Credit vs. Debit and China vs. the U.S.

In 2012, credit cards have gained market share on debit cards in the U.S. for the first time in more than 20 years, the Nilson Report, a payments industry newsletter, tells us in its latest feature, which offers projections for U.S. payment cards through 2017. It is a very modest shift, but the researchers expect that the trend will accelerate in the coming years.

I guess the most interesting thing that we learn is that credit card use is expanding faster than debit, even though the total amount of outstanding credit card balances in the U.S. has remained virtually flat since 2010, following a huge drop in the first couple of years after Lehman’s collapse in September 2008. So the financial crisis has not made Americans more averse to using their credit cards — consumers are just paying off their balances much faster than they used to do. And we have plenty of data to support that proposition. Let’s take a look at the latest.

Credit Makes Ground on Debit

Credit cards made up 52.82 percent of U.S. card spending in 2012, compared to 47.18 percent for debit cards, the Nilson Report tells us. For comparison, in 2011 credit cards accounted for 52.63 percent and debit cards — 47.37 percent of the total spending. In 2017, 54.72 percent of the total is expected to be generated from credit cards and 45.28 percent — from debit cards. Why are Americans starting to favor credit once again? Here is what David Robertson, Publisher of The Nilson Report, has to say on the matter:

There is a finite amount of money in deposit accounts owned by consumers. Credit cards are different. Because they can borrow money and pay it back over time, they can spend more on credit than they have in their own accounts.

In other words, it’s easier to run out of money in the checking account, to which your debit card is linked, than it is to exhaust your credit card limit.

Another driver behind credit cards’ expanding share of the market is legislation. The Durbin Amendment to the Dodd-Frank Act limited the amount of the debit interchange fees that can be collected by banks with assets of $10 billion or more to a maximum of 21?ó per transaction plus 0.05 percent of the transaction’s amount, plus 1?ó for certified fraud-prevention programs. That represented a decrease of 45 percent from the pre-Durbin debit interchange average of 44?ó per transaction. Unsurprisingly, having seen almost half of their debit interchange revenues evaporate overnight, the biggest U.S. banks made determined efforts to push their debit customers toward switching to credit cards to boost revenue. Such efforts included the discontinuation of debit card rewards programs and adding fees for checking accounts.

The total spending for goods and services on general purpose and private label consumer and commercial credit, debit, and prepaid cards grew from $4.301 trillion in 2011 to $4.633 trillion in 2012, and is projected to reach $7.285 trillion by 2017, we learn.

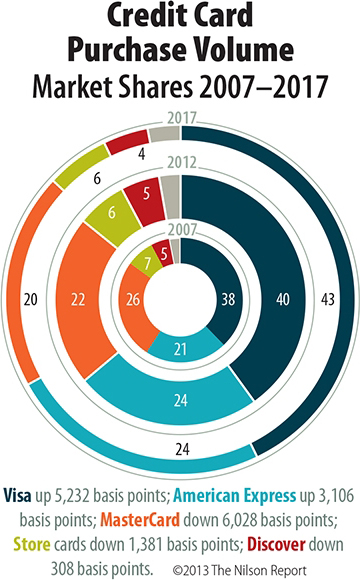

Visa and AmEx Are up, MasterCard and Discover Are Down

Visa’s debit cards had the highest share of the U.S. card market in 2012 — 23.83 percent of the purchase volume for all card types. Visa’s credit cards came in second with 21.18 percent. American Express’ credit cards had 12.70 percent of the market (AmEx issues only credit and prepaid cards, but not debit), MasterCard’s credit cards had 11.53 percent of the total and MasterCard’s debit cards — 9.67 percent. Discover came in last among the four biggest U.S. card brands and the Nilson Report didn’t even deem it necessary to mention the company’s share of the market in its statement.

Visa is expected to expand its lead over the competitors in the coming years. The San Francisco-based company’s credit card purchase volume is projected to have a market share of 23.65 percent in 2017 and its debit cards volume is expected to reach 22.98 percent. American Express’s share is also projected to grow — to 13.36 percent. MasterCard’s credit card share is expected to fall to 10.82 percent, as is its debit card share — to 9.40 percent. Though not mentioned in the statement, Discover’s share of the market is also projected to contract, as seen in the figure below.

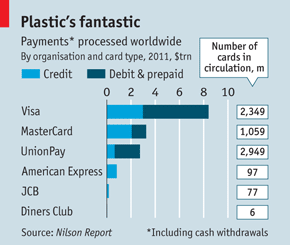

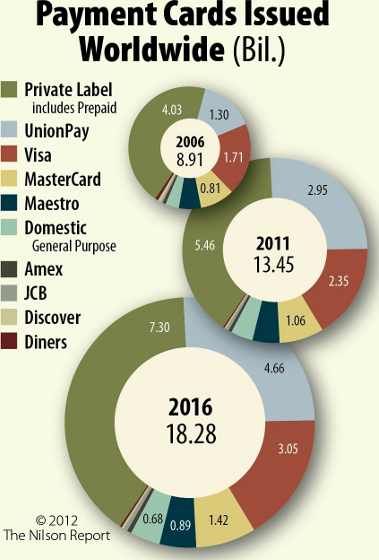

Now, I think that any projection for the future make-up of a payment card market, whether global or domestic, would be incomplete if you left China UnionPay — the Chinese credit card champion — out of it. Founded only in March 2002, by 2011, China UnionPay had already taken the global lead in the number of credit cards issued worldwide and is only set to expand it further in the coming years, as shown in the chart below. Now, by processing volume, Visa and MasterCard were still ahead of UnionPay at the end of 2011, as seen in the chart to the right (courtesy The Economist), but the Chinese company has probably overtaken MasterCard by now and is likely to surpass Visa in as few as 2 – 3 years.

Now, I think that any projection for the future make-up of a payment card market, whether global or domestic, would be incomplete if you left China UnionPay — the Chinese credit card champion — out of it. Founded only in March 2002, by 2011, China UnionPay had already taken the global lead in the number of credit cards issued worldwide and is only set to expand it further in the coming years, as shown in the chart below. Now, by processing volume, Visa and MasterCard were still ahead of UnionPay at the end of 2011, as seen in the chart to the right (courtesy The Economist), but the Chinese company has probably overtaken MasterCard by now and is likely to surpass Visa in as few as 2 – 3 years.

In the U.S., UnionPay has been gradually building its network of processors and merchant acquirers. In 2005, the company signed a deal with Discover Financial Services, which allowed UnionPay cardholders to make purchases at merchants accepting Discover in the U.S., though many retailers are reportedly unaware that they can take the cards. Furthermore, UnionPay’s PIN-based debit card transactions are processed in the U.S. via the Discover-owned Pulse network and are accepted at Pulse ATMs. In return, UnionPay is processing Discover transactions in China.

In 2007, First Data — the world’s biggest payment processor — and UnionPay signed a deal, which gave Chinese visitors access to First Data’s ATM network in Australia — Cashcard — which is the largest one in the country. Additionally, the two companies have agreed to expand their relationship to promote the acceptance of UnionPay cards in markets outside of China and yes, that includes the U.S.

Then in 2011, Elavon, a big acquirer and a subsidiary of U.S. Bancorp, signed an agreement with UnionPay to enable acceptance of UnionPay credit and debit cards at Elavon merchants in the U.S. and Europe (the company has more than 1.2 million merchants in the markets it serves, which also include Brazil).

Also in 2011, UnionPay and the NYCE Payments Network, a PIN-based debit network owned by Fidelity National Information Services (FIS), signed a deal for a reciprocal access to ATMs in both networks.

The Takeaway

So, in the U.S., Visa and American Express are growing faster than their domestic rivals — MasterCard and Discover — and the trend is expected to hold at least through 2017. Globally, however, China UnionPay’s growth is outstripping that of its major competitors by a wide margin. The Chinese champion is already the biggest payments company by some measures and in the next few years that will become true for all others. Furthermore, UnionPay has been making inroads in the U.S. market for some time and that process is set to accelerate. So expect to be seeing much more of UnionPay.

Image credit: Flickr / Richard Bao.

SUBJECT: DEBIT CARD PAYMENT OFFLINE PROCESS

Our client bank in Asia will provide us all information you need TO PROCESS OFFLINE TRANSFER FROM

HIS DEBIT CARD ACCONT TO YOUR BANK IN EURO DOLLRS

For the amount of 160M Euro Dollars (one transfer payment or several transfers whatever you wish)

15% of the total amount processed will be paid to your Bank

and we will Advise you for the rest of the transfer.

Thank you and waiting to hear from you.