taking on debt. Student loans are the only type of consumer debt that continued to grow during the recent recession, and they now stand at roughly $1 trillion — second only to mortgages.

Even though college is still a good risk, the payout has become less certain and, if Beaudry is right, smaller. In light of rising college costs, that means the investment has to be approached more carefully than in the past. One of the most important decisions is how much to pay for college, especially if debt is going to be a factor. Not only does financing increase the total cost of education, but monthly payments hit in the years of lowest earnings.

The New York Times recently profiled a 26-year-old woman who graduated from New York University with an interdisciplinary degree in religious and women’s studies. She was earning $22 per hour as a photographer’s assistant, but had $97,000 in student loan debt. She acknowledged that, in retrospect, she could have made different choices or she could have pursued that field at a less expensive school. Humanities majors are the lowest earners, with starting salaries of just $37,000 in 2012, barely above the wages of the average high school graduate. The McKinsey study found that more than half of recent college graduates would choose a different major or school if they could do it all over again. In that study, as well as others, graduates were more likely to be working in their field of choice if they studied health, education, or STEM fields — and less likely if they studied liberal arts, humanities, or communications.

Fortunately, debt burdens like the NYU student’s are rare. Only 10 percent of bachelor’s degree recipients leave college with more than $40,000 in debt, according to the College Board. Graduates of for-profit colleges have the highest debt burdens of any sector, and still only one-quarter of them have debt above $50,000, Avery and Turner calculated. Among all graduates who took out student loans, the median debt burden was $20,000 as of the 2007-2008 school year.

Part of the reason debt burdens don’t seem as high as the headlines suggest they should be is that the average price that students actually face is much lower. The average instate tuition at a public four-year school was $8,660 in the 2012-2013 school year. But thanks to student aid, which almost 80 percent of full-time undergrads receive, and tax benefits, the average student paid just $2,910, according to the College Board. For private nonprofit colleges, the published cost was $29,060, but the average net tuition cost faced by students was $13,380.

What really matters for choosing how much debt to incur is your ability to pay it back. Personal finance experts suggest that a manageable threshold for student debt payments is about 10 percent of income. Avery and Turner calculated what that would mean for the median student, who, as of 2008, graduated with about $20,000 in student debt. That equates to a $212 monthly payment over a 10-year period, so they would need to earn just over $25,000 to keep payments under the 10 percent threshold. The median earnings of a bachelor’s holder is nearly twice that.

Economists are used to sorting through the data on payoffs and debt, but can students? They might understand that college graduates tend to have better labor market prospects, Avery says. “It’s intuitive that they would understand that because they’ve had summer jobs.” But he says they’re less able to understand the right debt burden to undertake. “Long-term financial planning isn’t something that 18-year-olds are going to be good at,” he says. “They’ve never confronted the repayment of a loan, and even if they had, the behavioral impulse is to borrow, to downweigh the future and overweigh present consumption.”

At the same time, he says, some students even underinvest. Half of students who work more than 20 hours per week don’t have federal Stafford loans. These students not only potentially forgo the federal interest subsidy but also place themselves at greater risk of dropping out. “If I wanted to point to an area where students are not doing what they should be doing, that’s where I would start,” he says.

The complexity of the loan process is one common deterrent. Turner and Caroline Hoxby at Stanford University found that a program helping low-income students with information about financial aid and applying to college not only increased their application rates, but also their matriculation and academic success in higher-ranked programs — at a cost of just $6 per student.

That such small interventions can make the difference between going to college or not suggests students don’t always follow the straight-forward investment model when deciding whether and how to pursue higher education, wrote Philip Oreopoulos and Uros Petronijevic at the University of Toronto in a recent survey piece on the returns to college. “There is more than just a financial cost-benefit analysis to look at,” Deitz says. “There are preferences, what people want to do.”

On that subject, students know something economists don’t.

Image credit: Flickr / joebeone (changes have been made to the original image).