American Express Security Code: Everything You Need To Know

Whenever you make a payment for something you bought online or over the phone with your AmEx credit card, you will be asked to provide something called an “American Express security code”. In fact, you will be asked for a card security code whatever payment card you may be using, including Visa, MasterCard and Discover.

The feature in question is a security code on a card, which may also be called your credit card CVV (that stands for “card verification value”).

In this guide, you will learn what the card security code means, what types of it there are, where they are located on the various card types and how to use them. And because all card brands have them, we’ll also look at how Visa, MasterCard and Discover manage this security feature.

Table of contents:

- What Is The American Express Security Code For?

- How Are The Card Security Codes Used?

- How Do The Card Brands Manage CVV Codes?

- Where Are The CVV Codes Located?

- What Part Do Card Security Codes Play?

- American Express security code: The Takeaway

What Is The American Express Security Code For?

Merchants use the Visa, MasterCard, Discover and AmEx security code as another means to verify that the customer is in a physical possession of their credit or debit card when a payment is made online or over the phone. As these numbers are not encoded in the card’s magnetic stripe, they cannot be “read” by a point-of-sale (POS) terminal and so cannot be used in face-to-face transactions.

In fact, merchants are prohibited from storing your CVV or they risk severe penalties, including heavy fines and losing the ability to accept cards for payment altogether.

Some merchants still refuse to include a CVV field in their online checkout forms, out of a misplaced fear that doing so may confuse some of their customers or otherwise discourage them to complete the transaction and so lead to a lost sale. As I already indicated, such fears are unfounded and the reality is that the merchant stands to gain much more from requesting the CVV code than she stands to lose from not doing it. And so does the customer.

How Are The Card Security Codes Used?

Depending on your credit card brand (Visa, MasterCard, Discover or American Express), the security code may also be referred to as your:

- CSC or card security code

- CID or card identification number

- CVC or CVC2, or card verification code

- CVV2, or card verification value code, 2nd generation

This three-digit Visa, MasterCard and Discover code and the four-digit American Express CVV tell the merchant that you are in actual possession of the card and also protects you from credit card fraud. As you are not in front of them when the payment is made online or over-the-phone, the merchant cannot verify your identity with a photo ID or by comparing your signature to the one on the back of the card.

In such circumstances, asking for your credit card CVV is helpful for both parties in the transaction, because a potential fraudster will not have access to it if they stole your credit card number (or bought it on the black market online), but don’t have the actual plastic piece, on which it is embossed. In other words, your credit card CVV code is another way to help keep your credit card information safe online.

It should be noted that there is no universal standard governing the use of card security codes across all payment brands and so each one keeps its own set of rules. That being said, the rules are all quite straightforward and in any case they have more features in common than differences.

How Do The Card Brands Manage CVV Codes?

The card security codes are known by different names and abbreviations and the various payment networks which have instituted them are placing those security features at different locations within their cards, as explained in the table below:

|

Card Brand |

CVV Code |

Code Description and Location |

|

Visa |

CVV2 — Card Verification Value 2 |

The last three digits of the number printed in the signature panel on the back of each Visa card. |

|

MasterCard |

CVC 2 — Card Verification Code 2 |

MasterCard uses its security code the exact same way Visa does — see above. |

|

Discover |

CID — Card Identification Number |

Discover also uses the same process as Visa and MasterCard — see above. |

|

American Express |

CID — Card Identification Number |

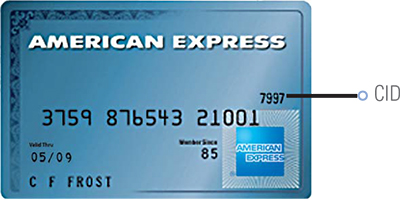

The AmEx CVV code is unique: it’s the four-digit number you see above the card number on the front of the card. |

Where Are The CVV Codes Located?

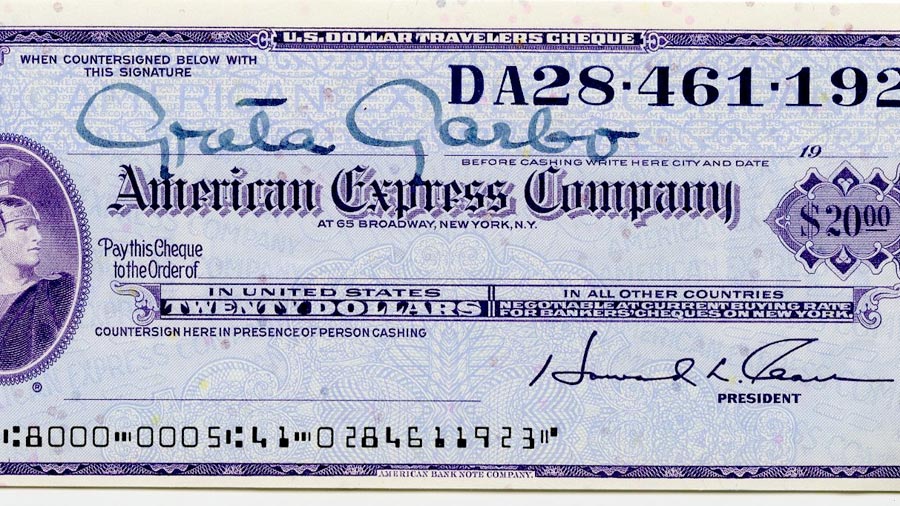

Now let’s be even more specific and visual and take a look into each individual card brand. First, here is the AmEx CVV location:

Now let’s look at MasterCard’s CVC 2:

Now it’s the turn of Visa’s CVV2 code:

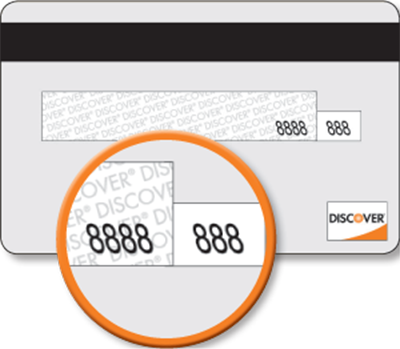

Finally, let’s take a look at Discover’s own CID code:

What Part Do Card Security Codes Play?

It is important to understand that the American Express security code and its counterparts at the other card brands are a part of a broader ecosystem of security features, which together help to reduce fraud and keep sensitive information safe. Let’s take a look at each one of them.

American Express Security Code And Features

American Express have the most unique design among the major payment cards, which is mostly to be found in the cards’ security features. Still, as is the case with Visa and MasterCard, it would take a trained eye just a few seconds to validate that these features have not been tampered with.

American Express Card Security Features

There are various different types of American Express designs, which means that not all of the brand’s cards will display all of the security features that follow, but most of them will.

AmEx account numbers begin with “3”. All AmEx account numbers are embossed on the card and begin with “37” or “34”. This rule applies to all American Express cards.

AmEx account numbers begin with “3”. All AmEx account numbers are embossed on the card and begin with “37” or “34”. This rule applies to all American Express cards.- American Express card numbers are all 15-digit long. This is unique to AmEx. The numbers have no alterations and are spaced in groups of four, six and five digits, as follows: “xxxx xxxxxx xxxxx”. In contrast, all Visa, MasterCard and Discover card numbers are 16-digit long, spaced in four even groups of four digits each.

- Card Identification Number (CID) / CVV. As we already saw, the AmEx security code is called CID and is the equivalent of Visa’s CVV2, MasterCard’s CVC 2 and Discover’s CID. Unlike its rivals, which all use three-digit security codes and put them on the back of their cards, either within or immediately to the right of the signature panel, American Express’ CID is four-digit long and is printed above the embossed account number on the right or left of the card.

- Cardmember name. The cardmember’s (as AmEx calls us) name is printed in the lower left corner of American Express cards, which is as the other brands do it.

- Member since. The “Member Since” date is embossed to the right of the card’s expiration date. For their part, Visa, MasterCard and Discover all put the “Member Since” date (where present) to the left of the expiration one.

- Expiration date. American Express’ expiration, or “Valid Thru”, date is embossed above the cardholder name field, in the format “mm/yy”.

- Centurion image. The Centurion image is placed in the middle of most, though not all, American Express cards and once again is unique to the brand (as well as trademarked). It is phosphorescent, with the repeated words “AMEX” visible under UV light.

- Centurion hologram. Some American Express cards display a hologram of the Centurion image embedded right into their magnetic stripe.

- Card number within the signature field. Again uniquely, the card’s account number is printed within the signature field of most American Express cards and, needless to add, must match the embossed one on the front of the card, as well as the one printed on the transaction receipt. The competitor brands usually print only the last four digits of their account numbers within the signature field (though not always, as we will see).

- Cardmember signature field. The card’s signature field is found below the magnetic stripe on the back of all American Express cards, just as it is on Visa, MasterCard and Discover ones. The words “Cardmember Signature” are printed right underneath it.

It should be reiterated that some American Express cards will not display all of these security features. For instance, you will not see the Centurion image on AmEx Blue cards and there may also be other missing features. Still, any security features that are present on the cards must adhere to the above specifications.

Visa

All valid Visa credit and debit cards have a set of unique security features, with some of which you are already familiar. Below you will find a complete list, along with tips on how to verify each card’s validity. Merchants are required to examine these features while waiting for the card issuer’s response to an authorization request. Remember that an authorization approval does not necessarily protect against fraud, but that is a subject for another day.

Visa Card Security Features

- Visa brand logo. The blue and gold logo of the Visa payment network is usually displayed on a white background in the bottom right of their cards, although it may be found in the top left or top right corner. Note that the upper left placement is used solely on chip cards.

- Visa card number. Visa credit and debit card numbers always begin with the number “4” and are all 16-digit long — there are no exceptions to this rule. The card numbers must appear in a single line and be clear and uniform in both their size and spacing.

- Card issuer BIN number. The first four digits of every Visa card number must be printed immediately underneath the number itself. This is the card issuer’s Bank Identification Number (BIN). These two numbers must always match each other.

- Member since. Some of Visa’s payment cards display the month and year when the account was first open. That date should be written in the format “mm/yy” and its location is usually found to the left of the expiration date and underneath the account number.

- Expiration date. Visa’s card expiration date is located below the 16-digit account number and should be written in the format “mm/yy”. Expired cards are no longer valid and must not be accepted for payment.

- Cardholder name. Visa’s cardholder name or a generic title may be either printed or embossed on the front of the card, though on some cards this field may be left blank.

- Micro-chip. Some Visa cards incorporate a chip, which, if present, is located right above the account number.

- Visa dove hologram. The network’s dove hologram may be located anywhere on the face or back of Visa’s card. When examined, this three-dimensional image should leave the impression to be moving as you rotate or tilt the card.

- Vertical orientation. Some Visa cards are oriented vertically and when they are, the account information is not embossed as it is on conventional cards, but is laser-printed instead. These cards feature magnetic stripes and a card verification code on the back, just as the horizontal-oriented ones.

- Mini-card. There is also a miniature version of the standard Visa Card and Visa Electron Card.

- Magnetic stripe. The magnetic stripe stores the card account’s identifying information. When the card is swiped through a point-of-sale (POS) terminal, these data are “read” and shown on the terminal’s screen. That information needs to match what you see on the card itself.

- Signature panel. The signature strip is found on the back of the card, with the word “Visa” repeatedly printed within an ultraviolet element inside it. Depending on the card’s design, that panel may have the full 16-digit account number printed on it or, alternatively, its last four digits or none at all. When the signature panel is scratched or erased, the word “void” shows repeatedly underneath.

- Card Verification Value 2 (CVV2). The three-digit CVV2 card verification number is placed in a white box either to the right of the signature strip or within it. As explained above, it is used in card-not-present transactions to validate that the customer is in physical possession of the card.

MasterCard

Similarly to Visa and American Express, all valid MasterCard payment cards display a set of unique security features, which you should be able to recognize. You will see that the two biggest U.S. card brands have developed very similar security standards for their cards’ designs, yet there are some differences.

MasterCard Card Security Features

- MasterCard brand logo. All cards must feature a full-color MasterCard brand mark, which is typically found in the bottom right corner.

- MasterCard account number. MasterCard’s card numbers must always begin with the number “5” and, just like Visa’s, are 16-digit long. They must be clear and uniform in both size and spacing and appear on one line.

- Bank Identification Number (BIN) number. The first four digits of the card number must match those printed directly below — the pre-printed BIN. As we already saw with Visa, this number identifies the card issuer.

- Card expiration date. A valid expiration date should be in the format “mm/yy” and be in the future.

- Cardholder name. Just as is the case with Visa cards, MasterCard’s cardholder name is printed on the face of the card.

- Micro-chip. Some MasterCard cards feature a chip, which is placed above the account number.

- HoloMag. MasterCard’s hologram, known as HoloMag, can be located on the front or back of the card. If on the front, it will be placed above the brand mark. If on the back, it will be seen next to or below the signature panel.

- Vertical orientation. Similarly to Visa, some cards’ design and brand mark may be oriented vertically.

- Signature panel. MasterCard’s signature panel is found on the back of the cards, with the word “MasterCard” printed in multi-colors at a 45° angle. The last four digits of the card number must be printed in reverse italic letters inside the signature panel.

- Card Verification Code 2 (CVC 2). The three-digit CVC 2 security code must be printed in reverse italics and placed to the right of the last four digits of the account number inside the signature panel.

- Magnetic stripe. MasterCard’s magnetic stripe, when present, must be located above the signature panel on the back of the card and be smooth and straight in appearance, with no visible signs of tampering. Some cards will have the HoloMag tape in place of the magnetic stripe.

It should be noted that there are various MasterCard designs in use today and some of the security features listed above may not be seen on some cards. Yet, when present, all of these features must comply with the above specifications.

Discover

The smallest of the major U.S. payment card networks has developed a card design, which is quite similar to those of Visa and MasterCard. Yet, as we will see below, there are still some unique features, which you need to know.

Discover Card Security Features

- Discover Network. The words “DISCOVER NETWORK” will show under an ultraviolet light.

- Discover card number. All Discover card numbers start with “6” and, like Visa’s and MasterCard’s, are 16-digit long. Embossed numbers must be uniform in size and spacing and extend into the card’s hologram. Unembossed Discover cards may show both the account number and expiration date, printed flat on the card’s face.

- Expiration date. As customary, the “Valid Thru” date, which shows the last month in which the card is acceptable for payment, is located below the account number and to the right of the “Member Since” date.

- Business name. When applicable, a “Business Name” may be embossed underneath the account name.

- Stylized “D”. This is an embossed security character, which appears as a stylized “D”. Please note that no stylized “D” is used on unembossed cards.

- Hologram. Some Discover cards may feature a hologram on the card’s front side, with a globe pierced by an arrow. When the back of the card shows a holographic magnetic stripe, however, there is no hologram on its front.

- Magnetic stripe. Discover’s magnetic stripe should be smooth, with no indication of tampering. Some cards feature a holographic magnetic stripe with blue circles.

- Discover Network on the back. The words “DISCOVER NETWORK” are repeatedly placed within the signature panel.

- Last four digits. The card number’s last four digits appear within the signature panel in reverse indent printing.

- Card Identification Number (CID). As already seen above, the three-digit CID is printed in a separate box to the right of the signature panel on the card’s back.

- Discover brand logo. The Discover Network Acceptance Mark is displayed on the face and / or back of the card.

American Express security code: The Takeaway

As you have just seen, the credit card companies have deployed plenty of security features, with the card security codes playing a prominent role among them, to help protect both themselves, but also their customers (i.e. you and me), from fraud. And for good reason. Fraud can be both incredibly costly, but also hugely inconvenient for everyone on the receiving end and it makes perfect sense to try and minimize it as much as possible.

Yet, even the best thought-out fraud protection strategies will not be enough when the card user fails to take an active role in certain circumstances. So, whenever you notice signs of suspicious activity or potential fraud attempts, be sure to call your credit card company (their number is on the back of your card) and ask them for assistance.

Image credit: Wikimedia.