Dick Durbin, PayPal and Home Depot’s Payment Acceptance Cost

Home Depot has reduced the prices of about 3,000 items in its stores since the limit on debit interchange fees was put into effect in October of last year, American Banker’s Maria Aspan is telling us. The home improvement chain is careful not to directly correlate the two events, but it makes it clear that Sen. Durbin’s legislation did play a major part in the price-reduction project. Needless to say, Home Depot executives are very happy with the huge reduction in their company’s debit acceptance cost (thrilled is their preferred adjective), but are also keeping themselves busy looking for ways to further reduce payment processing fees.

Luckily for Home Depot, there actually is a payment company big enough to be able to handle the huge retailer’s volume and more than willing to process its credit card transactions below cost. Yes, you read that correctly, Home Depot has found a payment processor which is now subsidizing its credit card acceptance cost and its name is PayPal. And yes, the home improvement chain’s executives are thrilled about that, too. But let’s take a closer look at these two related developments.

Durbin Amendment Leads Home Depot to Lower Prices

Here is what Dwaine Kimmet, Home Depot’s treasurer and vice president of credit, has to say about the effect of the Durbin Amendment on its company’s pricing strategy, as quoted by Aspan:

The money saved [by] Durbin goes into the pool of savings, lowers our overall operating costs and allows us to reinvest in the business to lower prices. We have absolutely lowered prices … [but] what I can’t do is draw that direct correlation to Durbin.

Just to refresh your memory, the Durbin Amendment to the Dodd-Frank financial overhaul legislation reduced the merchants’ cost of accepting debit card payments by 45 percent, from an average of $0.44 per transaction before the reform took effect to an average of $0.24 per payment post-Durbin. However, now that they have won the debit fee war, the merchants are training their guns on a much more tempting target: the credit card fees, which managed to escape Sen. Durbin’s ax completely unharmed. Here is how a cautious Kimmet puts it:

I don’t want to at all take away from Durbin – we’re very thrilled about it. But bank card fees have increased when my cost of accepting cash and checks have decreased. … Speaking primarily on the credit side, bank card fees are going up.

If I were conducting the interview, I would’ve asked Kimmet to elaborate on the rising credit card fee issue, as I’m not aware of increasing credit card interchange rates, but anyway. The point is that credit card fees are now the issue for the retailer and here is where PayPal comes into play.

How PayPal Is Subsidizing Home Depot’s Credit Card Acceptance Cost

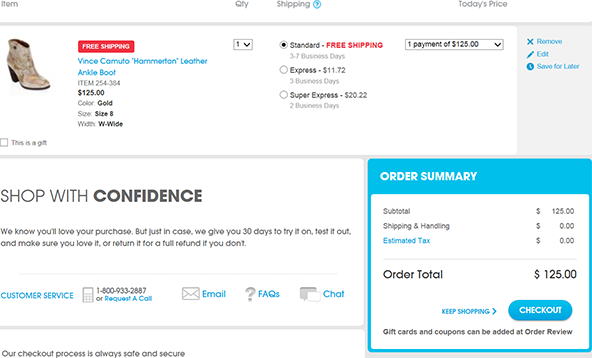

As many of you already know, earlier this year Home Depot added PayPal as a payment option at the checkouts of its stores. And I don’t think the payment processor had much difficulty in convincing the retailer to do so. In exchange for gaining entrance to thousands of high-volume stores across the country, PayPal had offered to absorb a portion of Home Depot’s credit card acceptance cost. One suspects that the retailer’s executives in charge of the negotiation have been thrilled with the proposal. How can PayPal do that? Well, we have already explained it before, but here is the gist:

About 55 percent of PayPal’s transactions are funded from its users’ debit or credit card accounts (and are subject to interchange fees, which are the fees collected by the issuers for each transaction involving one of their cards), while the rest are funded from the users’ bank accounts. What PayPal is indicating is that it is offering merchants to be processing bank card payments at a cost that is lower than interchange. And if the merchant is paying less than the full interchange amount, the processor would have to make up the balance. So PayPal is willing to not only forgo any profit on the card-funded transactions it will be facilitating, but to lose money on them. All of them!

Of course PayPal is not being charitable. On aggregate, it would still be in the black, because its margins on the transactions funded directly from its users’ bank accounts are huge and in any case enough to more than offset the losses from the bank card transactions.

Now the question is whether Home Depot customers will in fact be using the PayPal option at the checkout. We shall see.

The Takeaway

It is impossible to know how big of a role the reduction of the debit interchange fees has played into the lowering of the price of the 3,000 items to which Kimmet is referring, but, if confirmed, it would be the first such occurrence that I know of. However, more interesting to me is to see whether PayPal’s strategy of subsidizing retailers’ credit card transaction cost will prove successful. If it does, I just don’t see what PayPal’s competitors can do to counter it. Even in the unlikely event that Visa and MasterCard decided to respond by lowering the credit card interchange rates, PayPal could simply apply the reduction to its merchants’ processing rates and keep its advantage. Oh, and Home Depot executives would be thrilled!

Image credit: Allthingsd.com.

I have not noticed any price cuts in Home Depot. They should be more specific on that. What I see is that paints for example cost double what they did last year. So if the debit fees were so high, a price fall now should have been more noticeable.

PayPal seems to be in a very good position in its fight against the other processors. No one else can afford to process payments below cost.

If Home Depot has cut prices, which needs to be confirmed by an independent observer, the higher bank fees we are now paying more than offset any possible benefits we may have received from the Durbin Amendment.

Has anyone confirmed Home Depot’s claim? I shop there weekly and the prices of the stuff I buy has definitely not been lowered.

The way I see it, the Durbin Amendment is an example of regulation that produces results that actually benefit consumers. So they should cut the credit card rates too.

How exactly has the Durbin Amendment benefited the consumer? I don’t know if Home Depot has really reduced prices, but where I shop prices have been going up not down. At the same time, my bank now charges me a monthly fee for my checking account due to the lower debit fees. Where is my benefit?

Sarah, I agree regulation is the only way to fight back against the banks and we should be doing much more of it. And they should have started with the credit card fees, because they are so much higher than the debit cards. It is so much more difficult to do this now.

Whether or not Home Depot has lowered some of their prices, they have kept most of their debit fee savings for themselves. From my perspective it makes no difference whether the money is collected by the merchant or by the bank.

I would much rather give my money to Home Depot or Walmart than Bank of America or Chase. I get much more value from shopping with these retailers than from banking with these banks.

Couldn’t agree more. Even Wal-mart is better than the banksters although there is plenty to be desired there too.

Good, now Home Depot only needs to improve their customer service.