Americans Keep Paying down Credit Card Debt

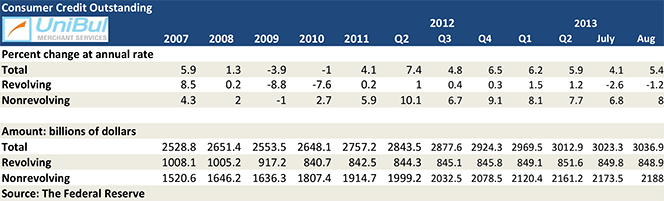

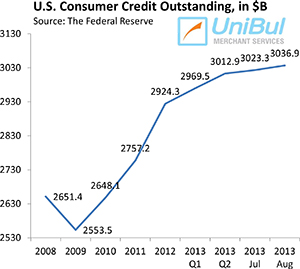

The total amount of outstanding consumer debt in the U.S. increased yet again, and by more than expected, in August — the 24th consecutive monthly increase — according to the latest Federal Reserve consumer credit data release. The total rose by $13.6 billion, following a $10.4 billion increase in July. Once again, the growth of the overall consumer debt total was the result of the continuing increase of the auto and student loan totals, which, in turn, have been fueled by the continuing recovery in the housing and stock markets. Since the outbreak of the financial crisis of 2008, auto and student loans have been the principal drivers of growth in consumer credit, whereas the credit card total, following a steep decline in the first couple of years after the meltdown, has remained relatively flat since around the end of 2010.

The growth of the federal student loan total had also slowed down considerably since the beginning of this year, which has been good news, considering that delinquencies and have gone through the roof and keep rising. However, August has brought another spike in that total, bringing the slowdown to an abrupt end.

The credit card debt total fell again for its third consecutive monthly decline, following a huge spike — the biggest one in years — in the month immediately preceding that trimester. As a result, the increase in May has now been more than fully reversed. And that should surprise no one who’s been paying attention — both credit card delinquency and charge-off rates have long been into record-low territories and are still falling. For as long as that trend holds, the credit card debt total will remain stagnant, if it doesn’t drop further. Let’s take a look at the latest Fed data.

Credit Card Debt down 1.2% in August

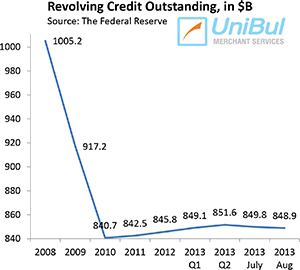

The total consumer revolving credit in the U.S., which is comprised almost exclusively of outstanding credit card balances, fell in August at a seasonally adjusted annual rate of 1.2 percent, or $900 million, from the previous month’s level, after a 2.6 percent decline in July. The Fed’s revolving credit total started a free fall in the immediate aftermath of Lehman’s collapse in September 2008 — a process that continued uninterruptedly until the end of 2010. Since then, it has bounced up and down, but has remained mostly unchanged.

The total consumer revolving credit in the U.S., which is comprised almost exclusively of outstanding credit card balances, fell in August at a seasonally adjusted annual rate of 1.2 percent, or $900 million, from the previous month’s level, after a 2.6 percent decline in July. The Fed’s revolving credit total started a free fall in the immediate aftermath of Lehman’s collapse in September 2008 — a process that continued uninterruptedly until the end of 2010. Since then, it has bounced up and down, but has remained mostly unchanged.

The total for August — $848.9 billion — is just 1 percent, or $8.2 billion, above the total reported at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Furthermore, the current total is lower by 15.5 percent, or $156.3 billion, than the all-time high of $1,005.2 billion measured at the end of 2008.

Non-Revolving Consumer Credit up 8%

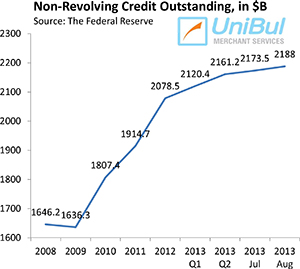

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued to rise, in keeping with another long-standing trend. The Federal Reserve reported a $14.5 billion — or 8 percent — increase in August from July’s level, bringing the total up to $2,188 billion. That followed a downwardly revised 6.8 percent increase in July.

The non-revolving component of the U.S. consumer debt total, made up of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued to rise, in keeping with another long-standing trend. The Federal Reserve reported a $14.5 billion — or 8 percent — increase in August from July’s level, bringing the total up to $2,188 billion. That followed a downwardly revised 6.8 percent increase in July.

As is clearly evident in the chart to the right, the non-revolving debt component of the total didn’t fall nearly as steeply as the revolving one in the aftermath of the financial crisis and then it was much quicker to rebound.

On the whole, with the unique exception of August 2011 when it fell by 5.2 percent, the non-revolving portion of the debt total has risen in every month since July 2010. The figure for August of this year was higher by 35.3 percent, or $570.6 billion, than the pre-crisis peak of $1,617.4 billion, measured more than five years earlier in July of 2008.

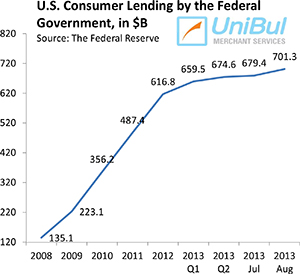

Student, Auto Loans Up

Following a period of relatively weak growth since the beginning of the year, the federal student loan total rose sharply in August. The Fed data tell us that lending to consumers by the federal government — which is mostly comprised of educational loans — jumped by $21.9 billion for the month to $701.3 billion, following an upwardly revised $4.8 billion increase in July. The last similarly large monthly increase in this debt category occurred in January of this year when the total grew by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has spiked by an astonishing 419.1 percent, or $566.2 billion.

Following a period of relatively weak growth since the beginning of the year, the federal student loan total rose sharply in August. The Fed data tell us that lending to consumers by the federal government — which is mostly comprised of educational loans — jumped by $21.9 billion for the month to $701.3 billion, following an upwardly revised $4.8 billion increase in July. The last similarly large monthly increase in this debt category occurred in January of this year when the total grew by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has spiked by an astonishing 419.1 percent, or $566.2 billion.

Fueled by still-low, though slightly higher than in previous months, interest rates, cars and trucks continued to sell very well in August, at an annualized pace of 16 million — the strongest showing since November 2007, according to Bloomberg.

Overall Consumer Credit up 5.4%

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving components — increased by 5.4 percent, or $13.6 billion, to $3,036.9 billion in August. That new total is greater by $449.4 billion, or 17.4 percent, than the pre-Lehman record-high of $2,587.5 billion, measured, once again, in July 2008.

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving components — increased by 5.4 percent, or $13.6 billion, to $3,036.9 billion in August. That new total is greater by $449.4 billion, or 17.4 percent, than the pre-Lehman record-high of $2,587.5 billion, measured, once again, in July 2008.

As others have pointed out, the Fed data are consistent with other trends showing that Americans have regained the confidence to make big-ticket purchases, such as homes and cars and to borrow for their education, but are still cautious when using credit cards for everyday purchases.

The Takeaway

So the biggest news in the latest Fed consumer debt report is the spike in the student loan category, following several months of relative calm. Other than that, Americans keep taking out ever more auto loans and remain obstinately unwilling to borrow more on their credit cards. And, considering the latest numbers on credit card delinquencies and defaults, it looks as though we should expect more of the same in the coming months.

Image credit: Flickr / geirarne.