Americans Take out More Student and Auto Loans, still Cautious with Credit Cards

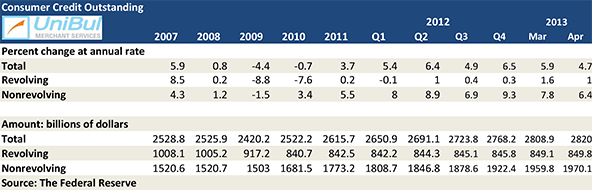

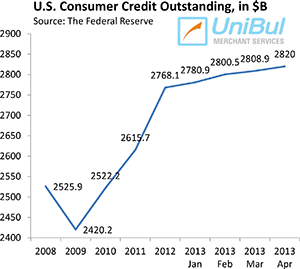

The total amount of outstanding consumer debt in the U.S. increased for yet another month in April — the twentieth consecutive increase — we find out from the latest Federal Reserve consumer credit data release. Once again, the rise in the Fed’s credit total is due primarily to the growth of its non-revolving components and especially that of its student loan and auto loan constituents. However, whereas the continually strong demand for auto loans is seen as a welcome sign of an improving economy and rising consumer confidence, the growth of the student debt total is alarming — not only is it reflecting the reality of still-limited job opportunities, but the repayment of these loans — half of which are in deferment — is becoming an ever growing concern.

On the other hand, throughout the post-Lehman period Americans have been very cautious when using their credit cards and that has once again been the case in April. Not only did the credit card debt total fall sharply in the couple of years immediately following the financial crisis and has remained virtually unchanged afterward, but the credit card delinquency and charge-off rates have reached record-low levels and are still falling. Let’s take a look at the latest Fed data.

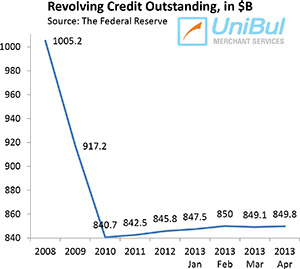

Credit Card Debt up 1% in April

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of outstanding credit card balances, rose in April at a seasonally adjusted annual rate of 1 percent, or $682 million, from the previous month’s level, after a 1.3 percent decrease in March, bringing the total up to $849.8 billion — just 1.1 percent, or $9.1 billion, above the total measured at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process.

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of outstanding credit card balances, rose in April at a seasonally adjusted annual rate of 1 percent, or $682 million, from the previous month’s level, after a 1.3 percent decrease in March, bringing the total up to $849.8 billion — just 1.1 percent, or $9.1 billion, above the total measured at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process.

The Fed’s revolving credit total had been falling continually since the beginning of the financial crisis in September 2008 until the end of 2010. The free fall (and it was free, as you can see in the chart to the right) ended sometime in 2011, for which year half of the Federal Reserve’s monthly credit releases, including each of the last four monthly issues, reported slight increases in the revolving debt total. Yet, as of the end of April, that total has barely changed since reaching its lowest point at the end of 2010 — revolving credit is still lower by 15.9 percent, or $160.5 billion, than the $1,010.3 total recorded at the end of 2008.

Overall Consumer Credit up 4.7%

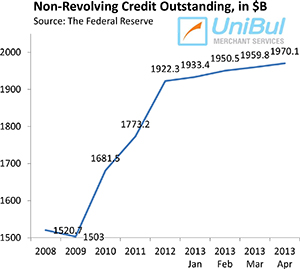

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported a $10.3 billion — or 6.4 percent — increase in April from March’s level, lifting the total up to $1,970.1 billion. That followed a downwardly revised $9.3 billion increase in March.

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported a $10.3 billion — or 6.4 percent — increase in April from March’s level, lifting the total up to $1,970.1 billion. That followed a downwardly revised $9.3 billion increase in March.

Strong demand for auto and federal educational loans continued in April. The Fed’s report showed that lending to consumers by the federal government — mainly educational loans — rose by $1.5 billion, following a $3.9 billion increase in March, a $4.2 billion increase in February and a whopping $25.9 billion spike in January, before seasonal adjustments. Since the end of 2008, the total of outstanding federal government loans to consumers has risen by 439.1 percent, or $458 billion.

lending to consumers by the federal government — mainly educational loans — rose by $1.5 billion, following a $3.9 billion increase in March, a $4.2 billion increase in February and a whopping $25.9 billion spike in January, before seasonal adjustments. Since the end of 2008, the total of outstanding federal government loans to consumers has risen by 439.1 percent, or $458 billion.

Record-low interest rates continue to keep high the demand for cars and trucks, which sold at an average annual rate of 15.26 million in the first quarter of the year, according to the Ward’s Automotive Group. In May, the figure was practically unchanged — 15.24 million.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for April is higher by 23.2 percent, or $371.4 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The figure for April is higher by 23.2 percent, or $371.4 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The aggregate amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving constituents — rose by 4.7 percent, or $11.1 billion, to $2,820.0 billion in April. The new total is larger by $232.6 billion, or 9 percent, than the pre-Lehman record-high of $2,587.4 billion, recorded in July 2008.

The Takeaway

The Federal Reserve’s latest monthly consumer credit report clearly shows that the attitudes developed by U.S. borrowers toward non-home-mortgage types of consumer debt in the aftermath of the Lehman Brothers’ collapse still hold. Americans are averse to taking on more credit card debt than they think they can repay quickly, which is confirmed not only by the stagnant level of the Fed’s revolving debt total, but also by the historically low, and still falling, credit card delinquency rates. According to the latest data released by Fitch Ratings, the credit card delinquency rate in May was 1.48 percent, down from 1.63 percent at the end of the first quarter and lower by more than 30 percent than the rate measured at the end of the first quarter of 2012.

However, as I and others keep pointing out, the issue is no longer credit card debt (and hasn’t been for a long time), but student debt, which keeps growing, even though there is a slowdown in the growth of federal student loans, which make up the lion’s share of the educational loan total. The scarcity of job opportunities has convinced many working-age Americans to invest in their education, with the hope of improving their job prospects once the employment picture finally gets back to normal. However, it has been taking an awfully long time for things to get back to normal and we still have a long way to go. In the meantime, the student loan delinquency and default rates are rising.