Americans Get Higher Credit Card Spending Limits and Are Using Them

The aggregate credit card spending limits of U.S. consumers have now reached their highest point since the start of the financial crisis of 2008, credit reporting agency Experian tells us in a new report, and are growing at a brisk pace. Moreover, we learn, there has been an increase in credit card originations across all consumer risk segments, although, as would be expected, prime and near-prime borrowers have seen their credit limits expand the most.

Another report, this one from payment processor First Data, tells us that, along with credit limits, credit card spending in the U.S. has been growing at a fast clip since 2010 and the growth rate seems to be accelerating. Yet, even as Americans have been using their credit cards more freely, following a short period of stagnation in the immediate aftermath of the financial meltdown, they have not become any more tolerant to credit card debt. On the contrary, First Data reports, outstanding balances are falling, creating challenges for issuers in the process. Let’s take a look at these trends.

Credit Card Limits Up

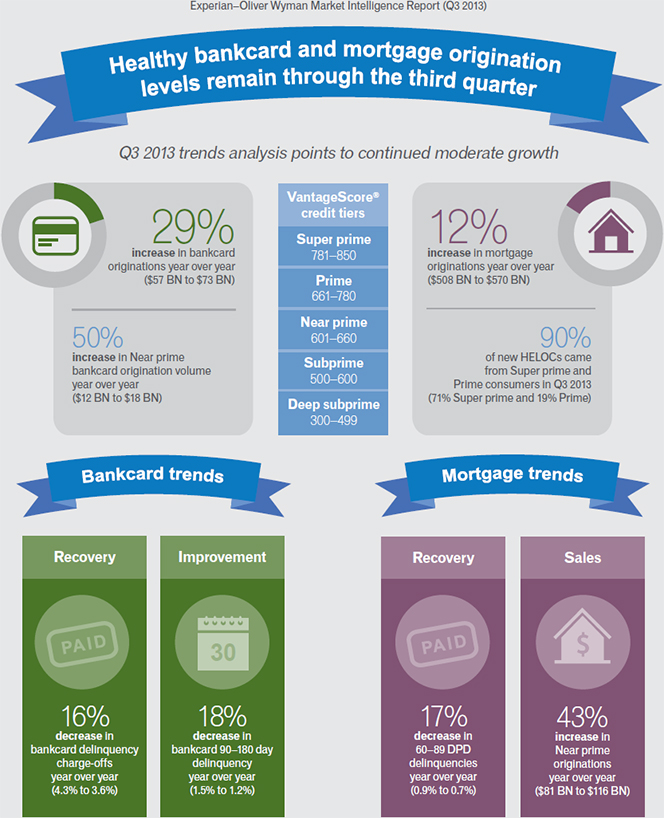

Analyzing bankcard trends from the Experian – Oliver Wyman Market Intelligence Report for the third quarter of 2013, the credit reporting agency finds a 29 percent annual increase in bankcard origination volumes (credit limits), which is equal to an increase of $16 billion in newly-issued bankcard limits. The 2013 Q3 bankcard origination volume of $73 billion, we learn, was higher than the corresponding total of $70 billion for 2008 Q4, the first full quarter after the collapse of Lehman Brothers.

As already noted, the increase in bankcard originations took place across all risk segments, which Linda Haran, senior director of product management and strategy for Experian Decision Analytics, sees as a good thing:

The positive growth trend signals a return to more normalized borrowing behaviors on the part of consumers. Notably, the $16 billion year-over-year increase on new credit limits spanned across almost all VantageScore segments, highlighting a return to more confident unsecured lending by card issuers.

And Haran seems to have solid grounds for her optimism: even as borrowers are getting easier access to credit, credit card delinquency and charge-off rates are falling. As Haran notes:

Even though overall debt levels for consumers increased 2.5 percent year over year to $10.8 trillion in Q3 2013, it is still well below 2008 levels, when consumer debt was nearly $12 trillion. In addition, delinquency rates for most lending products are at or near record lows, indicating that consumers are borrowing more responsibly. In fact, delinquent bankcard charge-offs decreased 16 percent in Q3 2013 compared with last year.

And newly-released data by First Data lend support for Haran’s analysis.

Credit Card Spending Up, Debt Down

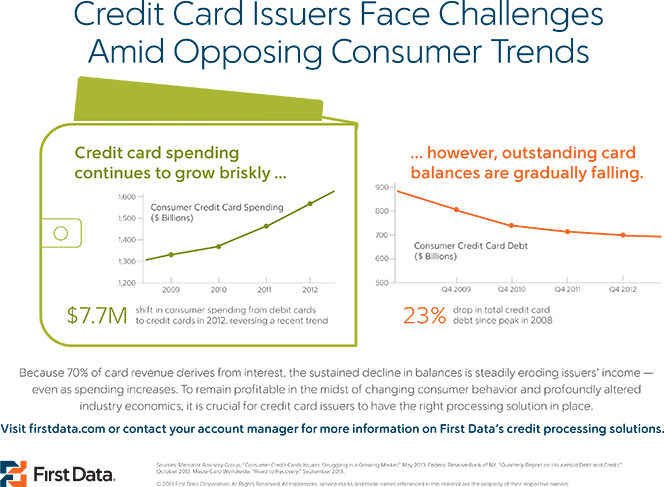

As you see in the infographic below, consumer credit card spending in the U.S. is growing briskly and at an accelerating rate. Yet, outstanding card balances have fallen by 23 percent since reaching a peak at the eve of the Lehman event and, more than five years later, they are still falling.

While these data indicate that, on the whole, Americans have, in recent years, become much better at managing credit card spending and debt, they also tell us that U.S. card issuers have a rather big problem. As First Data notes, 70 percent of the issuers’ revenues come from interest, so the ongoing decline of outstanding balances eats into their profits. And there is a limit on how much you can raise interest rates on the cardholders who do roll balances over from month to month.

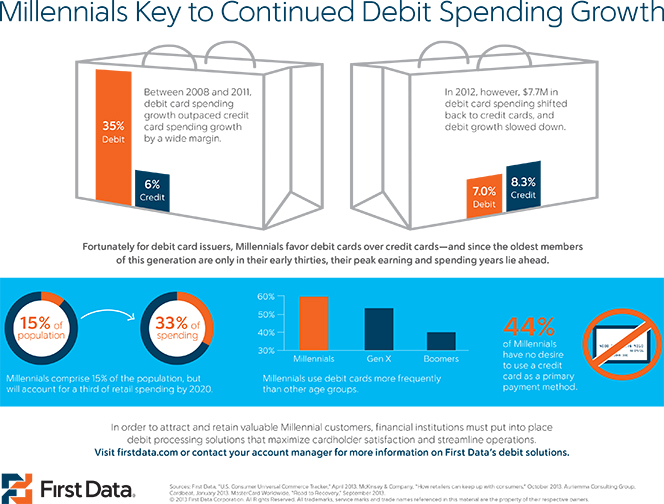

But won’t things change over time? Shouldn’t we expect that, once the 2008 financial crisis has receded far enough into the past, people would revert to type and become once again more at ease with credit card debt. Perhaps, but another First Data report indicates that the next generation of American cardholders may, if anything be even more averse to not only piling up credit card debt, but even to using credit cards in the first place.

As you see in the infographic below, Millennials — people born between the early 1980s and the early 2000s — favor their debit cards over credit cards by quite a margin and are using them much more frequently than older Americans. Furthermore, close to half of Millennials (44 percent) say that they have no desire to make credit cards their primary payment method. Of course, Millennials can change their payment preferences over time, but plenty of research strongly indicates that habits developed in a person’s early years are very difficult to dislodge later in life.

The Takeaway

Experian’s and First Data’s latest reports provide yet another evidence pointing toward a transformational shift that has taken place in consumers’ attitudes toward credit card spending and debt in the post-crisis period. For it is quite clear that Americans have become much more prudent in their use of credit cards and there is no indication that the process is about to reverse itself. On the contrary, both delinquency and charge-off rates are at record-lows and still falling and the monthly payment rate (MPR) — the portion of the total amount of credit card debt, which American cardholders are repaying at the end of each month — is at a record-high and still rising. It will be interesting to see how these indicators will be evolving over the course of this year.

Image credit: Uspirgedfund.org.