Americans Cut Back on Credit Card Debt, Take on More Auto and Student Loans

The U.S. consumer debt total rose again in December, we learn from the latest Federal Reserve consumer credit data release. It is the fifth consecutive such increase, which is exclusively the result of continuing strong growth of the non-credit-card part of the total and especially of its federal educational loan and car sale components.

On the other hand, Americans have cut back on their outstanding credit card balances, whose total at the end of December stood at about the same level it was at the end of last year’s first quarter. So, even as the housing market is slowly improving, as are the general economic conditions, Americans are showing no sign of warming up to credit cards, whose excessive use was one of the most conspicuous features of the hosing bubble. Let’s take a look at the latest Fed data.

Credit Card Debt down 5.1% in December

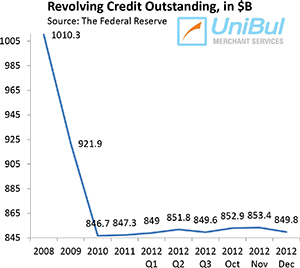

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, fell in December at a seasonally adjusted annual rate of 5.1 percent, or $3.6 billion, from November’s level, bringing the total down to $849.8 billion, just barely above the $849.0 billion total measured at the end of March of last year.

The total amount of outstanding consumer revolving credit in the U.S., which is comprised almost exclusively of unpaid credit card balances, fell in December at a seasonally adjusted annual rate of 5.1 percent, or $3.6 billion, from November’s level, bringing the total down to $849.8 billion, just barely above the $849.0 billion total measured at the end of March of last year.

After the fall of Lehman Brothers in September 2008, the revolving portion of the U.S. consumer debt total had been falling continually until the end of 2010. In 2011, however, it all changed and half of the Federal Reserve’s monthly releases for that year, including each of the last four reports, showed increases in the revolving debt total. Moreover, as the chart to the right clearly illustrates, that total has barely risen since reaching its lowest point at the end of 2010. And now the Fed tells us that at the end of December the revolving total was still lower by 15.9 percent, or $160.5 billion, than the $1,010.3 figure recorded at the end of 2008.

Overall Consumer Credit up 6.3%

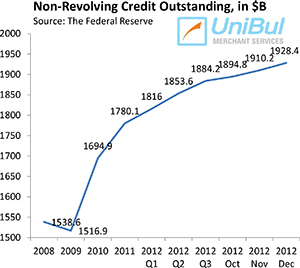

The non-revolving component of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported an $18.2 billion—or 11.4 percent—increase in December from November’s level, bringing the total up to $1,928.4 billion. Following a strong $15.3 billion increase in the previous month, December’s gain in non-revolving credit was the biggest one since November 2001, when the big automakers rolled out zero-percent financing and other major promotions and discount programs in a desperate attempt to get customers to start buying their cars again after the disruption caused by the September 11 terrorist attacks.

The non-revolving component of the consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, maintained its long-standing upward trend. The Federal Reserve reported an $18.2 billion—or 11.4 percent—increase in December from November’s level, bringing the total up to $1,928.4 billion. Following a strong $15.3 billion increase in the previous month, December’s gain in non-revolving credit was the biggest one since November 2001, when the big automakers rolled out zero-percent financing and other major promotions and discount programs in a desperate attempt to get customers to start buying their cars again after the disruption caused by the September 11 terrorist attacks.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the only exception of August 2011 when it fell by 5.2 percent. The figure for December is higher by 20.6 percent, or $329.7 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The aggregate amount of outstanding U.S. consumer credit—the sum of its revolving and non-revolving components—increased by 6.3 percent, or $14.4 billion, to $2,778.2 billion in December. The new total is larger by $190.8 billion, or 7.4 percent, than the pre-Lehman record-high of $2,587.4 billion, recorded in July 2008.

The Takeaway

The latest Federal Reserve data aren’t revealing any new trends. Americans are still paying down their credit card balances and even the holiday shopping season hasn’t managed to discourage them from pursuing that objective. It shouldn’t come as a surprise, then, that consumers continue to make their monthly credit card payments on time. In fact, according to credit ratings agency Fitch, the credit card delinquency rate at the end of January was 1.63 percent—the lowest one measured since the agency started keeping track on it in 1991.

At the same time, both the auto and student debt totals are growing very rapidly. As we’ve noted before, the student debt total is now greater by 56 percent than it was just four years ago and has now surpassed the credit card total for the first time ever. And Congress’ decision last year to keep the interest rate on new federal student loans at 3.4 percent for another year will do nothing to dampen demand. But then, dampening demand is the opposite of the stated government policy of giving student loans to everyone who wants them, irrespective of the borrowers’ ability to repay the debt. And the skyrocketing rates of delinquencies and defaults tell us that the result of that policy is precisely what it should have been expected. Of course, if you default on such a loan, the federal government can garnish up to 15 percent of your wages and the debt cannot even be discharged in a bankruptcy, so how does that serve the borrowers’ interest? It seems as if the time this question will have to be answered is rapidly approaching.

The government should get out of the student loan business altogether — that is the only way to curb the rising costs of education.

The student debt bubble is clearly inflating, but my guess is that it will be allowed to keep growing until it eventually bursts, whatever the consequences may be.