Americans Use Credit Cards More, but Stick to Cash as Well

This is one of the main findings of the latest Survey of Consumer Payment Choice, just released by the Federal Reserve Bank of Boston. It is the third in a series of annual studies aimed at gaining a comprehensive understanding of the cash and non-cash payment behavior of U.S. consumers and covers data for 2010. In it, the authors — Kevin Foster, Scott Schuh and Hanbing Zhanghe — tell us that in 2010, the number of consumer payments rebounded as the economy began to emerge from the financial crisis and recession. Mobile banking and mobile payments by consumers also continued to increase moderately, we learn.

The SCPC report gives us data and detailed estimates of the rates of adoption, shares of consumers’ usage, and number of payments made by consumers for nine payment instruments — cash, checks, money orders, traveler’s checks, debit cards, credit cards, prepaid cards, online banking bill payments (OBBP) and bank account number payments (BANP) — plus payments made directly from consumers’ income source. The report also gives us estimates of consumer activity related to banking, cash management and other payment practices. But today I’d like to focus my attention solely on the usage data for the main payment instruments — perhaps I will spend some time on the report’s other findings in future posts. Let’s get started.

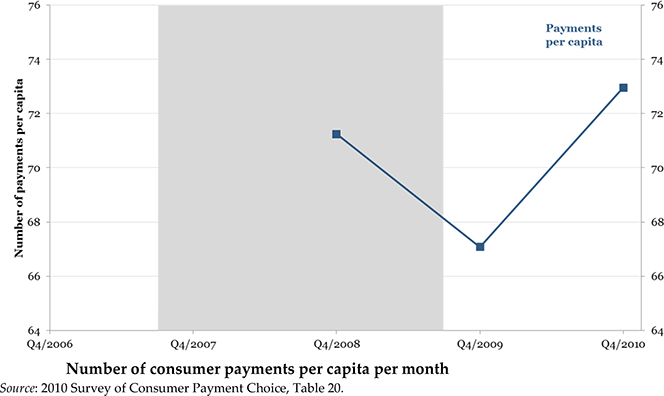

Consumer Payments up by 9%

In 2010, the report tells us, the number of consumer payments in the U.S. increased by nearly 9 percent from 2009’s level, as economic activity began to rebound from the financial crisis of 2008 and the recession.

Credit and Debit Cards up, but so Is Cash

Cash payments by consumers, which had risen sharply in 2009, did not fall back, but instead grew by another 3 percent in 2010. However, the share of cash payments, the dollar amount of cash withdrawals and cash holdings by consumers decreased slightly in 2010.

Credit card payments by consumers rose by 15 percent, reversing more than half of the 2009 decline, we learn, and the steady trend decline in paper check payments by consumers continued.

Debit cards and cash continued to account for the two largest shares of consumer payments (31.1 percent and 28.6 percent, respectively) and consumer adoption of all types of prepaid cards (38.2 percent) increased significantly in 2010.

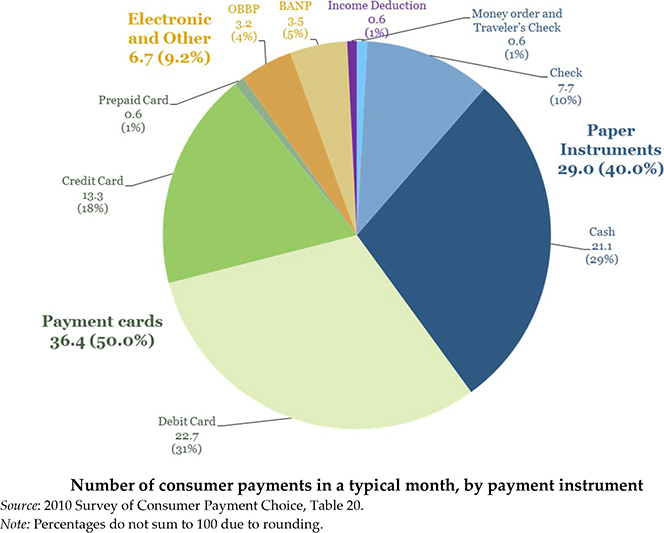

As you can see in the chart below, in 2010, consumers made an average of 36.4 payments using payment cards (or 50.0 percent of total payments), 29.0 payments using paper instruments (40.0 percent) and 6.7 payments using electronic and other instruments (9.2 percent) in a typical month. As already noted, debit cards and cash continued to be most popular among consumers. Consumers made an average of 22.7 debit card and 21.1 cash payments in a typical month, accounting for about three-fifths of all consumer payments in a typical month (59.7 percent). The next most popular payments instruments were credit cards (13.3 payments) and checks (7.7 payments). All other payment instruments were used for an average of 8.5 payments per month.

What Do We Pay For?

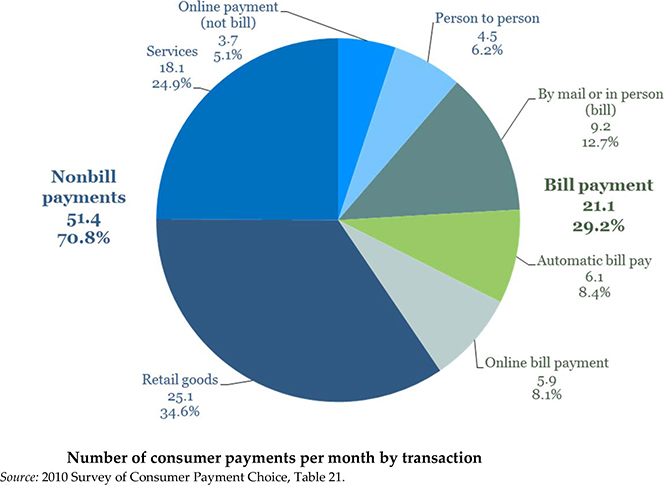

American consumers made 73 payments, on average, in a typical month in 2010. Of these, 29.2 percent — a monthly average of 21.2 — were bill payments and 70.8 percent — 51.4 — were non-bill payments. As you see in the chart below, the most common method of bill payment among consumers was by mail or in person, which is how they made 9.2 payments per month. Automatic bill payments — 6.1 per month — were about as popular as bill payments made online — 5.9 per month.

As you see, most non-bill consumer payments were made in person. In a typical month in 2010, Americans made an average of 25.1 payments for retail goods and 18.1 payments for services while shopping at traditional, brick-and-mortar stores, plus another 4.5 payments directly to another person (person-to-person, or P2P). Consumers made an average of 3.7 non-bill online payments per month.

How Much Do We Use of Each Payment Type?

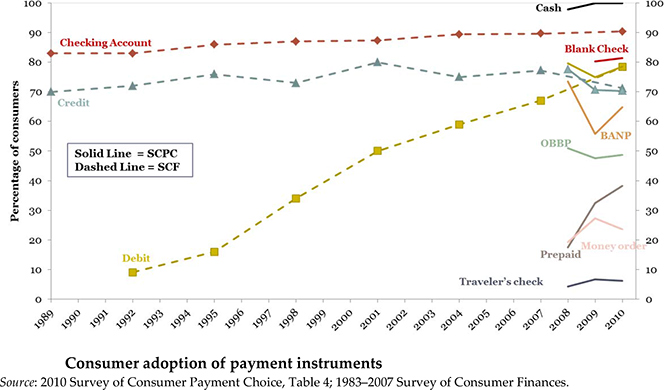

As of 2010, about two-thirds of American consumers had adopted the five most popular payment instruments: cash (100 percent), blank checks (87.0 percent), debit cards (78.4 percent), credit cards (70.3 percent) and BANP (64.8 percent). About half of consumers had adopted OBBP (48.7 percent) and more than a third had adopted prepaid cards (38.2 percent). Close to a quarter of consumers had adopted money orders (23.6 percent) and few had adopted traveler’s checks (6.2 percent).

After a long trend increase, the share of consumers with debit cards appears to be leveling off at around 75 – 80 percent. In contrast, consumer adoption of prepaid cards has been on the rise in recent years, as the share of consumers holding prepaid cards more than doubled from 2008 to 2010.

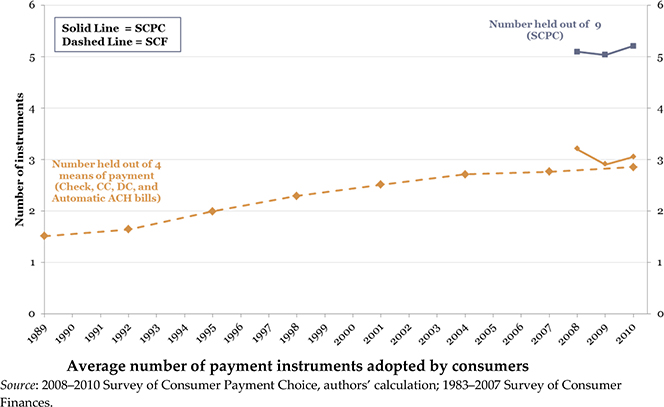

On average, Americans held 5.2 payment instruments out of the nine tracked by the researchers, up slightly from 2009’s average of 5.0, but not much different from 2008’s average of 5.1. From a smaller group of four payment instruments, including only a subset of BANP (automatic ACH bill payments), consumers held 3.0 of them on average. This number is about twice as large as in 1989, we are told.

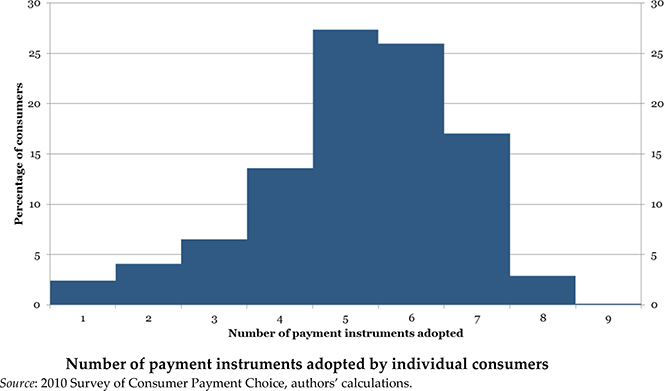

The authors then offer another way to view consumer adoption of the most common payment types. Looking at individual portfolios of instruments held by consumers, the most common number of instruments, held by 27.4 percent of consumers, was five. Almost as many consumers — 26.0 percent — had six instruments and another 30.6 percent of consumers had four or seven instruments. Only about one in eight consumers (13.1 percent) held fewer than four or more than seven payment instruments.

Cash Is Down

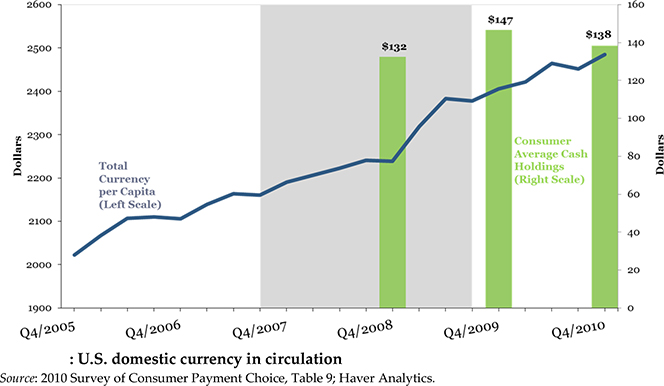

U.S. currency in circulation, measured on a per-capita basis, grew by 3.3 percent in 2010, after growing by 7.5 percent in 2009, as shown in the chart below. This estimate reflects total cash holdings by all domestic U.S. agents — households, firms, non-profit and government — as well as balances held in bank vaults. For consumers only, the average amount of currency held declined to $138 in the fourth quarter of 2010 from $147 in 2009 Q4. These amounts exclude unusually large amounts of high-value cash holdings, we are told.

Given that consumer cash payments and cash holdings did not change much in 2010, it is not surprising that cash withdrawals were little changed as well, the authors observe: consumers withdrew $502 per month on average in 2010, up from $488 in 2009.

The Takeaway

So the survey tells us that the shift away from paper checks and toward various types of electronic payments is still very much ongoing. Furthermore, the use of cash is stagnant. While there are still no signs that any of the traditional payment forms are facing imminent extinction, it seems inevitable that the continuing e-payment adoption and the rise of mobile payments will eventually lead to the disappearance of physical checks. Paper cash will probably linger on for decades to come, but its use will continue to decline.

Image credit: Walmart.com.