Alaska Keeps Leading Nation in Credit Card Debt, by a Huge Margin

The margin by which Alaskans lead the nation’s most credit card indebted states never ceases to amaze me and that was the case once again when I saw TransUnion’s latest quarterly analysis of credit-active U.S. consumers. Whereas in the first qusrter of this year Alaska’s average has decreased by a few percentage points from the previous quarter’s level, so have the ones of the states immediately behind our northernmost state in this unenviable statistic, so Alaska’s lead remains as wide as it was at the end of last year. Another noteworthy fact is that the other states rounding out the top four are the same as the ones from last quarter’s list, although they’ve changed positions and are closely spaced anyway. Much the same is true for the bottom of the table where we see only one new entrant.

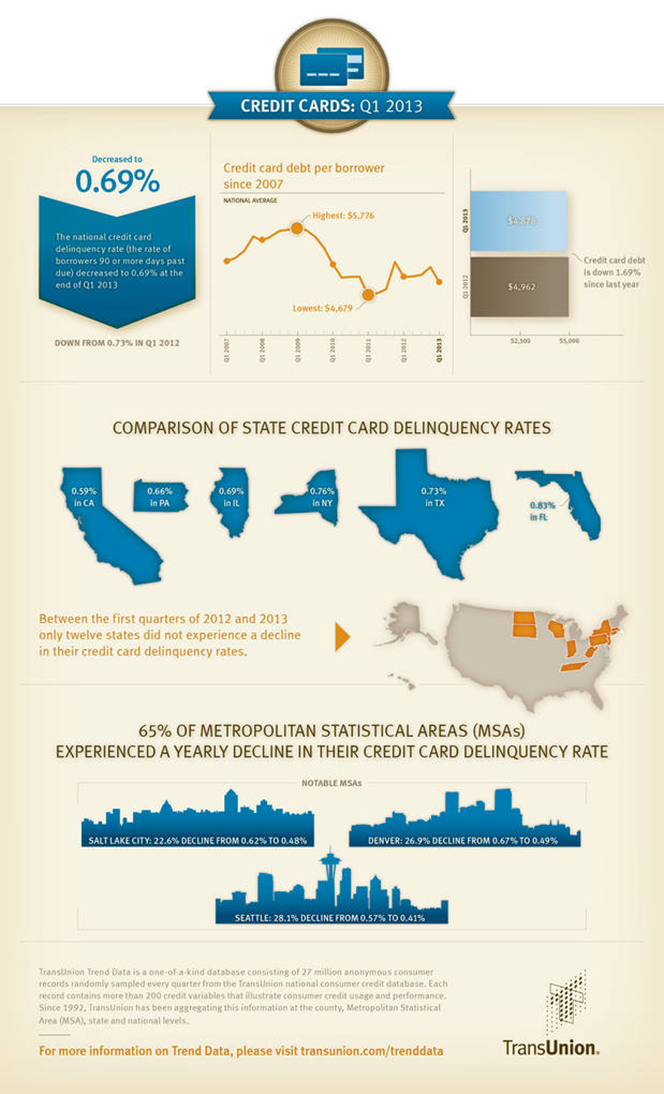

The national credit card delinquency rate in the first quarter has fallen both on a quarterly and yearly basis, TransUnion tells us and continues to be well below the historical average. Southern states have the highest delinquency levels, with Mississippi once again on top, even as it has registered a marked improvement. Only twelve states have experienced increases in their late payments rates, we learn, and the ones that lead in this category have all had very low starting points and their current levels are still below or very close to the national average. Let’s take a closer look at the numbers.

Alaskans Most Indebted to Credit Cards

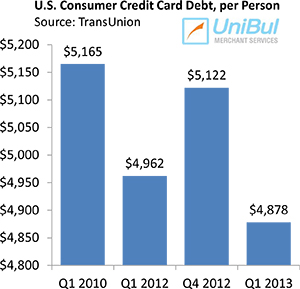

The average amount of credit card debt per U.S. borrower in Q1 2013—$4,878—has decreased by 1.7 percent from the $4,962 level measured in Q1 2012. On a quarterly basis the decrease was 4.75 percent—from $5,122 in Q4 2012. Credit card debt in the U.S. peaked at $5,729 in Q4 2009.

The average amount of credit card debt per U.S. borrower in Q1 2013—$4,878—has decreased by 1.7 percent from the $4,962 level measured in Q1 2012. On a quarterly basis the decrease was 4.75 percent—from $5,122 in Q4 2012. Credit card debt in the U.S. peaked at $5,729 in Q4 2009.

Here are the rankings of the leading states, by the average credit card debt of their residents, on both ends of TransUnion’s quarterly table:

1. Alaska — $6,789.

2. Colorado — $5,525.

3. North Carolina — $5,499.

4. Connecticut — $5,498.

…

47. Wisconsin — $4,189.

48. South Dakota — $4,038.

49. North Dakota?á– $3,987.

50. Iowa — $3,810.

On a quarterly basis, Alaska’s average fell by 3.2 percent—from $7,012 in Q4 2012—and the other most indebted states registered similar declines. The biggest year-over-year fall in credit card debt was recorded in Nevada—5.21 percent (from $5,019 to $4,758)—and the biggest increase occurred once again in the District of Columbia—2.46 percent (from $5,179 to $5,306).

Credit Card Delinquency Rate Down

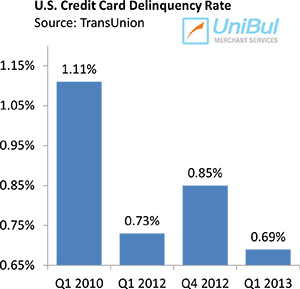

TransUnion reports that the U.S. credit card delinquency rate fell to 0.69 percent in Q1 2013, down from the 0.73 percent level recorded in Q1 2012, and also down from the previous quarter’s level of 0.85 percent. The delinquency rate is not quite at an all-time low—the lowest delinquency rate ever measured by TransUnion was 0.56 percent in Q3 1994—but it is nevertheless quite low by historical standards, and well below the peak of 1.42 percent measured in Q4 2003.

TransUnion reports that the U.S. credit card delinquency rate fell to 0.69 percent in Q1 2013, down from the 0.73 percent level recorded in Q1 2012, and also down from the previous quarter’s level of 0.85 percent. The delinquency rate is not quite at an all-time low—the lowest delinquency rate ever measured by TransUnion was 0.56 percent in Q3 1994—but it is nevertheless quite low by historical standards, and well below the peak of 1.42 percent measured in Q4 2003.

As I’ve noted repeatedly, TransUnion’s quarterly delinquency report is more valuable than the data we get from the card issuers’ monthly regulatory filings, because the credit bureau gives us a more comprehensive picture of the debt repayment behavior of American consumers. Whereas the credit card companies calculate their delinquency ratios on a per-account basis, TransUnion measures the share of consumers who are late on a payment to any one of their credit cards. Furthermore, the credit reporting agency defines an account as delinquent if a payment is past due by 90 days or more, whereas the issuers use two shorter time periods: early-stage delinquencies for payments late by 30-59 days and late-stage delinquencies for the ones overdue by 60 days or more. The end result is that TransUnion’s delinquency rate falls somewhere between the card issuers’ delinquency and charge-off rates (accounts are usually charged off as losses at 180 days after the last payment on the account).

Mississippi Has the Highest Delinquency Rate, South Dakota—the Lowest

In Q1 2013, only twelve states recorded an increase in their credit card delinquency rates. Listed below are the states leading both ends of TransUnion’s delinquency table:

1. Mississippi — 1.11%.

2. Alabama — 0.94%.

3. Arkansas — 0.89%.

4. Georgia — 0.87%.

…

47. Minnesota — 0.44%.

48. Montana — 0.43%.

49. North Dakota — 0.43%.

50. South Dakota — 0.43%.

The biggest year-over-year delinquency increase was recorded in North Dakota—30.30 percent—but the starting point (0.33 percent) was incredibly low. The largest decline was measured in Colorado—23.53 percent (from 0.68 percent to 0.52 percent).

The Takeaway

Ezra Becker, a TransUnion vice president, tells us that his company’s findings are precisely what we should have expected to take place this time of the year:

We traditionally see credit card delinquencies and balances decline during the first three months of the year as many people pay down their holiday shopping balances or use their tax refunds to pay off their debts.

In addition to the expected seasonal drop, Becker also sees the numbers as “indicative of how consumers continue to value their credit card relationships”. All other data I’ve seen over the years following Lehman’s collapse confirm Becker’s conclusion. Americans’ credit card accounts continue to look in great shape.

Here are TransUnion’s findings presented in an infographic:

Image credit: Flickr / 401(K) 2013.