Americans Pay down Credit Card Debt, Take out More Auto, Student Loans

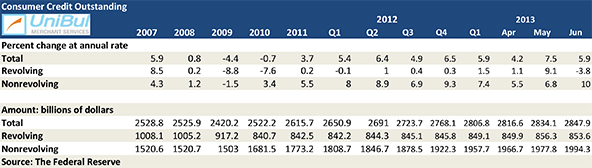

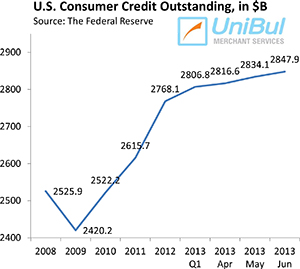

The total outstanding amount of consumer debt in the U.S. rose at a healthy pace for one more month in June — the 22nd consecutive monthly increase — the latest Federal Reserve consumer credit data release tells us. Unlike last month, however, when we saw a huge jump in the credit card portion of the total — the biggest one in years — that component registered a decrease in June, which wiped out more than 40 percent of the previous month’s growth, big as it was. And that should not come as a great surprise: all available data tell us that credit card delinquency and default rates keep falling and each month Americans are paying back an ever greater portion of their outstanding credit card debt. For as long as these trends hold, population growth would be the only factor pushing up the credit card debt total, but even its rate is evidently not high enough to overcome the downward pull of the competing forces.

The increase of the overall debt total is the result of the continuing growth of loans for autos and college tuition and is fueled by a recovering housing market and an improving consumer confidence. Auto loans and student debt have been the primary drivers of the growth in consumer credit in the post-Lehman period, whereas the credit card total has been virtually flat since the end of 2010. The bad news is that, even as credit card charge-offs and delinquencies are at historic lows, the corresponding student loan rates are at all-time highs and rising. But let’s take a look at the latest Fed data.

Credit Card Debt down 3.8% in June

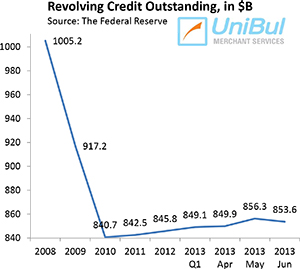

The total consumer revolving credit in the U.S., which is comprised almost exclusively of outstanding credit card balances, fell in June at a seasonally adjusted annual rate of 3.8 percent, or $2.7 billion, from the previous month’s level, after a downwardly revised 9.1 percent spike in May. The Fed’s revolving credit total began a free fall immediately following the collapse of Lehman Brothers in September 2008, which, as you can see in the chart to the right, ended sometime in 2010. Since then, it has barely changed.

The total consumer revolving credit in the U.S., which is comprised almost exclusively of outstanding credit card balances, fell in June at a seasonally adjusted annual rate of 3.8 percent, or $2.7 billion, from the previous month’s level, after a downwardly revised 9.1 percent spike in May. The Fed’s revolving credit total began a free fall immediately following the collapse of Lehman Brothers in September 2008, which, as you can see in the chart to the right, ended sometime in 2010. Since then, it has barely changed.

The total for June — $853.6 billion — is still just 1.5 percent, or $12.9 billion, above the total recorded at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Furthermore, the new total is still lower by 15.5 percent, or $156.7 billion, than the all-time high of $1,010.3 billion recorded at the end of 2008.

Overall Consumer Credit up 5.9%

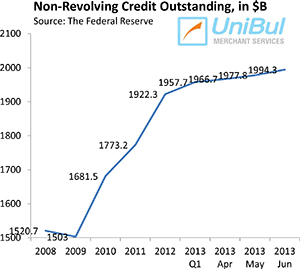

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued to increase, in line with a long-standing trend. The Federal Reserve reported a $16.5 billion — or 10 percent — increase in June from May’s level, raising the total up to $1,994.3 billion. That followed a downwardly revised 6.8 percent increase in May.

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued to increase, in line with a long-standing trend. The Federal Reserve reported a $16.5 billion — or 10 percent — increase in June from May’s level, raising the total up to $1,994.3 billion. That followed a downwardly revised 6.8 percent increase in May.

As you can see in the chart to the right, the non-revolving debt total didn’t plunge nearly as steeply as the revolving one in the aftermath of the financial crisis and resumed its rise much more quickly.

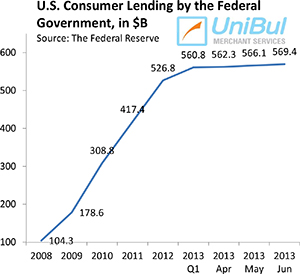

Demand for federal student loans continued to be strong in June. The Fed data tell us that lending to consumers by the federal government — mostly educational loans — rose by $3.3 billion for the month to $569.4, following a $3.8 billion increase in May. As you can see in the chart to your right, growth in this segment has slowed down considerably since January of this year when we saw the last really big increase — $25.9 billion. Overall, since the end of 2008, when it stood at $104.3 billion, the total of outstanding federal government loans to American consumers has increased by a staggering 445.9 percent, or $465.1 billion.

Demand for federal student loans continued to be strong in June. The Fed data tell us that lending to consumers by the federal government — mostly educational loans — rose by $3.3 billion for the month to $569.4, following a $3.8 billion increase in May. As you can see in the chart to your right, growth in this segment has slowed down considerably since January of this year when we saw the last really big increase — $25.9 billion. Overall, since the end of 2008, when it stood at $104.3 billion, the total of outstanding federal government loans to American consumers has increased by a staggering 445.9 percent, or $465.1 billion.

Once again, helped by low interest rates, cars and trucks continued to sell very well in July, at a 15.6 million annualized rate, according to the Ward’s Automotive Group. That is up from 15.9 million in June.

Looking back, with the sole exception of August 2011 when it fell by 5.2 percent, the non-revolving debt total has increased in every month since July 2010. The figure for June was higher by 23.3 percent, or $376.9 billion, than the pre-Lehman peak of $1,617.4 billion, recorded in July of 2008.

Looking back, with the sole exception of August 2011 when it fell by 5.2 percent, the non-revolving debt total has increased in every month since July 2010. The figure for June was higher by 23.3 percent, or $376.9 billion, than the pre-Lehman peak of $1,617.4 billion, recorded in July of 2008.

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving constituents — rose by 5.9 percent, or $13.8 billion, to $2,847.9 billion in June. That new total is larger by $260.5 billion, or 10.1 percent, than the pre-Lehman record-high of $2,587.4 billion, recorded in July 2008.

The Takeaway

Last month’s Fed data led me to suspect that consumer attitude may have finally begun to shift toward taking on more credit card debt, following five years of deleveraging. But June’s report tells me that the previous month may have been no more than an aberration, of which we had already seen a few in the post-Lehman period. Supporting this proposition is the latest data on credit card delinquencies and charge-offs. According to Fitch, 60-plus-day delinquencies have fallen to a new all-time-low of 1.34 percent in July. Charge-offs have also decreased in July — to an 84-month-low of 3.62 percent. Fitch isn’t telling us how the monthly payment rate has fared last month, but in June it had reached an all-time high of 25.3 percent and there is no reason to expect it to have fallen in any dramatic fashion. And these are the metrics that matter, for as long as they remain at current levels or close, credit card debt will not be an issue. Of course, exactly the opposite is happening to the student debt, which is why it has become such a big issue.