American Women Manage Credit Better than Men

That is the conclusion of a study conducted by Experian — one of the nation’s three major credit reporting agencies. The authors have analyzed the credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States and have found that women do better in each of these categories.

Naturally, the study has met with a lot of interest, which, doubtless, is precisely what Experian would have hoped to achieve. To further hype up the audience, an Experian executive informs us that women do better than men in managing money and debt, even as their pay, on average, is significantly lower than that of their male counterparts. Well, I, for one, see the income divergence as part of the explanation for Experian’s findings — it seems to me that earning much less money would force you to be that much more careful about how you spend it. But let’s take a look at Experian’s data.

Women Manage Debt Better than Men

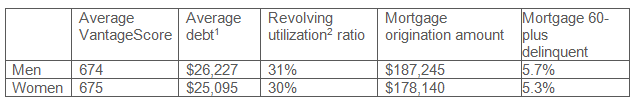

Experian has found that the average credit scores of men and women in their study are practically the same — the difference in only a single point — but there are substantial differences in other debt-related categories, including the following:

- Men have 4.3 percent more debt than women.

- Men’s credit utilization ratio — the ratio of used to available credit — is higher by 2 percent than women’s.

- Men’s average mortgage origination amount is higher by 4.9 percent than women’s.

- Men’s mortgage delinquency ratio is higher by 7 percent than women’s.

Here is a more detailed comparison:

Michele Raneri, Experian’s vice president of analytics, gives us the numbers behind the above-mentioned gender wage discrepancy and then proceeds to make a rather obvious observation:

When looking closer at our data and cross-referencing it with other data sources, we see that women working full-time in the United States earn approximately 23 percent less income3 than men but that women are taking steps to manage their finances better than men… The most notable difference is that men are taking bigger individual mortgage loans than women, but it would appear that they are having a slightly more difficult time making those payments on time.

Curiously, Raneri doesn’t even attempt to explain her findings, so I will take a shot at it in a bit. First, though, let’s take a closer look at the mortgage data.

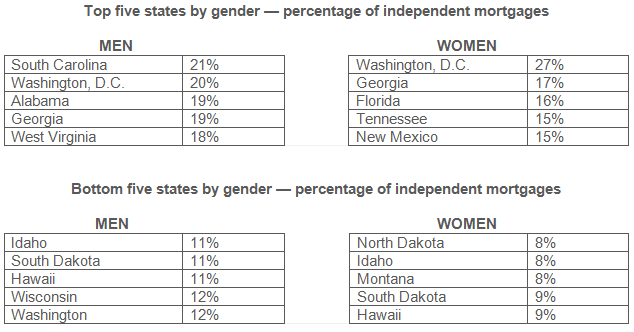

Men Take More Independent Mortgages than Women

On a national level, 72 percent of American consumers have joint mortgages, Experian tells us, and the remaining share belongs to men and women who borrowed on an individual (independent) basis. Overall, in the United States men have 18.3 percent more independent mortgages than women and they lead in every state, with the exception of Washington, D.C. (of course, that isn’t a state, but anyway) where women take out 33 percent more loans than men, we learn. Here are the states with the highest and lowest shares of independent mortgages, by gender:

Then the authors proceed to offer us some interesting mortgage data in a couple of states:

- The most significant difference [between men and women] at the state level is in Connecticut, where the average man has a mortgage loan of $229,510 and the average for women is $175,276, creating a gap of 24 percent between them. Men in Connecticut also have late payments 13.6 percent more often than women, carry an average debt that is 8.6 percent higher and have a 5.6 percent higher utilization amount than women.

- Florida stands out in the study, as the men and women in the Sunshine State both have some financial strain, but women still maintain a better financial picture on average. West Palm Beach, Fla. — Men have 24 percent higher mortgage amounts than women, and their occurrences of late payments on them are 17.5 percent higher than women. Miami, Fla. — Both sexes are struggling to pay their mortgages on time, with men’s occurrences of late payments at 13.1 percent and women’s at 12.7 percent, with a difference of only 2.8 percent between the two. The women in Miami, though, have a 6.9 percent lower average debt than men, which indicates they are approaching their debts better.

Of course, lest anyone forget, Experian doesn’t fail to inform us that, interesting as the gender differences in credit management may be, maintaining good credit is nevertheless what really matters.

The Takeaway

So here is what I can make of Experian’s data. Firstly, it seems to me that there is an obvious causation at work on the mortgage origination issue — men’s higher average income makes them better qualified for larger mortgages than women. The higher average mortgage origination amount would, in turn, explain men’s higher debt average. And men’s higher incomes could be making them more comfortable spending a larger proportion of their available credit than women — hence the slightly higher utilization ratio. However, I have no explanation to offer on the mortgage delinquency rate discrepancy.

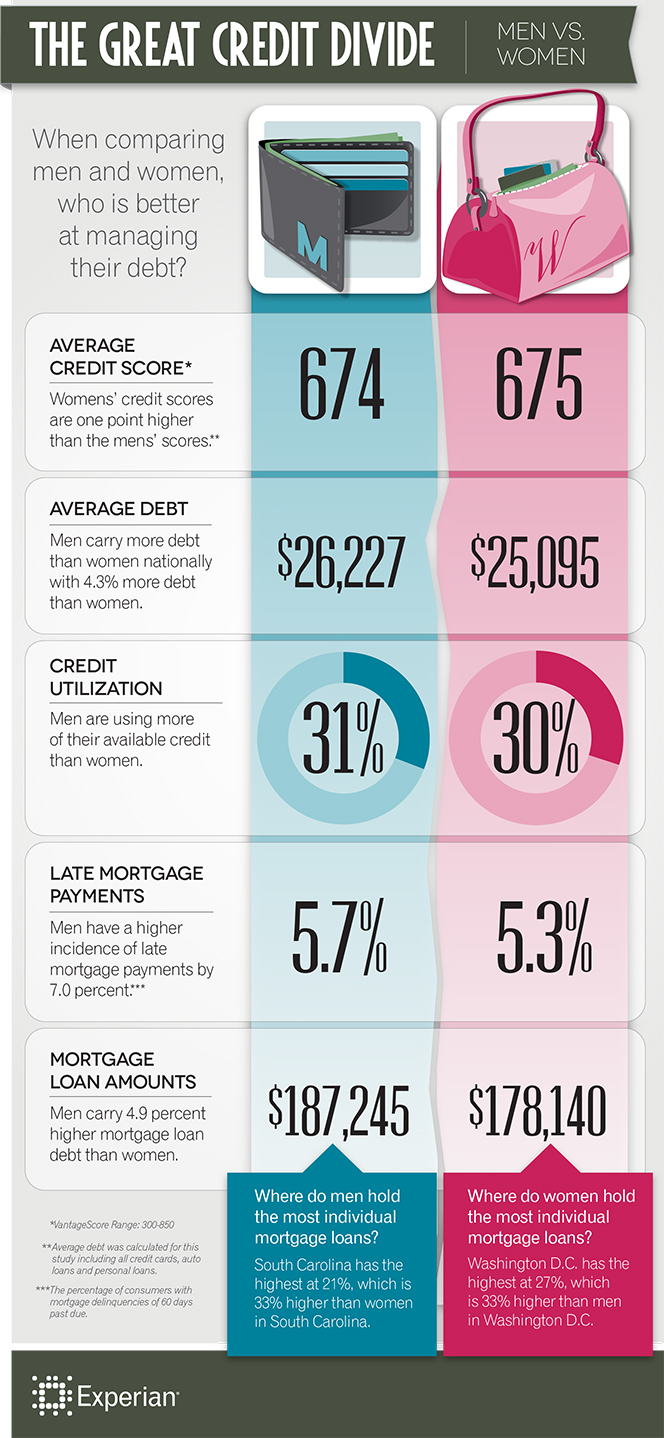

Finally, here is the infographic Experian has created to go along with their study:

Image credit: Experian.