Americans Still Cautious with Their Credit Cards, Less so with Student Loans

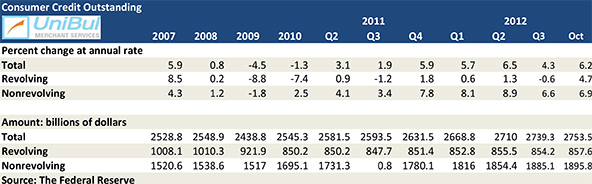

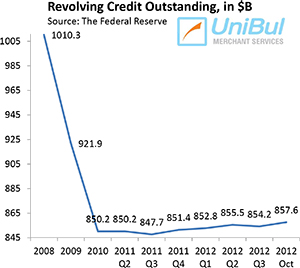

American consumers added to their credit card debt total in October, we learn from the latest Federal Reserve consumer credit data release. It is a small increase that fits well into a trend that began just over two years ago. Before that, back in September of 2008, the collapse of Lehman Brothers triggered a combination of quickly rising credit card delinquency and default rates. Frightened consumers were either unwilling or unable to take on new credit and focused on sorting out the debt they had already accumulated. In the case of the credit card debt category, that sorting out took the form of sharply rising credit card debt repayment rates, which combined with rising charge-off rates to cause the total amount of consumer credit card debt in the U.S. to plummet. However, that free fall ended sometime in the second half of 2010 and since then the credit card debt total has been bouncing up and down, but has remained virtually unchanged.

In contrast, the financial crisis has had a markedly less noticeable impact on the much larger consumer debt category that includes auto and student loans. The non-credit-card debt total (the “non-revolving credit” in Fed jargon) did contract slightly in 2009, in relation to 2008, but it has been rising almost uninterruptedly since then. Consequently, the total amount of U.S. consumer debt — the sum of credit-card and non-credit-card debt — is now well above its pre-crisis level. Let’s take a look at the latest Fed data.

Credit Card Debt up 4.7% in October

The aggregate amount of outstanding consumer revolving credit in the U.S., comprised almost exclusively of unpaid credit card balances, rose in October by 4.7 percent, or $3.4 billion, from September’s level, lifting the total up to $857.6 billion.

The aggregate amount of outstanding consumer revolving credit in the U.S., comprised almost exclusively of unpaid credit card balances, rose in October by 4.7 percent, or $3.4 billion, from September’s level, lifting the total up to $857.6 billion.

Following the financial meltdown of September 2008, the U.S. consumer credit card debt total had been falling continually until the end of 2010. Then it all changed and in 2011 half of the Federal Reserve’s monthly reports showed increases in the revolving debt total, including each one of the last four. Now the Fed tells us that at the end of October the total was still lower by 15.1 percent, or $152.7 billion, than the $1,010.3 figure recorded at the end of 2008.

Overall Consumer Credit up 6.2%

The non-revolving portion of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported a $10.7 billion — or 6.9 percent — increase in October from the September’s level, bringing the total up to $1,895.8 billion.

The non-revolving portion of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported a $10.7 billion — or 6.9 percent — increase in October from the September’s level, bringing the total up to $1,895.8 billion.

The non-revolving total has risen in every month since July 2010, with the sole exception of August 2011 when it fell by 5.2 percent. The current figure is higher by 18.6 percent, or $297.1 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving portions — rose by 6.2 percent, or $14.2 billion, to $2,753.5 billion in October. The new total is bigger by about $166.1 billion, or 6.4 percent, than the pre-Lehman record-high of $2,587.4 billion, recorded in July 2008.

The Credit Card Takeaway

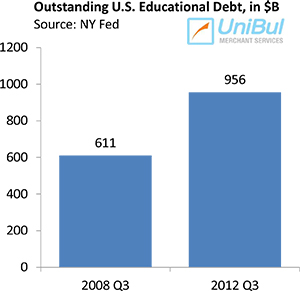

The latest Federal Reserve data aren’t pointing to any shifts in consumer borrowing trends. Americans are still very reluctant to expand their credit card balances in any significant way, as they have been ever since the financial crisis struck in 2008. On the other hand, consumers are much less cautious when it comes to taking out student and auto loans. Of course, it could convincingly be argued that they have no real alternative. Still, the fact is, as we keep pointing out on this blog, that student debt has been accumulating in the U.S. at an alarmingly accelerating rate and at the end of the third quarter of this year its total was greater by 56 percent than the corresponding figure recorded just four years earlier (see the chart at right). It is now also significantly larger than the credit card total. It seems ever clearer to me that this huge shift in debt accumulation across the different consumer debt categories is one of the major defining features of the post-Lehman period.

The latest Federal Reserve data aren’t pointing to any shifts in consumer borrowing trends. Americans are still very reluctant to expand their credit card balances in any significant way, as they have been ever since the financial crisis struck in 2008. On the other hand, consumers are much less cautious when it comes to taking out student and auto loans. Of course, it could convincingly be argued that they have no real alternative. Still, the fact is, as we keep pointing out on this blog, that student debt has been accumulating in the U.S. at an alarmingly accelerating rate and at the end of the third quarter of this year its total was greater by 56 percent than the corresponding figure recorded just four years earlier (see the chart at right). It is now also significantly larger than the credit card total. It seems ever clearer to me that this huge shift in debt accumulation across the different consumer debt categories is one of the major defining features of the post-Lehman period.