AmEx’s New Prepaid Card Shows How Issuers Will Fight Debit Fee Limit

Now that the Senate has voted against delaying the implementation of a Federal Reserve rule to limit the fees issuers are allowed to charge for debit card transactions, it is inevitable that banks will start pushing consumers toward using other payment methods, in addition to introducing fees elsewhere for services that were previously offered for free.

A new prepaid card, just introduced by American Express, is one such way of circumventing the debit interchange fee cap.

American Express Prepaid Card

AmEx’s new prepaid card is a surprisingly consumer-friendly product, considering that this is not how such cards are usually described. The only fee cardholders are charged is a $2 ATM fee, assessed after the first withdrawal, which is free (this is what AmEx charges; the ATM operator may charge a separate fee).

A typical prepaid card would come with fees for activation, purchases, balance inquiries, monthly maintenance and others that we have previously reviewed. AmEx will not charge even a foreign transaction fee.

Prepaid cards used to be the payment option of last resort, the choice for consumers who had no access to bank accounts and credit cards, due to bad or insufficient credit history. And they were being penalized for it.

Not anymore. This is a whole new type of payment product and is targeted at a much wider range of consumers. In the words of Dan Schulman, AmEx’s Group President, Enterprise Growth, as quoted in the FT: “This card will allow us to focus on serving new demographics.”

But why is AmEx focusing on these “new demographics?” Why now?

The Future of Prepaid

Well, the major reason for American Express to wade into prepaid card territory, as the FT points out, is that the CARD Act made it difficult for issuers to increase fees and interest rates on cardholders who are late on payments. To mitigate risk, issuers responded with lower credit lines and tougher underwriting standards, a strategy that further hurts revenues. So AmEx had to look elsewhere for new revenue opportunities.

Well, the major reason for American Express to wade into prepaid card territory, as the FT points out, is that the CARD Act made it difficult for issuers to increase fees and interest rates on cardholders who are late on payments. To mitigate risk, issuers responded with lower credit lines and tougher underwriting standards, a strategy that further hurts revenues. So AmEx had to look elsewhere for new revenue opportunities.

Now the debit interchange cap will spur other issuers into action as well. Prepaid cards are exempt from CARD Act regulations and will not be subject to the $0.12 debit interchange limit. So even if issuers make them free for cardholders, as AmEx did, prepaid cards will still be more profitable than debit, because merchants will be paying much higher transaction fees, while carrying virtually no risk for the bank.

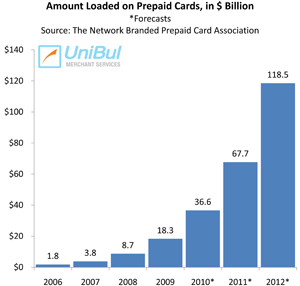

So we should expect to see a lot more similarly low-cost prepaid card offers soon. It is no surprise that various studies predict an explosion in the use of prepaid cards in the coming years. According to the Network Branded Prepaid Card Association, the amount loaded on prepaid cards will reach $118.5 billion in 2012, up from $1.8 billion in 2006. There is a good reason for it.

The Takeaway

From a consumer stand point, the evolution of prepaid cards is good news. The retailers’ victory over issuers in the debit card interchange war is unlikely to translate into lower prices at the store level. However, a side effect in the form of these new-age prepaid cards is definitely beneficial, especially for folks with low income and / or bad credit who typically pay the most for access to any form of financial services.

The cheap prepaid cards, issued by top-tier banks, will not be such good news for the largely unknown incumbents in the market, who have been hugely successful in the absence of heavyweight competitors. The biggest among them, Green Dot Corp., raised $160 million in its IPO in July of 2010, while the second-biggest company in the industry, NetSpend Holdings Inc., did even better, raising $204 million in its own IPO in October of last year. Lately, however, their share prices have dropped, as it has become clear that the big guys are coming.

Image credit: Americanexpress.com.

I recently tried an Amex Prepaid card, “filling it up” with the maximum $2500 amount. I used it yesterday at a restaurant and was shocked to see that the credit card receipt displayed for the merchant and the world to see “Remaining Balance $2308.20”. This is absolutely egregious. Amex makes my balance available to merchants? No PIN required? Are they kidding? I called Amex customer service, talked to three different guys named “Sam” in India. The first two hung up on me when they couldn’t come up with a response. The third claimed that he checked and the merchant had a “special terminal”. I have no desire to have everyone I buy a sandwich from and their employees, know what my available balance is. Plus, seems to me it’s a ridiculous security risk.

Hello Bill,

I understand your frustration. The card issuer always transmits the remaining balance on a prepaid card to the merchant’s POS terminal. At this point, however, several things can happen, one of which is, as in your case, the balance to be displayed on the terminal and to be printed out on the sales receipt. For Visa and MasterCard prepaid cards, on the other hand, the terminal will print “Confirmed” on the receipt, if the remaining balance is above $200, rather than the amount (see How to Manage Partial Transaction Authorizations for details).

I loaded over 600$ onto my card via a direct deposit. Yesterday I went to a local ATM to take out money for a new laptop purchase. I didn’t realize the withdrawl limit was 500 so after requesting 505 dollars the transaction was declined. I came home to find out in fact my account had been debited the 505 plus a 2 dollar atm fee. I called customer service and got little to no assistance. They told me to disput the charge and in the mean time I am out the money. I have heard of them doing this to MANY customers as of late. A very disturbing practice holding someones money hostage for days/weeks on end.