Americans Are Quickly Adopting Mobile Banking

That is the inescapable, though not unexpected, conclusion from the latest Federal Reserve Consumers and Mobile Financial Services survey and report. Prompted by the “rapid pace of developments in the area of mobile finance”, the Fed conducted the survey in November of 2012, less than a year after the first one was completed, to examine the trends in adoption and use of mobile banking and payments and compare the two surveys’ findings.

Though obstacles to consumer adoption remain, chief among them being concerns about security and a sense that the new technologies don’t really offer any benefits over existing ones, the use of mobile banking has increased by more than a third over the past year, we learn. Moreover, while still small in absolute numbers, the use of mobile phones for payments at the point of sale has increased even more rapidly. As an ever increasing number of consumers use smartphones, the researchers expect that the use of both mobile banking and mobile payments will continue to increase. Let’s take a look at their findings.

Use of Mobile Banking, Payments Up

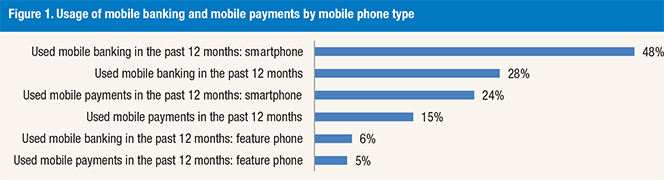

The Fed defines mobile banking as “[s]ervices that allow consumers to obtain financial account information and conduct transactions with their financial institution” using their phones, whereas mobile payments are services that “allow consumers to make payments, transfer money, or pay for goods and services”. Both have become more widely used over the past year. Mobile banking usage has increased from 21 percent of mobile phone users and 42 percent of smartphone users in December 2011 to 28 percent of mobile phone users and 48 percent of smartphone users in November 2012.

The use of mobile payments has increased less rapidly. In December 2011, 11 percent of mobile phone users and 23 percent of smartphone users reported using mobile payments. By November 2012, the ratios had risen to 15 percent and 24 percent, respectively.

Bank Branch Visits still Preferred Way of Banking

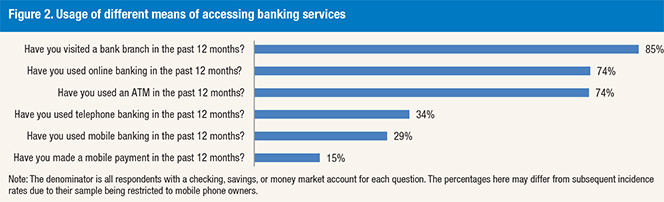

As you can see in the figure below, visiting a bank branch is still the preferred way for consumers to interact with financial institutions, with online banking and ATM visits following closely behind. Mobile banking occupies the second-to-last spot, but usage is growing fast — up by 7 percent from December 2011 to November 2012.

Young and Educated Consumers Most Avid M-Banking Users

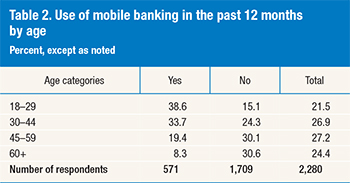

I suspect that it should come as no surprise to you to learn that mobile banking usage is highly correlated with age, with the 18-29 group accounting for approximately 39 percent of all mobile banking users, relative to 22 percent of mobile phone users.

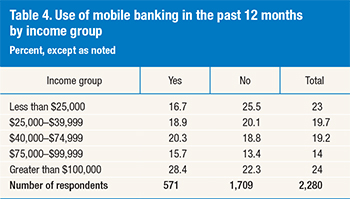

Mobile banking usage is generally unrelated to household income, the researchers find, except at the tails of the income distribution. Consumers earning less than $25,000 per year are significantly less likely to use mobile banking than their share of the mobile phone user population (23 percent) would suggest, whereas the opposite is true for those earning more than $100,000 per year. Here is the full distribution:

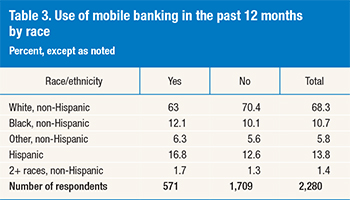

Minorities, Hispanic users in particular, are more likely to adopt mobile banking than non-Hispanic whites, as illustrated in the table below:

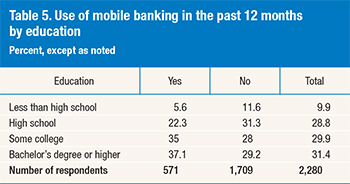

Educational level, it seems, is the most reliable determinant of mobile banking adoption. As shown in the table below, more than 72 percent of all mobile banking users have at least some college education, far more than their 60 percent share of all mobile phone users.

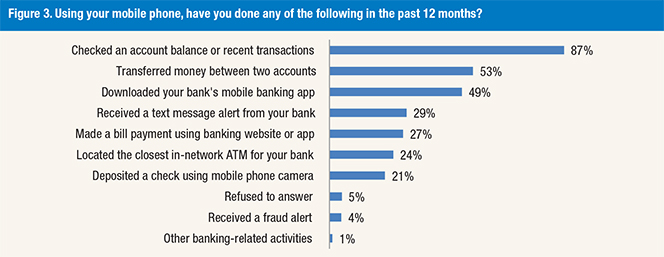

Checking Account Balances Most Common M-Banking Activity

Checking account balances and making transaction inquiries continue to be consumers’ favorite mobile banking activities, with 87 percent of users having performed at least one of them in the past 12 months, down only slightly from 90 percent in 2011. The transfer of money between accounts is the second most used mobile banking feature — 53 percent of users have reported that they had done so in the past year, up by 11 percent compared to 2011.

Among users, the frequency with which they use mobile banking has increased over the past year, we learn. Whereas the median reported usage was up only slightly — to 6 times per month from 5 times per month in 2011, the share of those using it more than 10 times per month rose to 35 percent from 22 percent.

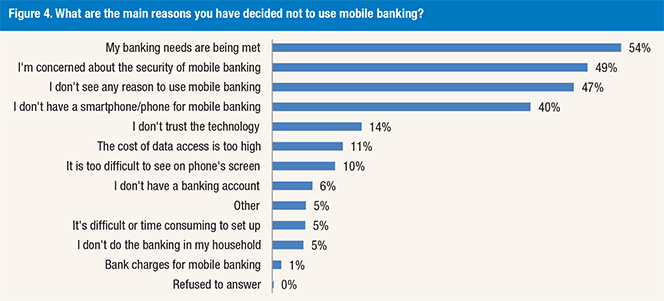

Half of Non-Users See no Need for Mobile Banking

The main reason why mobile phone users do not use mobile banking is that they believe their banking needs are met otherwise (54 percent). A substantial group of non-users (49 percent) are concerned about security and 47 percent don’t see any reason to use mobile banking at all.

Mobile Payments Limited but Growing

Mobile payments continue to have limited adoption, although usage is growing. Only 15 percent of mobile phone users said that they made a mobile payment in the past 12 months, up by a quarter from 12 percent a year before. The payment of bills is the most common type of mobile payments activity (42 percent), followed by making online purchases (35 percent) and both are down slightly in the past year. Using mobile phones to transfer money has become more common — nearly 30 percent of users transferred money directly to another person in the past 12 months, up from 21 percent in 2011.

Point-of-sale purchases with mobile phones have also become more common, with 9 percent of users reporting that they scanned a barcode or Quick Response (QR) code to make a payment and 9 percent saying that they used a mobile app to pay for a purchase. The share of users waving or tapping a mobile phone at a cash register to pay for a purchase has more than doubled from the previous survey, to 6 percent in 2012 from just over 2 percent in 2011.

Security Concerns, Alternatives Slow Down M-Payments Progress

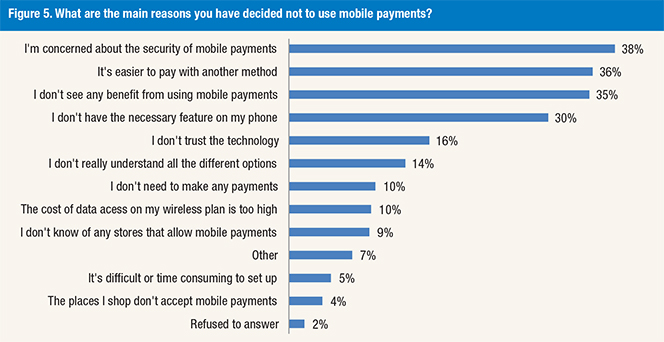

The biggest reason why consumers do not use mobile payments is security, cited by 38 percent of non-user respondents. Moreover, a substantial number of consumers see little or no need for mobile payments: 36 percent have reported that it is easier to pay with other methods and 35 percent have said that they don’t see any benefit from using mobile payments.

The Takeaway

On the whole, the use of mobile banking and mobile payments is growing and there is every reason to expect that in the not-too-distant future they will become the prevalent method of doing both banking and payments. The factors limiting consumer adoption — security concerns and the sense that mobile services don’t offer any real benefits to the user over existing methods — will gradually be overcome, as technologies improve and consumers become better educated about the new services. So yes, the future of mobile does look bright.

Image credit: Smartplanet.com.