Consumer Credit Card Use Falls for 25th Consecutive Month

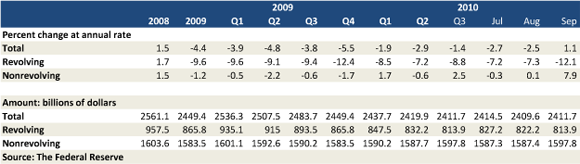

Americans cut back on their outstanding revolving credit lines, comprised mostly of credit card balances, for the 25th month in a row in September, according to the latest data released by the Federal Reserve. Outstanding revolving credit fell by $8.3 billion in September from August, a decrease of 12.1 percent at an annualized rate. This comes after a fall of $5 billion the previous month.

This new belt-tightening trend began with the onset of the financial crisis just over two years ago. Overall, since its peak in August 2008, revolving credit in the U.S. has dropped by $159.7 billion, from $973.6 billion to $813.9 billion, a decrease of 16.4 percent. During this period the average U.S. family with outstanding credit card debt — 54 million by the Fed’s count — has reduced it by $2,957, according to the report.

A separate report from Fitch Ratings, a credit ratings agency, also showed a marked improvement in the delinquency and default metrics it tracks. Late-stage delinquencies – payments late by 60 days or more – decreased by 0.06 percent, reaching a new two-year low at 3.50 percent in September.

Early-stage delinquencies — payments late by 30 days or more — also fell, by 0.01 percent to 4.61 percent, according to Fitch.

Charge-offs — loans lenders no longer expect to be repaid and have written off their books as losses — fell by 1.14 percent on a month-to-month basis to 9.22 percent in September, reaching an 18-month low. Compared to the same period last year, the drop is 14 percent. Issuers typically charge off balances 180 days after the latest payment on the account.

The sharp decrease in consumer credit card debt is due in part to lower credit card use and a rise in the repayment rate. Again according to Fitch, Americans are paying back a larger percentage of their monthly credit card balances than they have in a long time. Fitch’s monthly payment rate (MPR) has been rising steadily, after reaching a six-year low of 15.78 percent in February 2009, during the peak of the crisis. In September, the MPR fell slightly to 19.65 percent, which is still 9 percent higher than the same period last year and the third highest level since the beginning of 2008.

The decline in defaults and delinquencies is also good news for card issuers, who have been charging off more than $20 billion per quarter, beginning in the second quarter of 2009, according to CardHub.com, a credit card comparison website. This figure is about equal to the amount of the decline in outstanding credit card balances. Lower delinquency levels mean that issuers now have to set aside less money to cover potential losses than they did at the peak of the crisis.

With the start of the Holiday shopping season just three weeks away, it will be interesting to see whether alternative payment methods like cash and debit will continue to gain ground on credit card use. Credit standards that continue to be tight will no doubt play a role as well.