Can Credit Cards Be Crowdsourced?

Barclays, a big British bank, thinks they can and has begun testing the concept in the U.S. There are precious few details about the program and that’s to be expected, as the issuer is moving gingerly into unexplored territory. And it is certain that there will be surprises along the road.

I really like what Barclays is doing and hope that they can get it right. But whether they do or don’t, I don’t think there is any doubt that the card issuers will keep trying to figure out how to use social media to grow their business and to improve their reputation. So all of them will be closely following the progress of Barclays’ pilot, hoping to learn something from it. And there will be a lot to be learned.

How Will It Work?

Barclaycard Ring, as the new card is called, is a MasterCard that is currently only available through an invitation. Its initial terms are quite good:

- 8 percent variable interest rate for all balances (purchases, balance transfers and cash advances).

- No balance transfer fee.

- No annual fee.

- 1 percent foreign transaction fee.

- Up to $25 late payment fee.

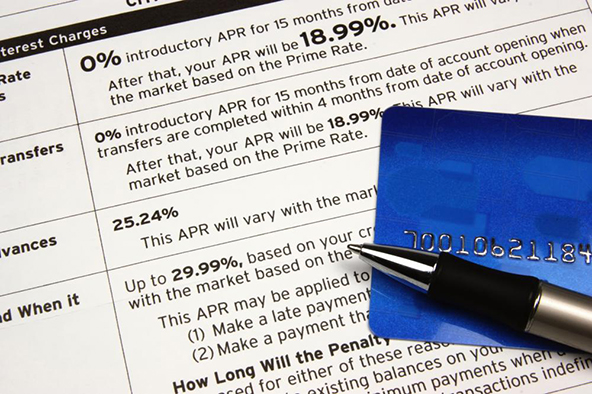

These are very reasonable terms, even as there is no zero-percent promotional interest rate, which the bank says is actually good for its customers:

0% promotional rates hurt our bottom line and as result in us charging higher rates in the long-term. With Barclaycard Ring, you have one low variable rate of 8% (not 7.9%, either) with no balance transfer fees. We want you for the long term, and we think you deserve clear-cut pricing. Of course, you might miss the 0% APR offer at first. But, that rate could ultimately cost us our relationship if we later have to raise your rates later in order to cover our expenses during the promotional period, and we don’t want that.

I like that; it’s honest and straightforward. But let’s move on to the crowdsourcing part of the project, which is what makes it unique. So the idea is that Barclaycard Ring cardholders will be sharing in the bank’s profits from the program, if any. We are told that each cardholder will have an impact on the profits “by doing things that keep costs down and profits up” (things like making payments on time, signing up for the less expensive paperless statements and referring friends to the program). Moreover, Barclays will be keeping everyone up-to-date on how the program is doing by publishing its financial statements on the card’s website.

Barclaycard Ring cardholders will be able to voice their opinions about the program on a specially-created forum for members of the program. The bank says that it intends to listen to the suggestions of its customers and adjust the program’s terms accordingly over time. We’ll see about that.

What Should We Make of It?

What I like most about Barclaycard Ring is its avowed transparency. Banks know better than anyone just how unpopular with their customers they’ve become and are looking for ways to reverse the trend (or at least some of them do). Now, that does not mean that they are any less interested in making profits, nor should we expect them to be. On the contrary, now that banks have to make up for plenty of revenue lost to regulation of one kind or other, they are just as intent on profiting from their credit card operations as ever.

However, at least one of them has now decided to let everyone watch in real time how it is making money from credit cards and how much. And whatever you may think of Barclays’ stated goal of “sharing” the program’s profits with its cardholders, you can’t accuse it of hiding anything. So I, for one, like what I’m seeing.

The Takeaway

It is too early to pass any judgment on the merits of Barclays’ crowdsourcing credit card program. I also don’t think that the bank’s executives have any idea what will come out of it. After all, they surely realize full well that their customers will want ever lower cost of using their cards and ever greater benefits. That much is certain. The bank hopes that it will be able to moderate these demands by showing its customers just how much it makes off them. Here is how the program’s “Community Manager” frames the objective on its blog:

We have to ensure that Barclays’ shareholders get a fair return on their investment, but then after that we want to share what’s left with you.

And therein lies the problem. How do you define how much of a “return” is fair? The past few months have revealed just how wide the chasm between banks and consumers is on the term’s definition. But then there is really no definition. It is all a matter of perception and I think that the bank can only hope for a positive outcome if it convinces its customers that it’s being honest with them. If it can achieve that, Barclays will find that the two parties’ perceptions of fairness will come much closer.

Image source: Barclaycard.

read the disclousers!!!!!!!! how can u have a card and not know how to check for thigns like that?? the disclousers are the small prints on the bottom of every document u get from them . READ IT!!!