Americans Adopt New Payment Methods, but Stick to Old Ones as Well

That is one of the most salient points made in a recent presentation given by Oz Shy from the Federal Reserve Bank of Boston. In it, he summarized the consumer payments data results from the 2011 Survey of Consumer Payment Choice (SCPC) (not publicly available as of yet) and other recent studies.

According to another statistic from the SCPC, the huge growth of debit card use in the U.S. over the past decade has resulted in a higher number of debit card transactions than cash payments in 2011. I’m pretty sure that this is the first time that cash has been supplanted at the top of this chart by another payment instrument and, given the fast proliferation of mobile payments technologies, I suspect that cash will only keep losing ground. Let’s take a look at the data.

What Choices Do We Have?

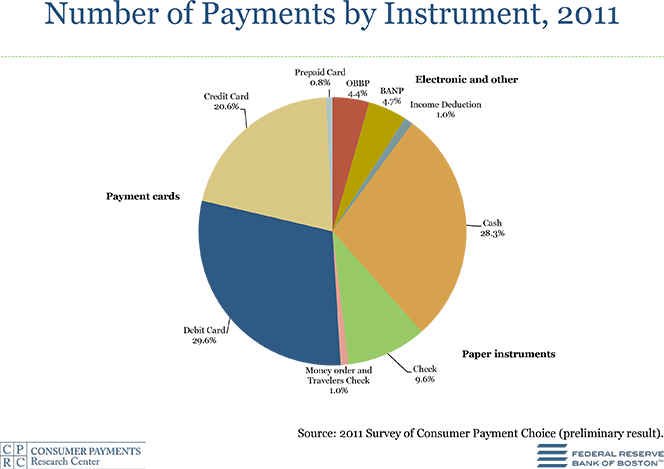

The SCPC provides detailed information on the adoption and use of nine payment methods: four paper instruments: cash, check, money orders, and traveler’s checks; three payment card types: credit?á cards, debit cards and prepaid cards; and two types of online?á payments:?á online banking bill payments (OBBP) and bank account number payments (BANP). The difference between the last two payment types is a minor one, but evidently it is significant enough to warrant tracking them separately. OBBP are payments made from a bank website where a consumer enters information about the biller. By contrast, bank account number payments are made from the biller’s website when a consumer enters her bank account and bank routing numbers. Now let’s review the data.

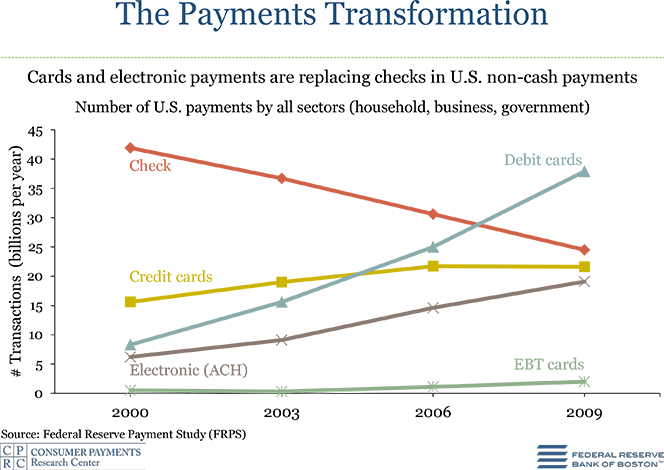

Debit Cards up, Checks Down

Since 2000, there has been a steady decline in the use of checks by Americans, which has been mirrored by a correspondingly steady rise of debit card and ACH use and a somewhat less prominent increase in the use of the other forms of electronic payments.

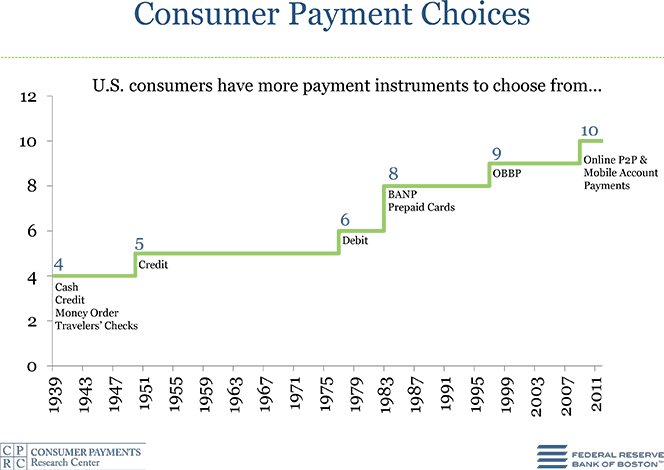

The Proliferation of Payment Choices

Here is a timeline of the introduction of new payment options. As you see, the starting point is 1939, when Americans had four payment methods to choose from: cash, credit, money order and traveler’s check.

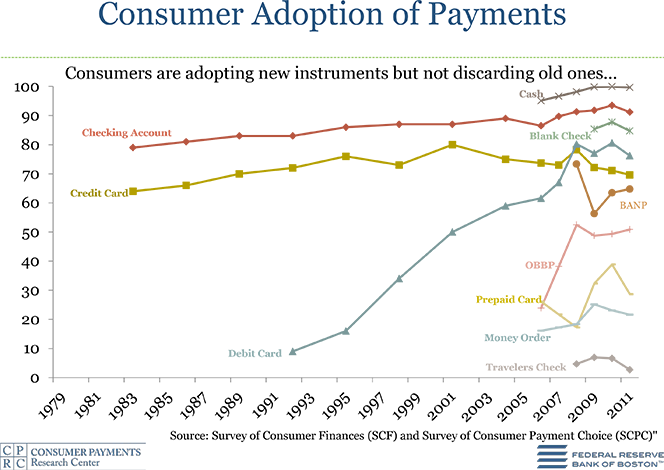

Adopting the New, Sticking to the Old

As already noted, even as Americans are quick to embrace new payment methods, they haven’t been discarding the old ones. As you can see in the chart below, even as the use of paper checks is on the decline, a great majority of consumers are nevertheless still using them.

Mixing It Up

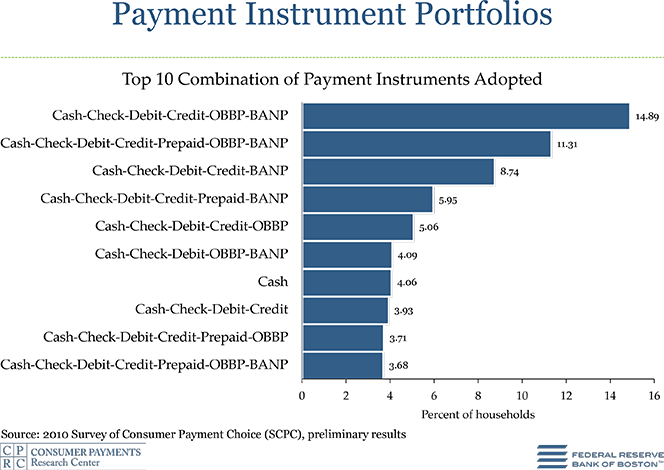

The vast majority of Americans — 96 percent of the total — use at least four different payment instruments, and 92 percent use five or more, in different combinations, which are presented in the chart below.

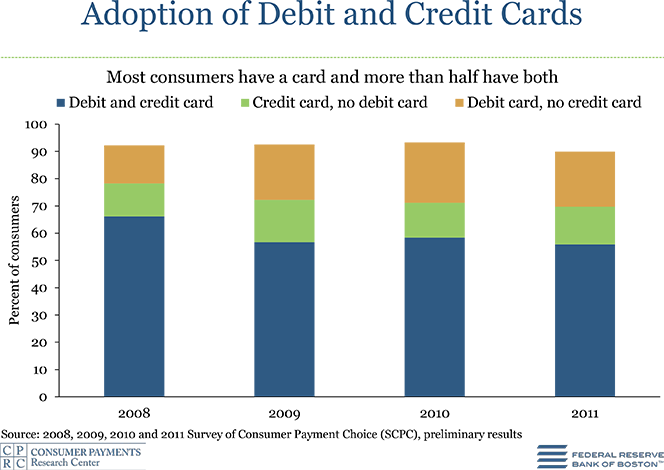

More than Half of Americans Use Debit and Credit

About ten percent of U.S. consumers have neither credit nor debit card and most of the rest use both, as the chart below illustrates.

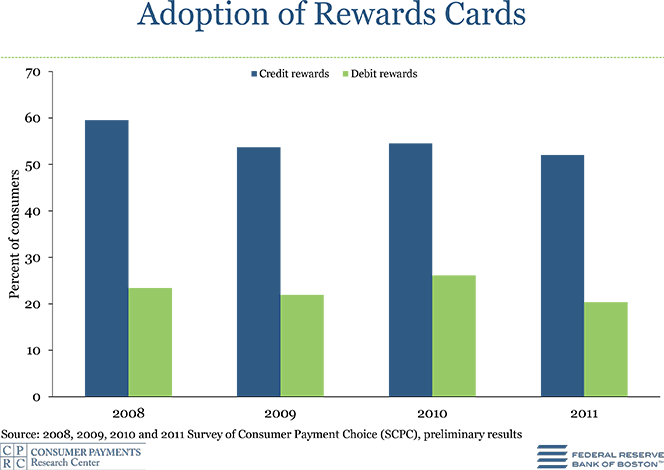

Use of Rewards Cards Down

Since 2008, the use of both credit and, to a lesser degree, debit rewards cards has declined, which probably mostly reflects a reduced availability, rather than a diminishing demand for these products.

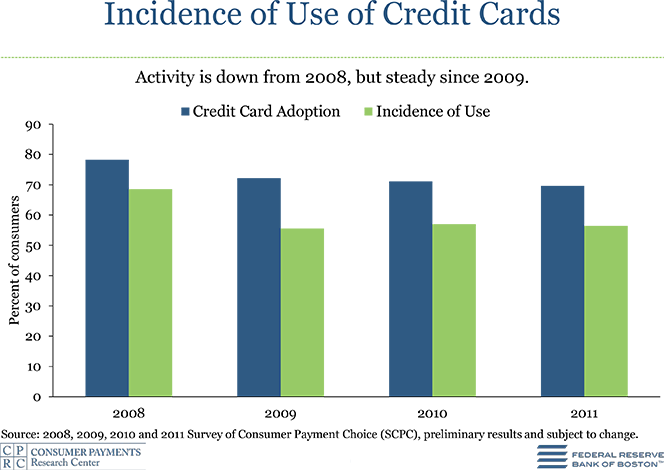

Fewer Consumers Use Credit Cards

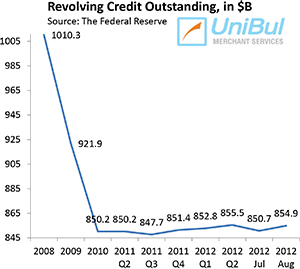

Since 2008, the number of consumers using credit cards has fallen and the same is true for debit cards. However, whereas since 2009 the trend is still downward for credit cards, there is a slight uptick in the re-adoption of debit cards.

Debit Takes the Lead

In 2011, debit cards were used in 29.6 percent of all payments in the U.S. Cash was used in 28.3 percent of the transactions. Here is the full breakdown:

What Do We Pay For?

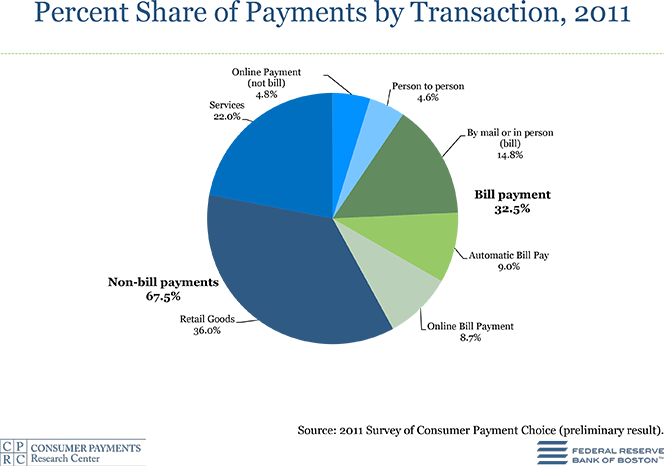

It turns out that slightly more than two-thirds of all payments made in the U.S. in 2011 were of the non-bill type and 36 percent of the total belonged to payments for retail goods. Here is the full breakdown:

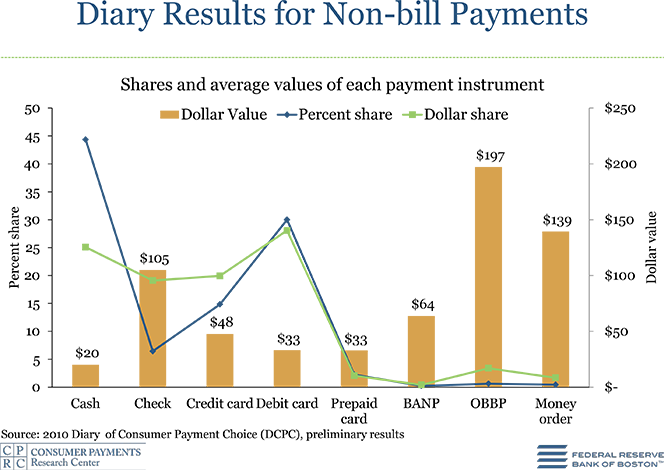

Online Bank Bill Payments Have Highest Value

The average amount of a single OBB payment is $197; the second-highest average belongs to money orders — $139 — and the third-highest — $105 — to paper checks. Here is the full breakdown:

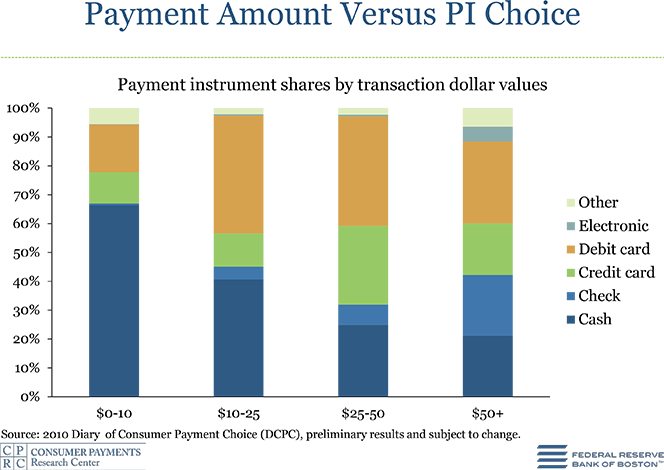

Cash Preferred for Small Amounts, Debit, Checks — for Large Payments

About two-thirds of all payments for amounts between $0 and $10 are made in cash. However, the share of cash payments for amounts greater than $50 falls to about 20 percent and most of the difference is made up for by increases in the use of debit cards and checks. Here is the chart:

The Takeaway

So there it is. Americans write fewer paper checks and use cash less frequently than they used to, whereas the use of all types of electronic payments is on the rise. While there are no signs that any of the traditional payment forms are facing imminent extinction, it is inevitable that the rise of mobile payments will accelerate the trend toward the preferential use of electronic payments even further.

Image credit: Instoretrends.com.