Are Australians the New Americans in Credit Card Spending?

While Americans have been making huge progress in reducing their outstanding credit card balances, Australians have been going in the opposite direction, according to data released by the Reserve Bank of Australia. The numbers show that on average Australians now owe more on credit cards than Americans did at the end of 2009, in the midst of our debt-reduction frenzy.

Australians Owe AUD49.3B on Credit Cards

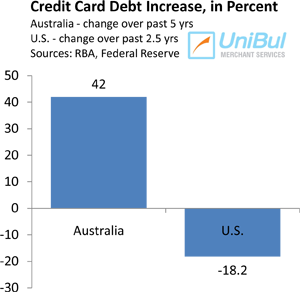

So the latest Reserve Bank of Australia (RBA) data reveal that over the past five years Australians have increased their outstanding credit card balances by 42 percent and now owe AUD 49.3 billion (USD 52.3 billion), AUD 36 billion (USD 38.2 billion) of which is accruing interest. By comparison, as of the end of March of this year, the aggregate outstanding credit card balances in the U.S. have fallen by USD 177.5 billion, or 18.2 percent, according to the Federal Reserve, from its August 2008 level, the month before the financial meltdown began.

The average Australian household now owes AUD 3,321 (USD 3,520) per card, which means that the overall indebtedness is often much higher, as many households use more than one credit cards. As a natural consequence, the rate of late payments has also increased, with 14 per cent of cardholders missing a payment in the past three months.

The number of open credit card accounts has also risen substantially and is now at about 15 million, an increase of 18 percent over the five-year period covered by RBA’s study. This is another area of strikingly different patterns evolving in the U.S. and Australia. Since reaching their peak in the second quarter of 2008, shortly before the Lehman Brothers’ collapse, the number of open credit card accounts in the U.S. has fallen by 24 percent and at the end of the first quarter of 2011 stood at 379 million, according to data from the New York Fed.

Are Australians the New Americans?

So what’s going on in the Land Down Under? Why have the Aussies taken to emulating our destructive credit card spending habits from before the Lehman collapse? Well, there are several potential causes that have been pointed out, although they still leave plenty of room for questions.

So what’s going on in the Land Down Under? Why have the Aussies taken to emulating our destructive credit card spending habits from before the Lehman collapse? Well, there are several potential causes that have been pointed out, although they still leave plenty of room for questions.

Firstly, credit cards have been easily accessible, as evidenced by the 18 percent jump over the examined five-year period. Issuers’ underwriting criteria may have been unusually lax in the build-up to the enactment of the GFC, the Australian version of the U.S. CARD Act, which introduced tighter lending standards, among other new rules, in January.

Secondly, interest rates are higher in Australia than they are in the U.S., with the official RBA rate up 1.75 percent since mid-2009 t0 4.75 percent. The majority of cards come with rates higher than 20 percent.

Then there is the rising Australian dollar, which has boosted its purchasing power and spurred online shopping.

Of course, as always, credit card companies are also blamed, for devising ways to trick cardholders into actually using their generously issued credit lines.

Yet, even taken together, I don’t find that the proposed causes are offering a particularly convincing answer for the source of the Australians’ credit card woes. After all, we’ve also had our CARD Act, rising interest rates and misbehaving issuers to deal with. And it’s not like the U.S. dollar has been in a free fall. So really, are the Aussies becoming the new Americans in credit card spending?

Image credit: Omgtoptens.com.