A Credit Card Payment Is So Incredibly Simple… Until You Take A Closer Look.

Every now and then I will come across a new description of the credit card transaction process. These take various shapes, some are supported by visual representations of the various interactions that take place after a card payment is initiated and, as you would expect, some are better than others. But I’m always grateful to the authors for giving me the opportunity to refresh my own knowledge.

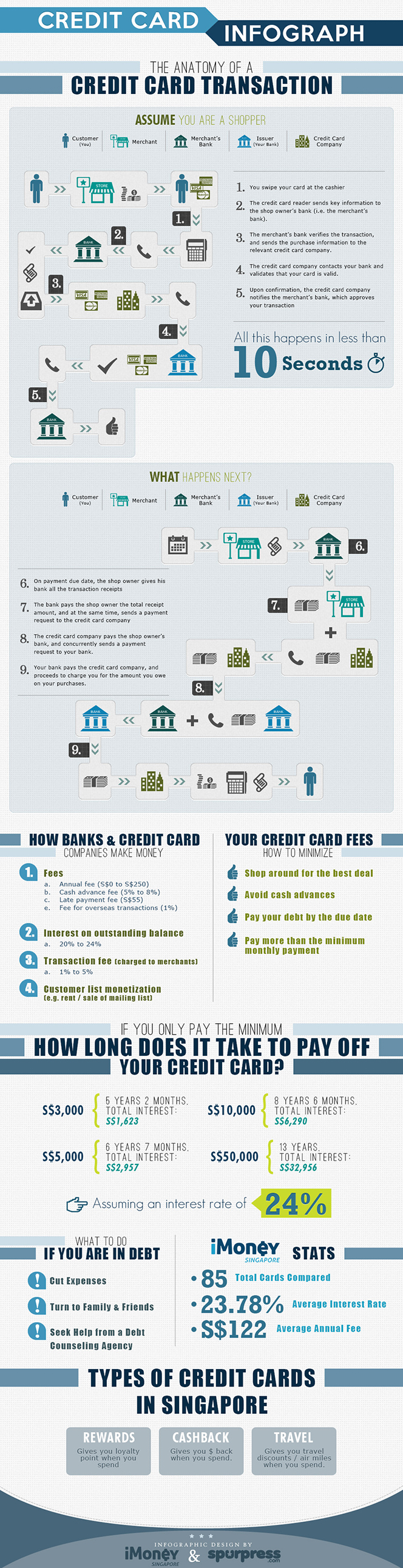

Well, the latest such description to come my way is an infographic produced by Singapore’s iMoney and spurpress.com. It is a good effort to get at the heart of the issue, visually pleasing and, I think, straightforward enough for everyone to understand. However, straightforwardness and simplicity usually come at the cost of accuracy and this graph is no exception. For, whereas the transaction process is correctly presented (albeit there is something to be desired in the authors’ choice of terms), that is not the case in the offered explanation of “how banks & credit card companies make money”, as I will explain in a bit.

I also felt like comparing the iMoney graph to the ones produced by the credit card networks themselves. After all, Visa and MasterCard should know best how their transaction processes work. Whether they also know best how to present these processes to the lay public will be up to you to decide.

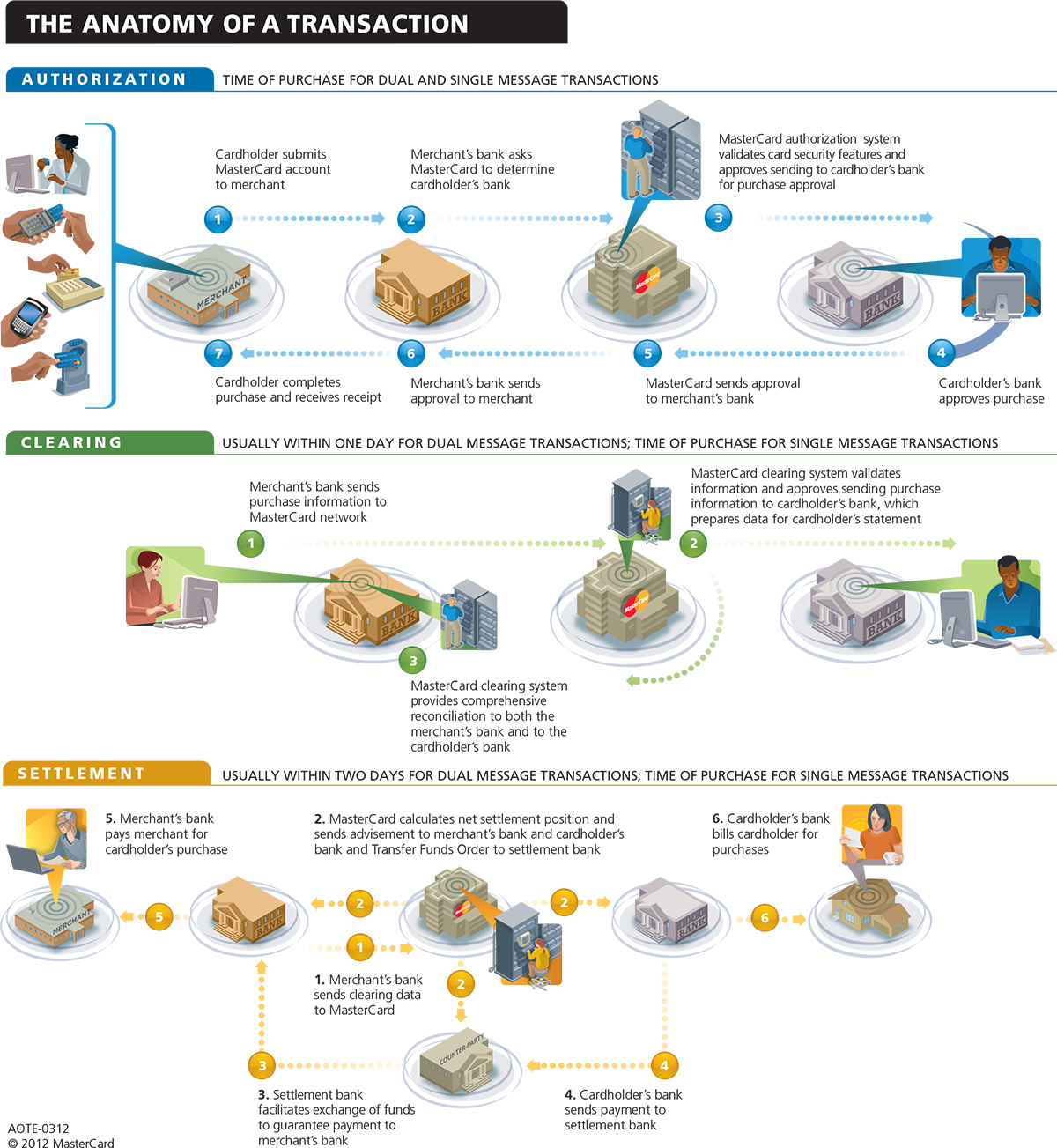

MasterCard’s Credit Card Transaction Cycle

So let’s first take a look at MasterCard’s graph. Here it is (click on the image below for a better view):

As you can see, the graph segments the card transaction’s life cycle into three distinct stages: authorization, clearing and settlement. Authorization is the process through which a merchant obtains approval from the card issuing bank to accept the presented card for payment. It takes place in real time, as the transaction occurs, and lasts for no more than a second or two.

Clearing is the process through which the card issuer exchanges transaction information with the merchant’s processing bank (also known as an acquiring bank) and occurs simultaneously with the settlement. I should note that clearing and settlement only take place in Visa and MasterCard transactions, for American Express and Discover are both the issuers of the cards bearing their logos and the processors of the payments made with them.

The final stage of the process — settlement — is the actual exchange of funds between the card issuer and the acquiring bank, which completes the simultaneously cleared transaction and initiates the reimbursement of the merchant for the amount of the associated card sale that was submitted. These funds are exchanged daily between the processors and the issuers for the net value of the cleared transactions.

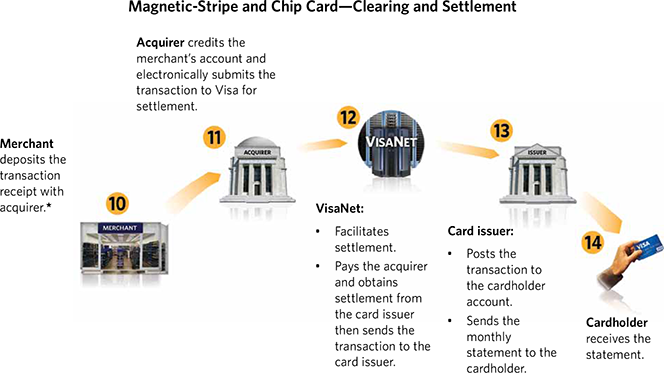

Visa’s Transaction Life Cycle

Now here is Visa’s representation of the card transaction process:

You will note how much more emphasis Visa has placed on the first stage of the process — authorization — than on the clearing and settlement of its transactions.

iMoney’s Take

Finally, let’s take a look at the graph which prompted this exercise. Here it is:

On the whole, the card transaction process is represented correctly. The authors could have been more careful with the terms (by “credit card company” they mean “card issuer”, even though they’ve listed both as transaction participants), but never mind.

And then there is the question of how “how banks & credit card companies make money”, which is where the authors should really have been much more careful. It is important to understand that there are three distinct types of entities, which have been lumped together into this group: card issuers, acquirers and card networks. Each of these transaction participants claims a strictly defined portion of the overall fees paid by merchants for each card transaction:

- The card issuer receives the full amount of the interchange fees, which are determined by Visa and MasterCard and make up the lion’s share of the merchant’s processing fees (about three-quarters, on average, in the U.S.). In the wake of the Durbin Amendment, the Federal Reserve limited the debit interchange fees at a maximum of 0.05 percent of the transaction amount, plus 21?ó per transaction and an additional 1?ó can be added for fraud prevention measures implemented by the issuing bank. Credit card interchange fees, on the other hand, are left entirely to the discretion of the two card networks, at least for the time being.

- The acquirer receives the difference between the merchant’s overall processing fees and the applicable interchange fees.

- The card network receives the “assessment fees”, which are perhaps best looked at as association or network fees. At present, both Visa and MasterCard have set their assessment fees at 0.11 percent of the transaction amount, for both credit and debit cards.

The other issues touched on in the graph are quite speculative and I will leave it to you to decide what to make of them.

Image credit: MasterCard.