Credit Cards and the Chinese Nouveaux Riches

Somehow I had missed this one in the first two days after it was posted, but I’m glad I did eventually come across it. The Financial Times tells me that the Ritz in London has managed to substantially increase its revenues from Chinese tourists last year simply by beginning to accept their credit cards. Well, if the Ritz people had asked me, I would have told them that that was exactly the type of outcome they should have expected and advised them to start doing so years ago.

Upmarket hotels and retailers here in Boston seem to have woken up to the new reality somewhat earlier than their cross-Atlantic counterparts. I think it’s been at least a couple of years since I first began noticing the UnionPay logo prominently displayed at high-end Newbury Street storefronts. And there is a good reason for that: the number of Chinese millionaires is exploding and, just as rich people elsewhere are fond of doing, they like to travel and spend their money. So I thought I should give you some statistics to illustrate the new trend.

Ritz’s Chinese Coup

First, though, let’s see what the FT is reporting on Ritz’s Chinese experience. Here is what the hotel’s general manager tells the newspaper:

We’re the first hotel to introduce China UnionPay credit cards… As a result the Chinese market became big for us over 2011 and we’re looking at a double-digit increase [in Chinese guest numbers] this year.

In 2011, the year in which Ritz began accepting Chinese credit cards, spending by Chinese guests, who until then were paying in cash, grew by 25 percent, the FT reports. The spending increase has come mostly from booking suites, rather than less expensive rooms, we learn. The hotel’s GM draws the obvious conclusion:

[The Chinese] don’t mind spending. When they come over they want to spend the money they’ve saved.

It’s a fascinating article, so go read the whole thing.

Chinese Credit Card Explosion

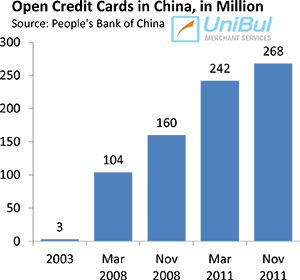

Now let’s take a closer look at the Chinese credit card market. So according to official data from the People’s Bank of China (PBC), in 2003 there were only 3 million active credit card accounts in the country. By March of 2008 that number had spiked to 104 million and by November of 2008 it had further exploded to 160 million. By the end of March of 2011 there were 242 million active credit cards in China and the latest PBC figure I have, for November 2011, puts that number at 268 million. Again, these are just credit cards.

Now let’s take a closer look at the Chinese credit card market. So according to official data from the People’s Bank of China (PBC), in 2003 there were only 3 million active credit card accounts in the country. By March of 2008 that number had spiked to 104 million and by November of 2008 it had further exploded to 160 million. By the end of March of 2011 there were 242 million active credit cards in China and the latest PBC figure I have, for November 2011, puts that number at 268 million. Again, these are just credit cards.

According to other PBC data, cited by The Wall Street Journal, at the end of March of this year there were more than 3.1 billion open credit and debit card accounts in China, with a total transaction volume across these cards of more than 84 trillion yuan ($13.4 trillion). At present, only one company, China UnionPay, is allowed to process card transactions in the country.

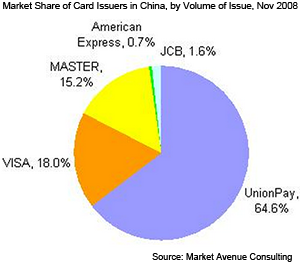

Furthermore, UnionPay is by far the biggest issuer of Chinese payment cards, accounting for almost two-thirds of the market. Visa and MasterCard, the two biggest global card networks, are trailing a good distance behind the leader.

Furthermore, UnionPay is by far the biggest issuer of Chinese payment cards, accounting for almost two-thirds of the market. Visa and MasterCard, the two biggest global card networks, are trailing a good distance behind the leader.

However, China is now relaxing its restrictions on foreign credit card companies, perhaps at least partly in response to a World Trade Organization (WTO) investigation, which resulted in a ruling from earlier this year, which stated that China is discriminating against foreign providers of credit and debit card payments. Even while the WTO case was still under investigation, in February Citi became only the second foreign bank, and the first non-Honk-Kong one – to be allowed to enter the Chinese credit card space on its own. So the Chinese credit card market is slowly opening up.

The Takeaway

The FT’s Ritz story is becoming ever more commonplace. The Chinese nouveau riches are quickly increasing in number and their appetite for luxury goods is growing even faster. According to a Bain study, the growth rate of luxury good purchases by Chinese consumers is vastly greater than the one for their rich-world counterparts. Says Bruno Lannes, head of Bain’s Consumer Products and Retail Practice in Greater China and lead author of the study:

In less than five years, the Chinese consumer has transformed from a niche emerging market to a core target for global luxury brands… We continue to see a phenomenal luxury goods growth story in China but are seeing some signs of market maturation.

Moreover, Lannes’ study tells us, the growth rate of Chinese luxury purchases made abroad is outstripping the one for Mainland China. So it would only make sense that Westerners should make it easier for their rich Chinese visitors to spend their money, wouldn’t it?

Image credit: Business Review Australia.

I wonder if the Chinese people buy online also with credit card? Good article Cheers

I have a question: is the Chinese Union Card in anyway associated with VISA, MC, Amex, etc?